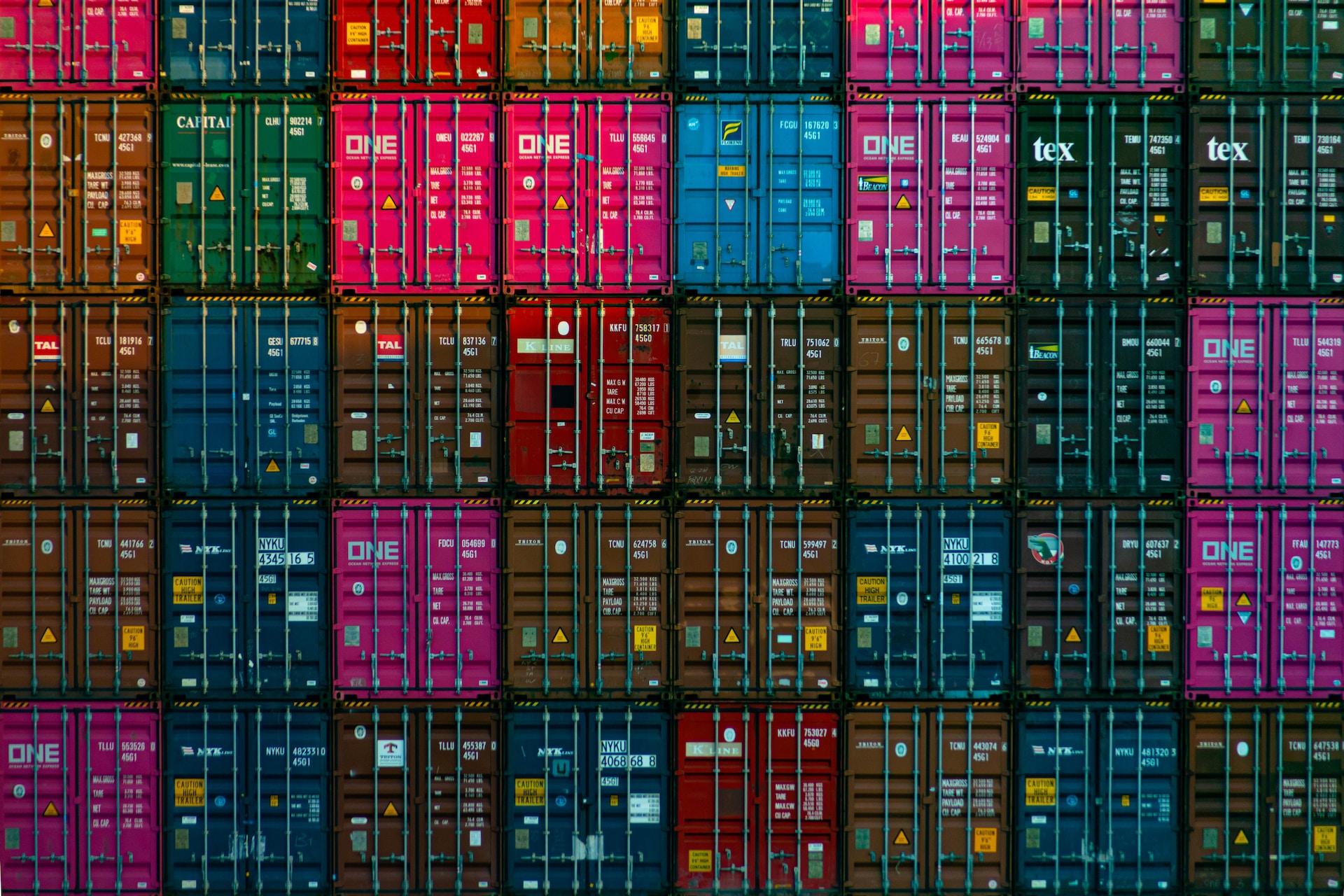

Cargo insurance is a vital risk management instrument for enterprises involved in commodities transportation. Cargo insurance protects enterprises' financial interests, ensures compliance with legal requirements, and facilitates international trade operations by providing financial protection against potential losses or damages during transportation. Businesses can select the most appropriate coverage for their specific needs and risk profile by studying the various forms of cargo insurance and carefully considering the elements that determine their policy selection. Purchasing cargo insurance provides not only peace of mind, but also contributes to the entire success and sustainability of a company's trading activities.

Definition and Meaning

Cargo insurance is a form of insurance policy that covers physical loss or damage to commodities while they are being transported by sea, air, road, or rail. It protects exporters, importers, and other stakeholders financially by covering for losses incurred due to unanticipated circumstances that may affect the cargo. Cargo insurance, in essence, transfers the risks connected with the transportation of commodities from the cargo owner to the insurance firm.

Cargo Insurance Types

Cargo insurance policies of various varieties are available to meet the specific demands and requirements of enterprises involved in the transportation of products. These policies are classified according to the mode of transportation, the level of coverage, and the type of products being transported. The following are the most common types of cargo insurance:

- All-Risk Insurance: This type of cargo insurance provides the most comprehensive coverage, protecting the insured against all conceivable risks, such as loss or damage during transportation due to accidents, theft, natural disasters, or other catastrophes. However, specific occurrences or conditions, such as incorrect packing, inherent vice, or delays, may be excluded from all-risk insurance.

- Free of Particular Average (FPA): FPA is a more limited form of cargo insurance that covers only losses or damages caused by certain events or risks, such as the vessel sinking, stranding, or colliding. It does not cover partial losses, normal wear and tear, or losses caused by negligence or misbehavior.

- With Average (WA): This form of cargo insurance policy covers partial cargo losses or damages caused by general average and specific average events. General average refers to losses incurred when extraordinary steps are taken to protect the vessel and cargo, whereas particular average includes losses suffered during transit that are not covered by FPA.

- Shipment-by-Shipment Insurance: This sort of cargo insurance policy is ideal for firms who require coverage for individual shipments or consignments. It provides coverage from the point of origin to the ultimate destination for the duration of the travel.

- Open Cover Insurance: Open cover insurance is a more flexible alternative for organizations that need to cover many shipments over a specific time period. The insured can declare shipments as they occur under this insurance, eliminating the need to negotiate a new coverage for each shipment.

Cargo Insurance Benefits

Investing in cargo insurance provides various advantages to enterprises involved in commodities transportation:

- Financial Protection: Cargo insurance protects you financially against losses or damages that occur during the shipment of goods. Businesses can protect their financial interests and avert future financial disasters by transferring risks to an insurance firm.

- Legal Compliance: Cargo insurance may be required in some jurisdictions for enterprises involved in the shipping of products. Businesses can comply with local requirements and avoid any penalties or legal difficulties by obtaining the necessary insurance coverage.

- Increased reputation: Cargo insurance reflects a company's commitment to risk management and due diligence, which can boost its reputation with clients, partners, and regulatory authorities.

- Specific Needs Coverage: Cargo insurance coverage can be modified to meet specific needs of a business, ensuring suitable coverage for the nature of the items being transported and the potential risks involved. This enables businesses to select the type and scope of coverage that best meets their needs and risk tolerance.

- Facilitates Trade Financing: Cargo insurance is frequently required by financial institutions in international trade as a prerequisite for trade financing, such as letters of credit or bank guarantees. Businesses can gain easier access to these funding choices by purchasing cargo insurance, so facilitating their trading operations.

- Claims Management Assistance: Reputable insurance companies often give complete claims management assistance, guiding businesses through the claims procedure in the event of losses or damages. This assistance might help to speed up the claims process and guarantee that businesses obtain adequate compensation for their losses.

- Global Networks: Cargo insurance providers frequently have a global network of partners and resources that can help firms manage risks and handle claims across multiple jurisdictions. This is especially useful for enterprises involved in international trade since it gives them access to local expertise and support when needed.

Considerations When Choosing Cargo Insurance

Choosing the right cargo insurance coverage necessitates careful consideration of various criteria, including:

- Type of Goods and Value: The kind and value of the items being carried are important factors in establishing the type and level of coverage necessary. A more complete policy may be required for high-value or fragile goods, whilst less expensive or durable goods may require less broad coverage.

- Mode of Transportation: The mode of transportation, whether by sea, air, road, or rail, can have an impact on the potential risks and hazards associated with the transit. It is critical to select a policy that covers the mode of transportation utilized for the shipment.

- Geographic Factors: The shipment's route and destination can have an impact on the potential dangers involved. Shipments to places prone to natural disasters, political instability, or high crime rates, for example, may necessitate more complete coverage.

- Legal Requirements: Companies should be aware of the legal requirements and laws that govern cargo insurance in their jurisdiction as well as the destination country. Ensuring that these regulations are followed can help to avoid legal issues and potential penalties.

- Insurance Providers: When selecting a cargo insurance provider, companies should assess the firm's reputation, financial stability, global network, and claims handling support. Working with a renowned and dependable supplier can aid in the easy and rapid processing of claims in the event of losses or damages.

Related Information