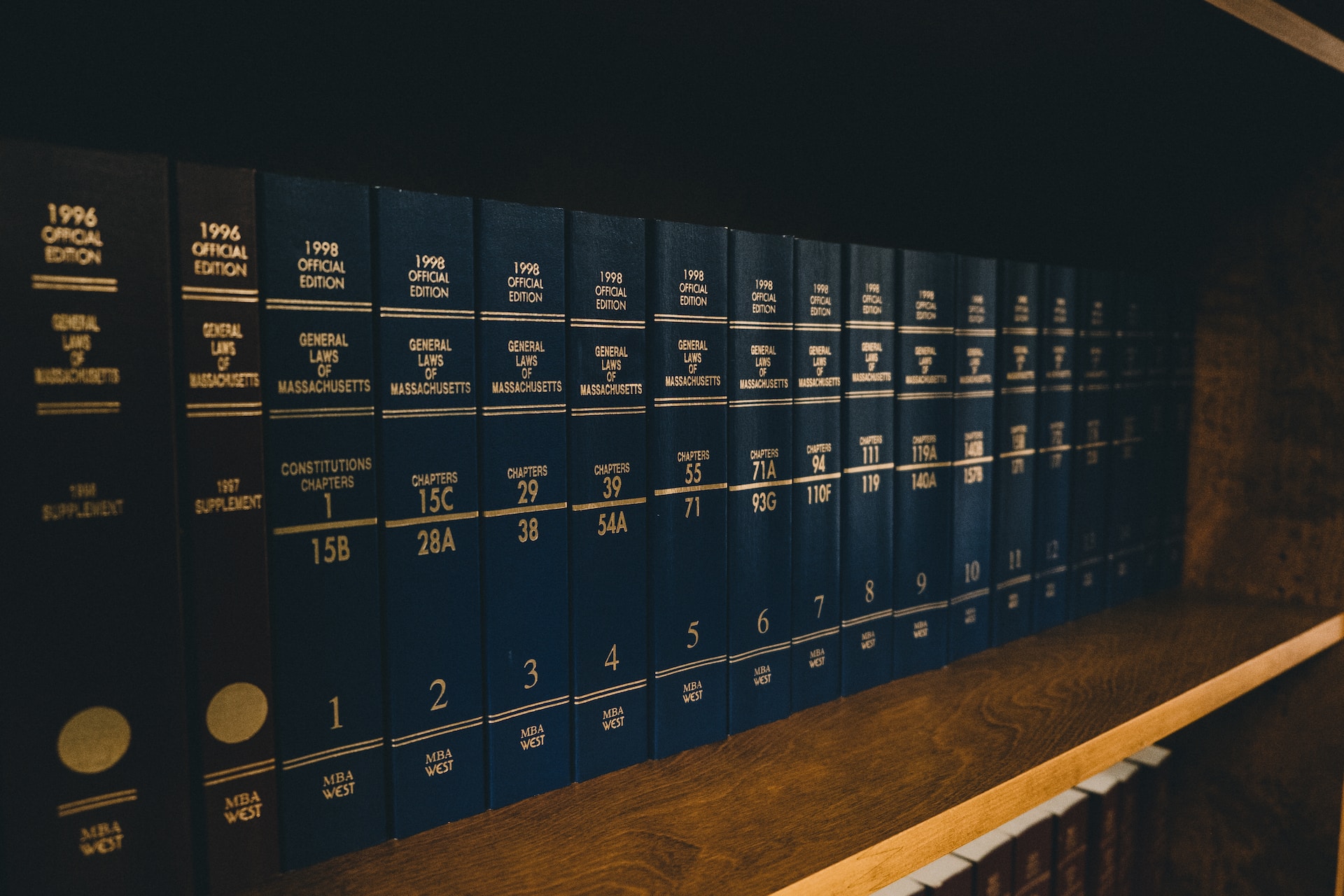

A crucial element of legislation called the Foreign Corrupt Practices Act (FCPA) tries to stop bribery and corruption in cross-border economic dealings. The FCPA, which was passed in 1977, has had a big impact on how businesses operate internationally. This article offers a thorough explanation of the FCPA, covering its main sections, methods of enforcement, and recommended compliance procedures.

Key Provisions of the FCPA

The FCPA has two main provisions:

- Anti-Bribery Provisions: These rules forbid businesses and people from promising, approving, or making any payments or gifts to candidates, political parties, or foreign officials in order to win or keep business. The anti-bribery laws are applicable to both domestic and foreign businesses that are listed on American stock exchanges or conduct business here.

- Accounting Provisions: Under the FCPA, businesses must keep accurate books and records and set up an internal control system to identify and stop misconduct. Regardless of whether they conduct foreign business activities, these regulations apply to all American businesses as well as foreign businesses listed on American stock exchanges.

Enforcement of the FCPA

The Securities and Exchange Commission (SEC) and the U.S. Department of Justice (DOJ) work together to enforce the FCPA. While the SEC focuses on civil enforcement pertaining to accounting and internal control standards, the DOJ is in charge of prosecuting criminal FCPA breaches. Serious penalties, such as substantial fines, jail time, and maybe being barred from federal contracts, can result from breaking the FCPA.

Elements of an Effective FCPA Compliance Program

Companies should put in place a strong compliance program to reduce the risk of FCPA infractions and related fines. Important components of a successful FCPA compliance program include:

- Risk Assessment: Organizations should regularly conduct risk assessments to identify and rank potential FCPA risks, including those related to third-party interactions, specific geographical regions, and business transactions.

- Policies and Procedures: Create and implement precise rules and procedures to address identified FCPA risks, including as standards for gifts, entertainment, and travel costs, as well as steps for carrying out partner due diligence.

- Training and Education: Conduct routine training and education sessions on FCPA obligations, business policies, and processes for staff members and third-party partners.

- Monitoring and Auditing: Put in place methods for monitoring and auditing to make sure FCPA policies and procedures are followed and to look for any infractions.

- Reporting and Investigation: Establish private channels for staff members to report possible FCPA infractions as well as third-party partners, and make sure that any reported issues are thoroughly investigated right away.

- Remediation: Take the necessary corrective action to resolve found FCPA violations, including disciplinary action, strengthening internal controls, and, if necessary, self-reporting to enforcement authorities.

Best Practices for FCPA Compliance

Companies should take into account the following recommended practices for FCPA compliance in addition to putting in place a strong compliance program:

Setting a high ethical standard and promoting a compliance culture are two ways that company leadership can actively show their dedication to FCPA compliance.

- Tone at the Top: To detect potential FCPA risks, perform in-depth due diligence on all third-party partners, including agents, consultants, and suppliers.

- Due Diligence: Make sure that workers and third-party partners are aware of the potential repercussions of non-compliance by clearly communicating FCPA expectations and requirements to them.

- Clear Communication: Review and adjust FCPA compliance policies and practices on a regular basis to take into account changing risks and legal requirements.

Conclusion

Companies conducting business internationally must comprehend and abide with the FCPA. Companies may manage FCPA risks, safeguard their brand, and evade expensive fines by putting in place a strong compliance program and following best practices. Organizations must be cautious in upholding their commitment to moral behavior and openness in all of their transactions as the global business landscape continues to change. By doing this, they can promote a culture of compliance, reduce their exposure to risks associated with corruption, and aid in the worldwide struggle against bribery and corruption.

Related Information