In an increasingly interconnected world, the development of cross-border infrastructure plays a pivotal role in fostering economic growth, enhancing regional integration, and facilitating international trade. From highways and railways to ports and energy grids, these projects form the backbone of global commerce, enabling the efficient movement of goods, services, and people across borders. However, the realization of such infrastructure initiatives often hinges on the availability of adequate financing mechanisms, with trade finance emerging as a critical enabler in this regard.

Trade finance encompasses a range of financial instruments and products tailored to facilitate international trade transactions. It provides the liquidity and risk mitigation tools necessary to support the complex supply chains and large-scale investments inherent in cross-border infrastructure projects. Here’s how trade finance contributes to the success and sustainability of such endeavors:

1.Risk Mitigation: Cross-border infrastructure projects typically involve multiple stakeholders across different jurisdictions, each exposed to various risks such as political instability, currency fluctuations, and regulatory uncertainties. Trade finance instruments such as letters of credit, guarantees, and insurance products help mitigate these risks by providing assurances to parties involved, thereby enhancing confidence and encouraging investment.

2.Working Capital Support: Large-scale infrastructure projects often require substantial upfront investment and ongoing working capital to procure materials, equipment, and services. Trade finance solutions such as supplier credits, inventory financing, and factoring enable project developers and contractors to manage cash flow effectively, ensuring seamless operations throughout the project lifecycle.

3.Optimized Cash Flow: Infrastructure projects typically span several years, during which time funds may be tied up in various stages of construction, procurement, and operation. Trade finance instruments such as project finance and structured trade facilities enable developers to optimize cash flow by aligning financing with project milestones, reducing the burden of upfront capital requirements and improving overall project feasibility.

4.Enhanced Access to Funding: Access to affordable financing is often a significant challenge for infrastructure projects, particularly in emerging markets. Trade finance mechanisms, including export credit agencies (ECAs), multilateral development banks (MDBs), and trade finance platforms, provide alternative sources of funding and liquidity, expanding access to capital for both public and private sector entities involved in infrastructure development.

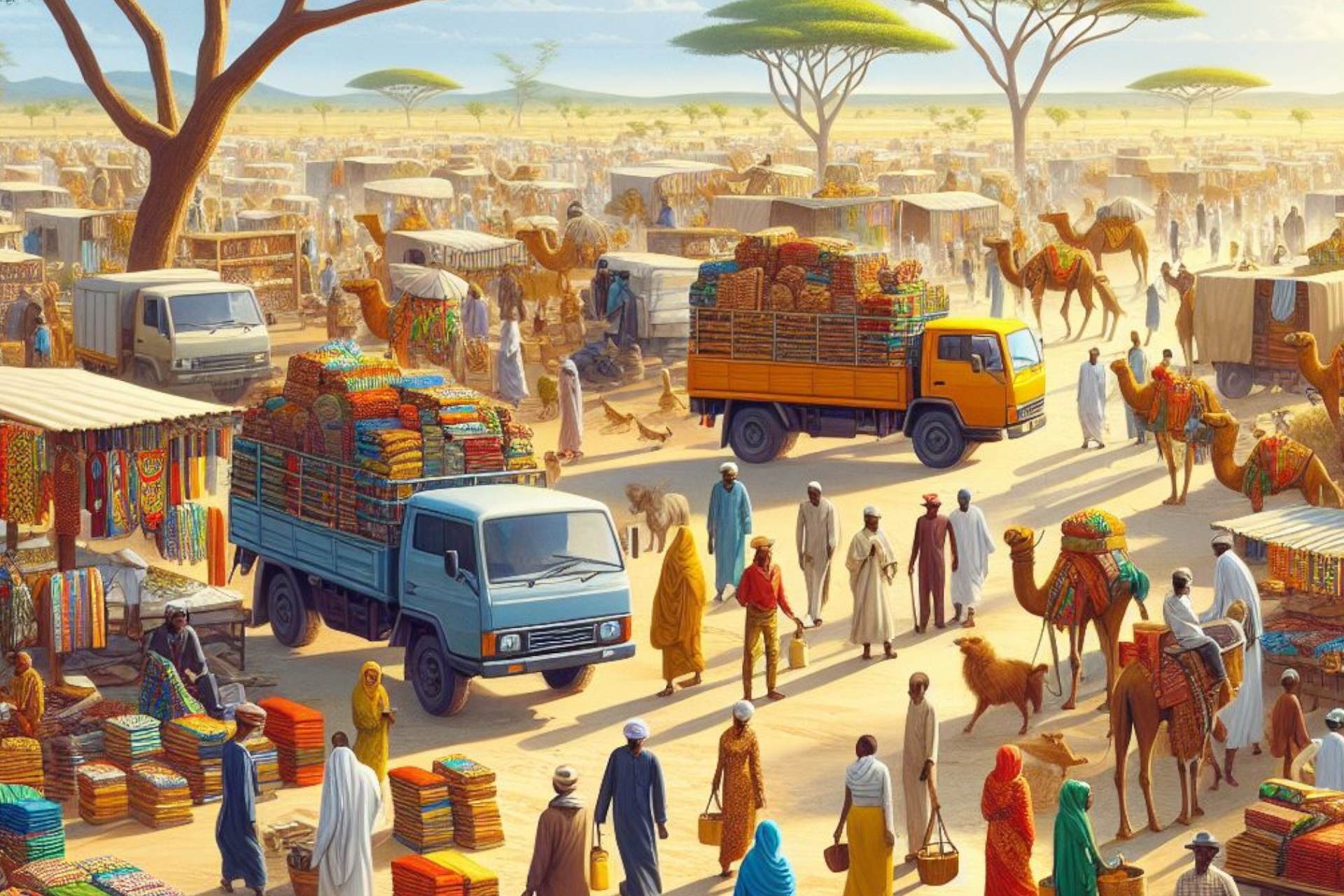

5.Facilitation of International Trade: Cross-border infrastructure projects serve as catalysts for international trade by improving connectivity, reducing transportation costs, and streamlining customs procedures. Trade finance facilitates the financing and execution of trade transactions associated with these projects, enabling smoother cross-border commerce and promoting economic integration at regional and global levels.

As governments, multilateral institutions, and private sector entities continue to prioritize the development of cross-border infrastructure as a key driver of economic growth and sustainable development, the role of trade finance in supporting these initiatives becomes increasingly prominent. By providing the financial tools and mechanisms necessary to mitigate risks, optimize cash flow, and enhance access to funding, trade finance plays a crucial role in ensuring the successful implementation and long-term viability of cross-border infrastructure projects worldwide.

#TradeFinance #InfrastructureDevelopment #CrossBorderTrade #GlobalEconomy #SustainableDevelopment #ProjectFinance #RiskMitigation #InternationalTrade #EconomicGrowth #FinancialInclusion

Read more views