“`html

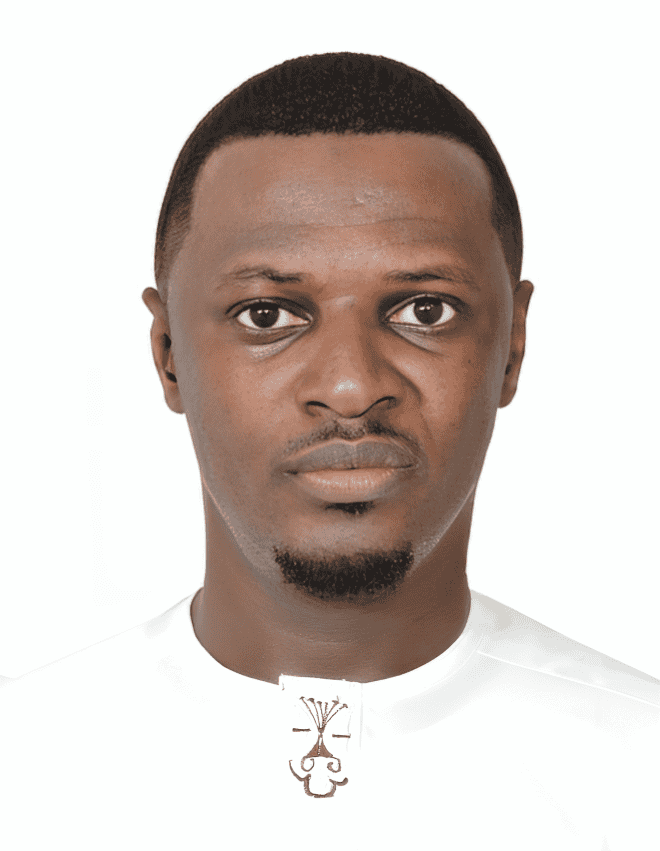

Ibrahim Musa

Euro Exim Bank

Ibrahim Musa – Member of the Business Council for Banking and Trade Finance and International Trade Policy

Ibrahim Musa is a Trade Finance Specialist at Euro Exim Bank, where he focuses on providing innovative trade finance solutions that support international trade and facilitate seamless cross-border transactions. As a member of the International Trade Council, he actively participates in the Banking and Trade Finance and International Trade Policy Business Council, contributing his expertise to enhance global trade practices.

Ibrahim began his career in trade finance driven by a strong interest in international business and economic development. His background in public administration and financial analysis laid a solid foundation for his specialization in trade finance and regulatory compliance. He holds a Bachelor of Science in Public Administration and has earned certifications in Project Management (PMP), Trade Finance, and Risk Management. These qualifications, combined with his strong analytical skills and stakeholder engagement abilities, have been instrumental in advancing his career.

Throughout his professional journey, Ibrahim has successfully led significant initiatives, including the Trade Regulation Assessment Initiative in West Africa and the development of a Risk Mitigation Framework at Euro Exim Bank, which improved trade flow efficiency and reduced risks in trade finance operations. He is particularly proud of implementing a risk mitigation framework that decreased potential trade finance risks by 15% and enhancing cross-border trade efficiency through regulatory assessments.

The trade finance industry has evolved rapidly since Ibrahim started, with advancements in digitization, blockchain technology, and stricter regulatory compliance reshaping operations and enhancing transparency. He recognizes that the industry currently faces challenges such as adapting to technological changes and navigating complex global regulations amid economic uncertainties.

Looking ahead, Ibrahim sees the trade finance industry moving toward increased digital transformation, with blockchain and artificial intelligence driving secure and efficient transactions while emphasizing regulatory compliance and sustainable trade practices. He is excited about the potential of blockchain to secure trade transactions and AI to automate risk assessments, which he believes will revolutionize trade finance.

For those starting in the industry, Ibrahim advises building a solid understanding of international trade regulations and financial analysis, remaining adaptable, and embracing new technologies to stay ahead. He approaches challenges by analyzing situations, learning from setbacks, and focusing on solutions to achieve his goals.

Inspired by thought leaders such as Christine Lagarde and Ngozi Okonjo-Iweala, who advocate for sustainable development and economic growth, Ibrahim is committed to making a positive impact in the field of trade finance. Outside of his professional life, he enjoys reading about global economics, traveling to explore different cultures, and volunteering for community development projects focused on education and youth empowerment.

“`

Would you like me to clean up any other profiles for Euro Exim Bank or other council members?