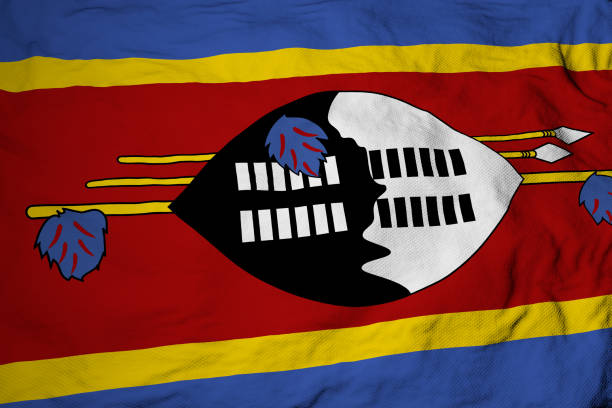

Eswatini

On this page you will find beneficial information regarding foreign direct investment in / trading with Eswatini. If you are interested in exploring trade or investment possibilities in the country, feel free to contact the International Trade Council team. Additionally, we encourage you to engage with the official government investment agency featured on this page.

It is important to note that while the statistics presented on this page were understood to be accurate at the time of publication, they are subject to change over time. Please consult your ITC Trade Commissioner for up-to-date information.

Type of Government: Monarchy

Population: 1.202 million (2022)

GDP: 4.85 billion USD (2022)

Corporate Tax Rate: 27.5%

Personal Income Tax Rate: 25% - 30%

Major Exports: The top exports of Eswatini are Scented Mixtures ($559M), Raw Sugar ($302M), Industrial Fatty Acids, Oils and Alcohols ($208M), Sawn Wood ($80.1M), and Non-Knit Women's Suits ($65.1M), exporting mostly to South Africa ($1.35B), Kenya ($97.6M), Nigeria ($67.6M), Democratic Republic of the Congo ($61.3M), and Mozambique ($61M).

Major Imports: The top imports of Eswatini are Refined Petroleum ($216M), Gold ($89.4M), Electricity ($56.1M), Corn ($43.1M), and Gas Turbines ($38.6M), importing mostly from South Africa ($1.55B), China ($81.8M), United States ($68.9M), Mozambique ($64.9M), and Mauritania ($56.3M).

Investment Agency: Eswatini Investment Promotion Authority (EIPA)

Website: https://investeswatini.org.sz/