As companies navigate the complexities of international trade, export credit insurance emerges as a strategic tool for managing risks and unlocking new growth opportunities. By harnessing the power of export credit insurance, businesses can chart a course towards sustainable expansion and prosperity in the ever-evolving global economy.

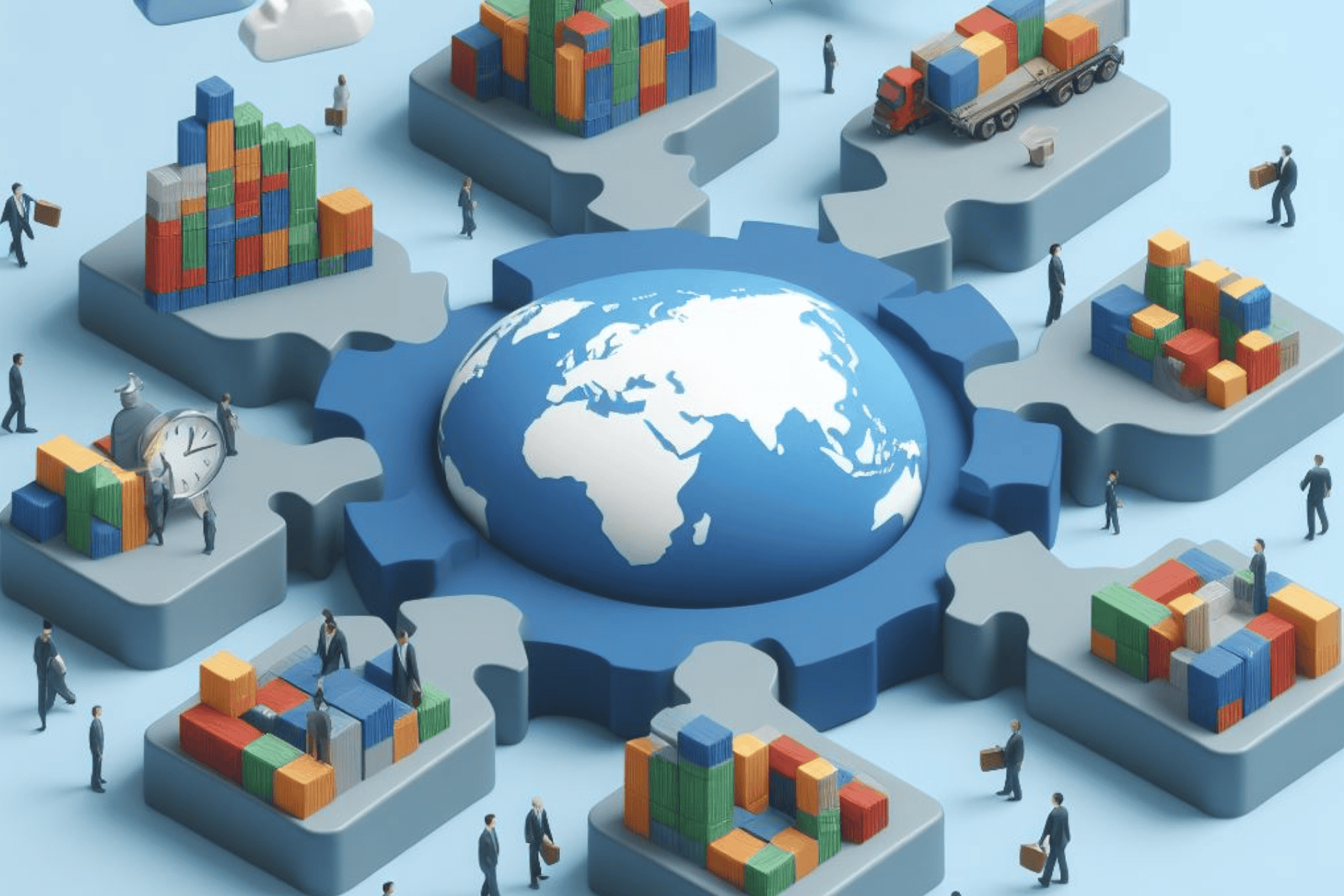

In today's interconnected global marketplace, businesses are constantly seeking avenues for growth and expansion. For many enterprises, especially those venturing into international trade, leveraging export credit insurance can be a game-changer. This often-overlooked financial tool provides a safety net against the uncertainties of foreign transactions, empowering companies to explore new markets with confidence and mitigate risks along the way.

Export credit insurance, also known as trade credit insurance, is a risk management tool that protects businesses against the non-payment of accounts receivable due to commercial or political reasons. This insurance policy covers losses arising from a variety of scenarios, including buyer insolvency, protracted default, political instability, or currency fluctuations. By safeguarding against these potential pitfalls, export credit insurance offers a lifeline for companies looking to expand their footprint beyond domestic borders.

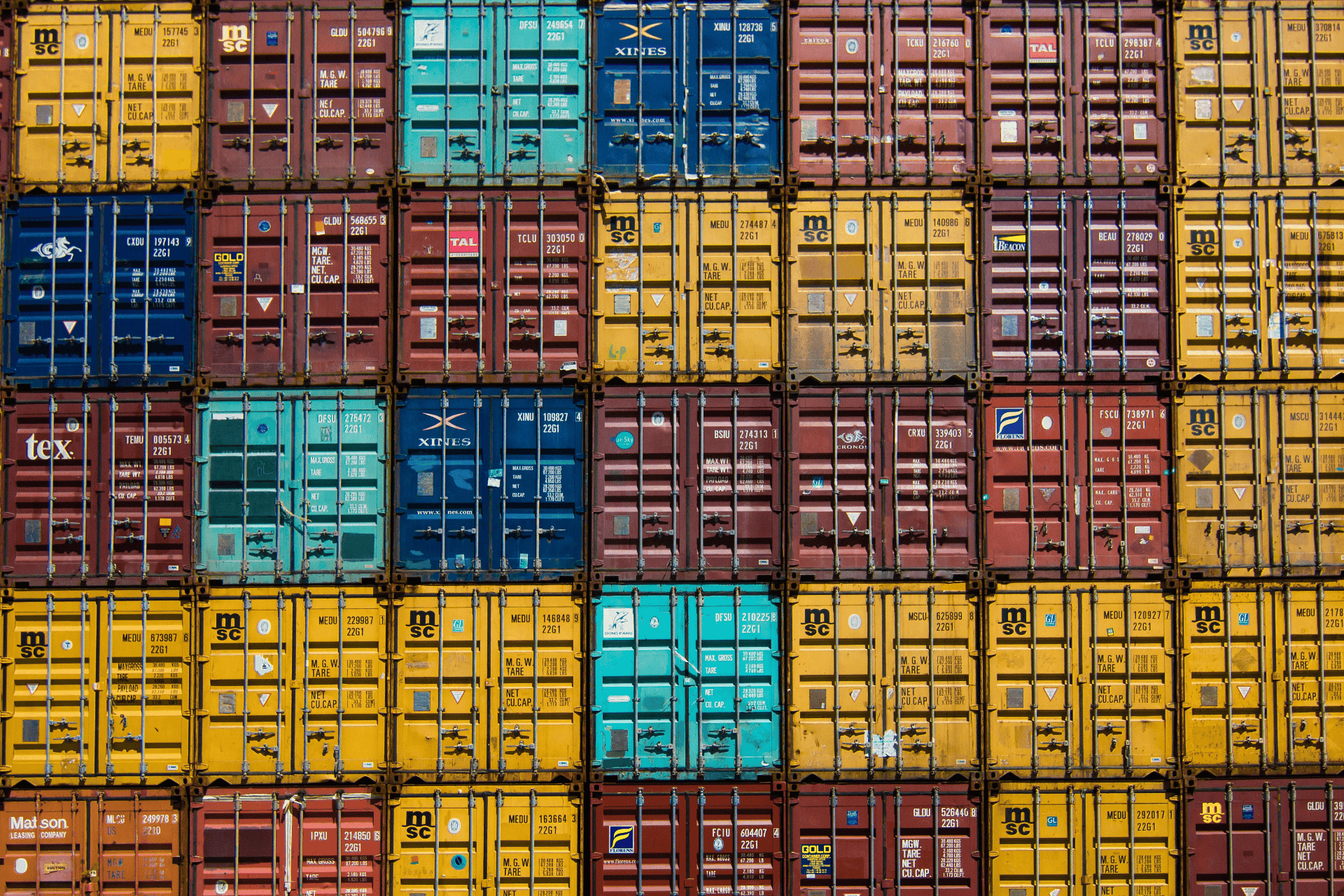

One of the key benefits of export credit insurance is its ability to enhance liquidity and facilitate access to financing. Banks and financial institutions are more inclined to extend credit to businesses backed by comprehensive insurance coverage, as it minimizes their exposure to risk. This, in turn, enables companies to secure favorable terms for trade financing, negotiate better contracts with suppliers, and pursue larger export orders with confidence.

Moreover, export credit insurance provides a competitive advantage by enabling businesses to offer open account terms to overseas buyers. In a competitive global market, flexible payment terms can be a decisive factor in winning contracts and securing long-term partnerships. By mitigating the risk of non-payment, export credit insurance empowers companies to extend credit to their customers, thereby enhancing their competitiveness and market reach.

Furthermore, export credit insurance serves as a valuable tool for risk management and strategic planning. By providing insights into the creditworthiness of overseas buyers and markets, businesses can make informed decisions about where to allocate resources and which opportunities to pursue. Additionally, export credit insurance can help companies navigate complex regulatory environments and comply with international trade regulations, ensuring smooth and compliant transactions across borders.

In essence, export credit insurance is not just a protective measure against unforeseen losses; it is a catalyst for business growth and expansion. By mitigating risks, enhancing liquidity, and facilitating access to financing, export credit insurance empowers businesses to seize opportunities in the global marketplace and realize their full potential.

ExportCreditInsurance #TradeCreditInsurance #BusinessGrowth #GlobalExpansion #RiskManagement #InternationalTrade #FinancialSecurity #MarketReach #CompetitiveAdvantage #StrategicPlanning #TradeFinancing

Related Information