Understanding the trade effects of global currency fluctuations is crucial for businesses, policymakers, and economists. Currency movements impact competitiveness, trade balances, import costs, and exchange rate risk. Monitoring and analyzing currency trends and employing appropriate strategies to manage currency risk are essential for businesses engaged in international trade. As currency markets remain dynamic and interconnected, staying informed about global economic developments and exchange rate movements is crucial for navigating the complexities of international trade.

Exchange Rates and Competitiveness

Exchange rates, the value of one currency relative to another, play a crucial role in determining the competitiveness of nations in international trade. When a country's currency depreciates, its exports become more competitive in foreign markets as they become relatively cheaper. Conversely, a currency appreciation makes exports more expensive, potentially reducing competitiveness.

For example, a study by the International Monetary Fund (IMF) found that a 10% depreciation in a country's currency can lead to an average increase in export volumes of around 1.5%.

Trade Balances and Currency Movements

Currency fluctuations also influence trade balances, which represent the difference between a country's exports and imports. When a country's currency depreciates, its exports become relatively cheaper, potentially boosting export volumes and improving the trade balance. Conversely, a currency appreciation can make imports more affordable, potentially leading to an increase in import volumes and a widening trade deficit.

Price Effects and Import Costs

Currency fluctuations impact the prices of imported goods and services. A depreciating currency can increase the cost of imports as it takes more domestic currency to purchase foreign goods. This can result in higher prices for imported products, affecting consumers and businesses reliant on foreign inputs.

Conversely, an appreciating currency can lower the cost of imports, making foreign goods relatively cheaper for domestic consumers and businesses.

Exchange Rate Risk and Hedging Strategies

Currency volatility introduces exchange rate risk for businesses engaged in international trade. Sudden and significant currency fluctuations can erode profit margins and introduce uncertainty in planning and forecasting. To mitigate these risks, businesses often employ hedging strategies, such as forward contracts or options, to protect against adverse currency movements.

Regional Trade and Currency Relationships

Regional trade blocs, such as the European Union and the North American Free Trade Agreement, often have currency arrangements that influence trade dynamics. For example, the euro as a common currency within the Eurozone eliminates exchange rate fluctuations among member countries, simplifying trade transactions and reducing currency-related risks.

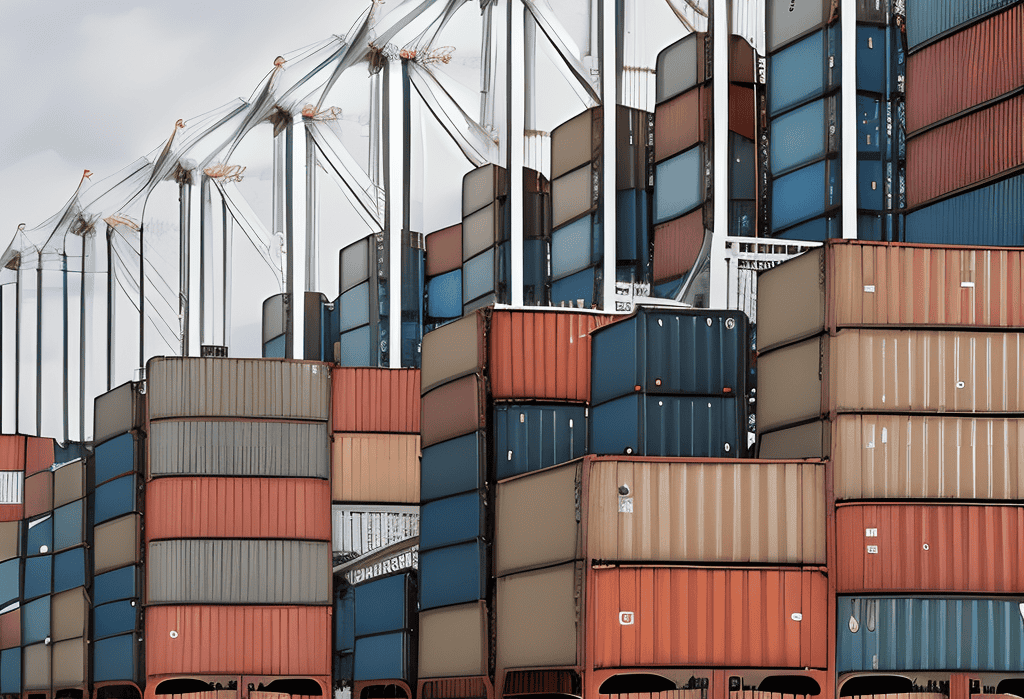

Global Supply Chains and Currency Implications

Currency fluctuations can impact global supply chains, which involve the movement of goods and services across multiple countries. Fluctuating exchange rates can affect the costs of inputs, transportation, and the final price of goods along the supply chain, potentially disrupting cost structures and profit margins.

Read more views