Navigating the legal landscape of international trade requires a deep understanding of international trade law, proactive risk management, and robust compliance measures. By unraveling the complexities of international trade law, conducting legal due diligence, implementing compliance management systems, and staying informed and adaptive to changes in the legal landscape, businesses can mitigate legal risks, ensure regulatory compliance, and thrive in the global marketplace.

International trade law governs the rules, regulations, and agreements that govern cross-border commerce, shaping the rights, obligations, and responsibilities of businesses engaged in global trade. Understanding the complexities of international trade law is essential for businesses to navigate the legal landscape, mitigate risks, and ensure compliance with regulatory requirements. Here, we delve into the intricacies of international trade law and strategies for managing legal challenges in global trade.

Unraveling the Complexities of International Trade Law

- Multilateral Trade Agreements:

Multilateral trade agreements such as the World Trade Organization (WTO) agreements establish rules and principles governing international trade, including tariffs, non-tariff barriers, and dispute resolution mechanisms. Businesses must stay informed about changes in trade agreements and comply with their provisions to access global markets and benefit from trade liberalization.

- Regional Trade Blocs:

Regional trade blocs such as the European Union (EU), NAFTA, and ASEAN create preferential trade arrangements among member countries, facilitating tariff reductions, market access, and regulatory harmonization. Businesses operating in regional trade blocs must comply with regional trade regulations and leverage preferential trade agreements to gain competitive advantages in regional markets.

- Customs and Import/Export Regulations:

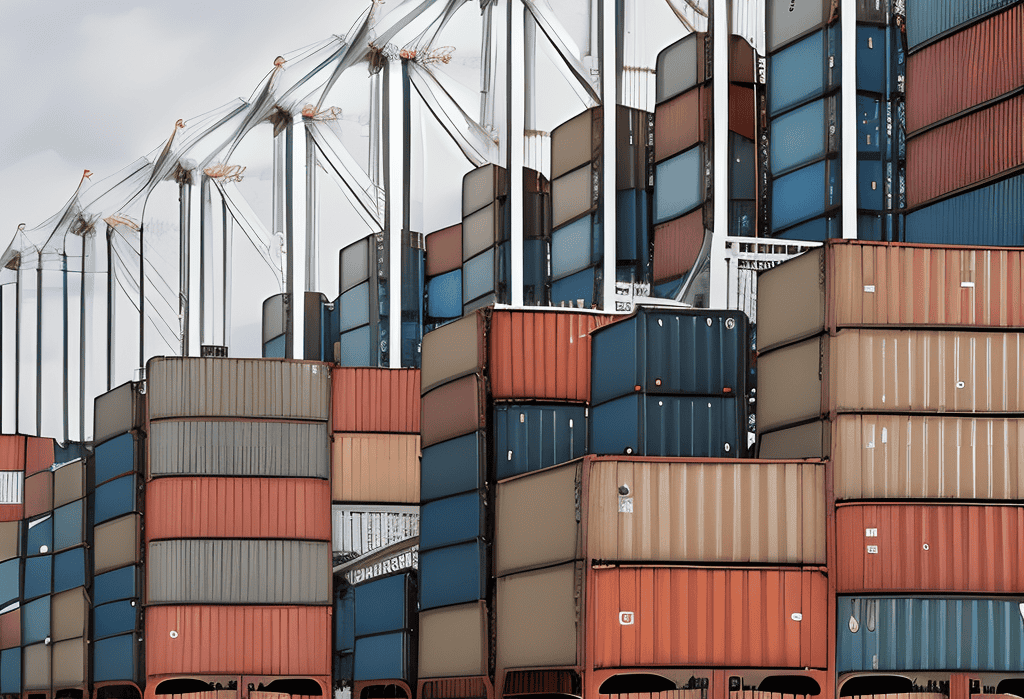

Customs regulations govern the importation and exportation of goods across national borders, including customs duties, import/export controls, customs valuation, and customs clearance procedures. Businesses must understand customs regulations in target markets, classify products correctly, and comply with import/export documentation requirements to ensure smooth customs clearance and avoid penalties.

Strategies for Navigating International Trade Law

- Legal Due Diligence:

Conduct legal due diligence to assess legal risks, obligations, and compliance requirements associated with international trade transactions. Consult with legal experts, review contracts, agreements, and regulatory documents, and address legal issues proactively to mitigate risks and ensure compliance with international trade law.

- Compliance Management:

Implement robust compliance management systems to monitor and enforce compliance with international trade regulations, trade agreements, and export control laws. Develop internal policies, procedures, and training programs to educate employees about legal obligations, detect compliance breaches, and implement corrective actions.

- Dispute Resolution Mechanisms:

Be prepared to resolve disputes arising from international trade transactions through negotiation, mediation, arbitration, or litigation. Include dispute resolution clauses in contracts, establish mechanisms for resolving disputes amicably, and seek legal advice to protect rights and interests in case of legal disputes.

- Stay Informed and Adaptive:

Stay abreast of changes in international trade law, regulatory developments, and judicial decisions that may impact business operations. Monitor legislative updates, subscribe to legal publications, and engage with legal advisors to stay informed and adaptive to changes in the legal landscape of international trade.

#InternationalTradeLaw #LegalCompliance #TradeRegulations #CustomsCompliance #LegalDueDiligence #DisputeResolution #BusinessStrategy #GlobalTrade #LegalRiskManagement #RegulatoryCompliance

Read more views