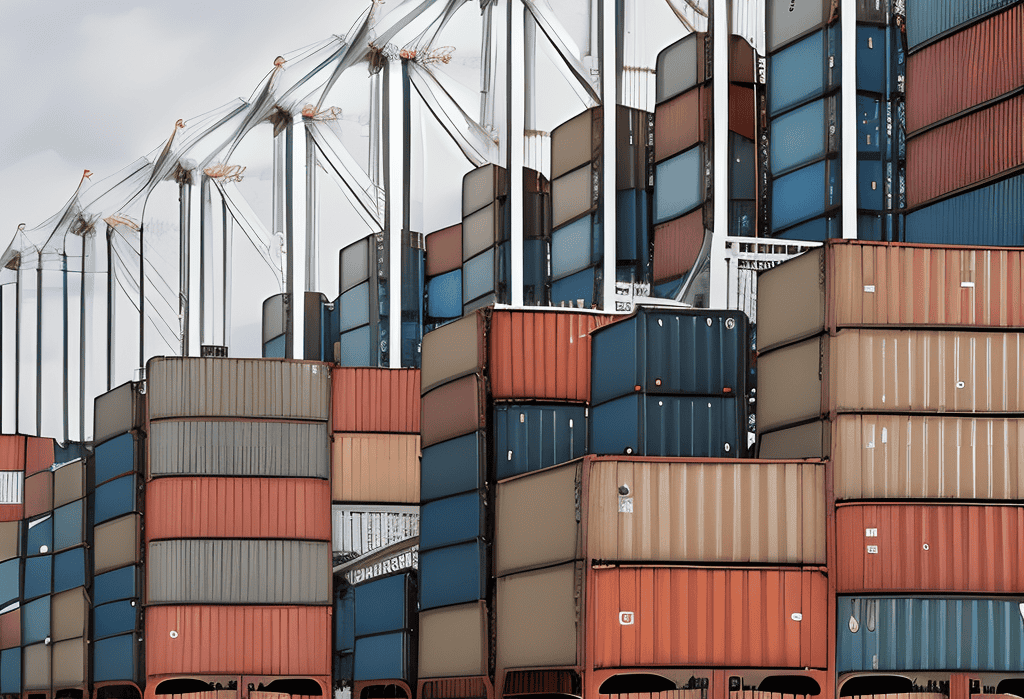

Trade deficits and surpluses are critical components of a country's economic landscape. While persistent imbalances can have implications for domestic industries, employment, and exchange rates, it is essential to consider a broader range of economic factors and policies when assessing their overall impact. Achieving a sustainable trade balance requires a nuanced understanding of comparative advantages, exchange rate dynamics, and strategic policy measures to foster healthy trade relationships and economic growth.

Global Trade Balance Overview

According to the World Trade Organization (WTO), the total value of world merchandise exports and imports in 2020 was $17.99 trillion and $17.25 trillion, respectively. This resulted in a global trade surplus of $739 billion. However, it is important to note that trade balances vary significantly among countries and regions.

Countries with Largest Trade Surpluses

Several nations are known for their consistent trade surpluses. As of 2020, China holds the title for the largest trade surplus, with an excess of $536 billion. Other countries with notable trade surpluses include Germany ($253 billion), Japan ($120 billion), and the Netherlands ($99 billion).

Countries with Largest Trade Deficits

Conversely, certain countries consistently experience trade deficits. The United States, for instance, has the largest trade deficit globally, reaching $926 billion in 2020. Other countries with significant trade deficits include the United Kingdom ($215 billion), India ($158 billion), and Australia ($153 billion).

Factors Influencing Trade Imbalances

Multiple factors contribute to trade imbalances. These include:

- Comparative Advantage: Countries often specialize in producing and exporting goods and services in which they possess a comparative advantage, leading to trade imbalances. For example, countries with abundant natural resources might have trade surpluses in raw materials.

- Exchange Rates: Currency valuation affects trade balances. A weaker domestic currency makes exports more competitive, potentially leading to a trade surplus, while a stronger currency may contribute to a trade deficit.

- Domestic Consumption and Savings: Variances in domestic consumption and savings rates can influence trade imbalances. High consumption levels may lead to increased imports, resulting in trade deficits.

Implications of Trade Deficits and Surpluses

Trade deficits and surpluses can have both positive and negative consequences:

- Trade Deficits: Persistent trade deficits can strain a country's economy. They may indicate a reliance on imports, a decrease in domestic production and employment, and potential risks to domestic industries. However, trade deficits also provide access to a wide variety of goods and services, stimulate competition, and can be financed by foreign investments.

- Trade Surpluses: Trade surpluses are often seen as positive, indicating competitiveness in export markets and a capacity to accumulate foreign reserves. However, excessive trade surpluses can lead to imbalances, overdependence on external demand, and potential conflicts with trading partners.

Addressing Trade Imbalances

Countries employ various strategies to address trade imbalances, such as:

- Trade Policies: Governments may implement trade policies, including tariffs, quotas, and subsidies, to promote exports or restrict imports.

- Currency Interventions: Central banks can intervene in currency markets to influence exchange rates and enhance export competitiveness or curb import dependence.

- Negotiating Trade Agreements: Bilateral or multilateral trade agreements aim to enhance market access and reduce trade barriers, fostering more balanced trade relationships.

Read more views