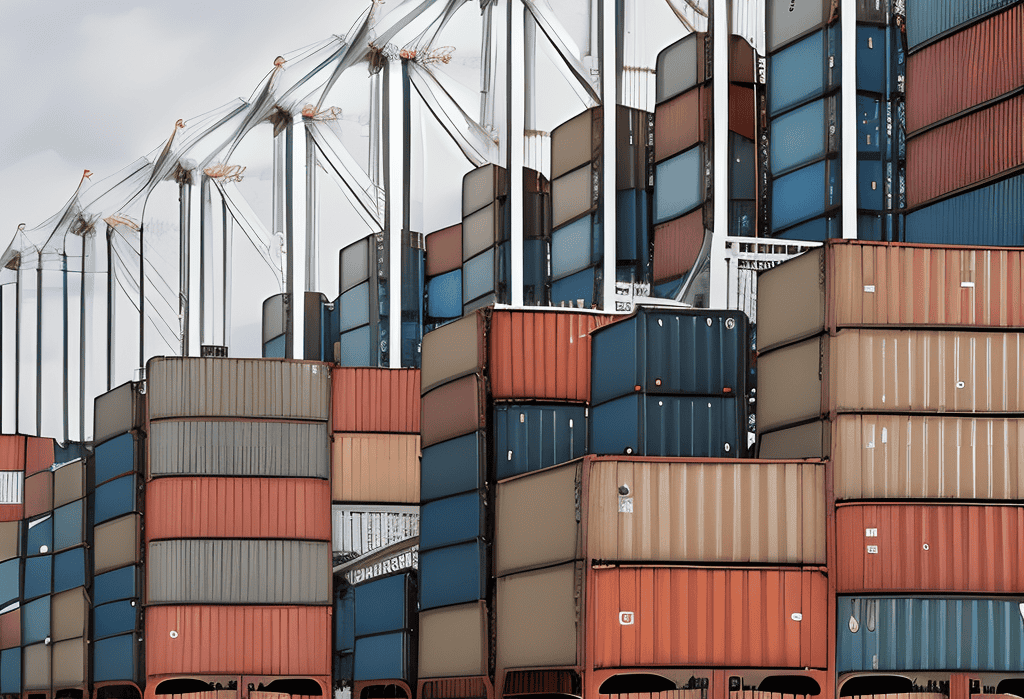

Trade finance plays a vital role in empowering global trade by facilitating transactions, mitigating risks, and optimizing cash flow for businesses engaged in international commerce. By partnering with experienced trade finance providers, optimizing cash flow management, mitigating payment risks, and staying informed and adaptive to market changes, businesses can leverage trade finance solutions effectively to drive growth and success in the global marketplace.

In the interconnected world of international trade, trade finance plays a crucial role in facilitating transactions, mitigating risks, and enabling businesses to navigate the complexities of cross-border commerce. Trade finance encompasses a range of financial products and services designed to support trade transactions, manage liquidity, and optimize cash flow throughout the supply chain. Here, we explore the role of trade finance in facilitating international trade and strategies for leveraging trade finance solutions effectively.

Understanding the Role of Trade Finance

- Trade Facilitation:

Trade finance instruments such as letters of credit, documentary collections, and trade credit insurance facilitate trade transactions by providing assurance to buyers and sellers, mitigating payment risks, and accelerating the flow of goods and services across borders.

- Risk Mitigation:

Trade finance solutions help businesses manage various risks associated with international trade, including credit risk, currency risk, political risk, and counterparty risk. By providing risk mitigation tools such as trade credit insurance, guarantees, and hedging instruments, trade finance enables businesses to conduct transactions with confidence and certainty.

- Working Capital Optimization:

Trade finance facilities such as export financing, import financing, and supply chain finance optimize working capital management by providing liquidity to finance trade-related transactions. These financing solutions improve cash flow, reduce financing costs, and enhance operational efficiency throughout the supply chain.

Leveraging Trade Finance for Global Trade Success

- Partner with Experienced Trade Finance Providers:

Collaborate with reputable financial institutions, banks, and trade finance providers with extensive experience and expertise in international trade. Choose partners that offer comprehensive trade finance solutions tailored to the specific needs and requirements of your business and target markets.

- Optimize Cash Flow Management:

Utilize trade finance solutions such as invoice financing, factoring, and supply chain finance to optimize cash flow and working capital management. Leverage financing options that align with the cash conversion cycle of your business and provide flexibility in managing payment terms and credit terms.

- Mitigate Payment Risks:

Protect against payment risks by utilizing trade finance instruments such as letters of credit, bank guarantees, and credit insurance. Ensure that payment terms are clearly defined, and payment transactions are secured to minimize the risk of non-payment and disputes.

- Stay Informed and Adaptive:

Stay abreast of changes in trade finance regulations, market trends, and emerging technologies to adapt to evolving trade finance landscape. Explore innovative solutions such as blockchain-based trade finance platforms, digital trade finance, and fintech solutions to enhance efficiency and transparency in trade finance operations.

#TradeFinance #InternationalTrade #GlobalCommerce #FinancialSolutions #RiskManagement #WorkingCapital #SupplyChainFinance #BusinessStrategy #CashFlowManagement #GlobalEconomy

Read more views