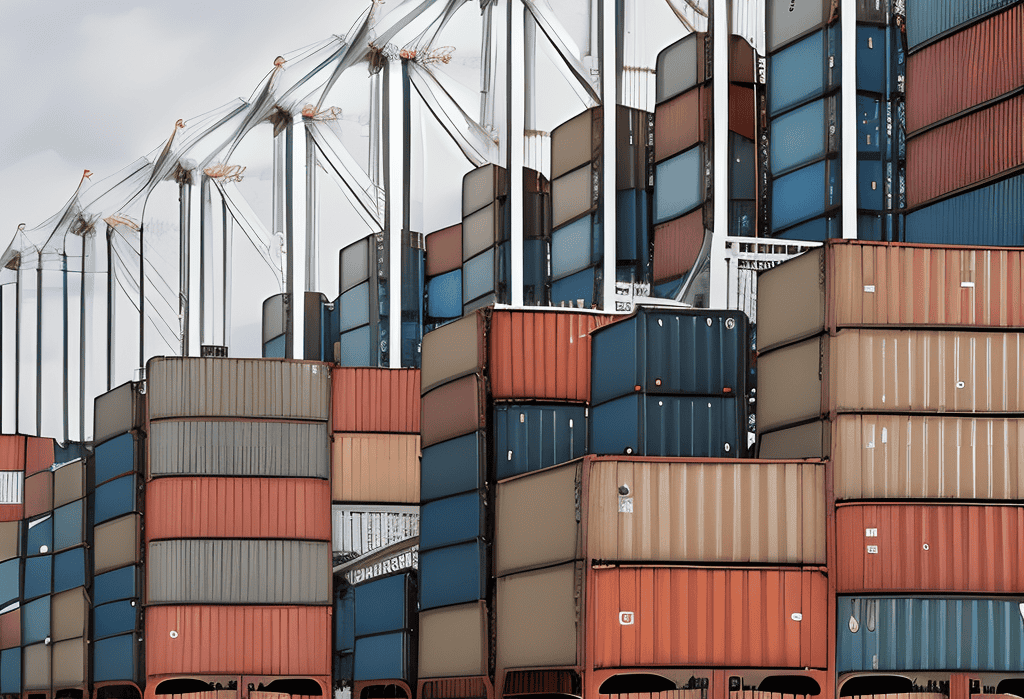

Customs brokers play a vital role in facilitating international trade and driving efficiency, compliance, and cost savings in cross-border commerce. By providing expertise, assistance, and compliance support, customs brokers help businesses navigate complex customs regulations, expedite customs clearance processes, and ensure compliance with applicable laws and regulations in global trade transactions.

Customs brokers play a crucial role in facilitating international trade by providing expertise, assistance, and compliance support to businesses navigating complex customs regulations and procedures. From import and export documentation to tariff classification and customs clearance, customs brokers help businesses navigate regulatory requirements, minimize delays, and ensure compliance with customs laws and regulations in global trade transactions. Here, we explore the role of customs brokers in facilitating international trade and driving efficiency and compliance in cross-border commerce.

Understanding the Role of Customs Brokers

- Compliance and Regulatory Expertise:

Customs brokers possess specialized knowledge and expertise in customs regulations, tariff classifications, and import/export documentation requirements, enabling them to assist businesses in navigating complex customs procedures and ensuring compliance with applicable laws and regulations in international trade transactions.

- Documentation and Paperwork:

Customs brokers help businesses prepare and submit the necessary documentation and paperwork required for importing and exporting goods across borders. From customs declarations and certificates of origin to import licenses and shipping manifests, customs brokers facilitate the smooth flow of goods through customs checkpoints, minimizing delays and ensuring compliance with regulatory requirements.

- Tariff Classification and Valuation:

Customs brokers provide guidance and assistance to businesses in determining the correct tariff classification and valuation of goods for customs purposes. By accurately classifying goods and assessing their customs value, customs brokers help businesses calculate applicable duties, taxes, and fees, ensuring compliance with tariff regulations and minimizing the risk of customs disputes or penalties.

Benefits of Working with Customs Brokers

- Expedited Customs Clearance:

Customs brokers leverage their expertise and relationships with customs authorities to expedite customs clearance processes, minimize delays, and facilitate the timely release of goods across borders. By streamlining customs procedures and resolving customs issues efficiently, customs brokers help businesses avoid costly delays and disruptions in supply chains.

- Compliance Assurance:

Customs brokers assist businesses in navigating complex customs regulations and compliance requirements, ensuring adherence to applicable laws and regulations in international trade transactions. By providing guidance on regulatory compliance, customs documentation, and risk mitigation strategies, customs brokers help businesses minimize the risk of non-compliance penalties and legal liabilities in global trade.

- Cost Savings:

Customs brokers help businesses optimize customs duties, taxes, and fees by providing guidance on tariff classifications, valuation methods, and duty reduction programs. By leveraging their expertise in customs regulations and tariff regimes, customs brokers help businesses identify opportunities to minimize customs costs, maximize duty savings, and improve cost competitiveness in global markets.

#CustomsBrokers #InternationalTrade #CustomsCompliance #GlobalBusiness #CrossBorderCommerce #TradeFacilitation #CustomsClearance #RegulatoryExpertise #Logistics #BusinessEfficiency

Read more views