Repatriating profits in international business presents multifaceted challenges that require strategic foresight, financial acumen, and regulatory compliance expertise to overcome. By understanding the complexities of profit repatriation, implementing proactive risk management strategies, and leveraging tax optimization techniques, businesses can navigate regulatory hurdles, mitigate currency risks, and optimize returns on repatriated funds, ensuring financial resilience and competitiveness in the global marketplace.

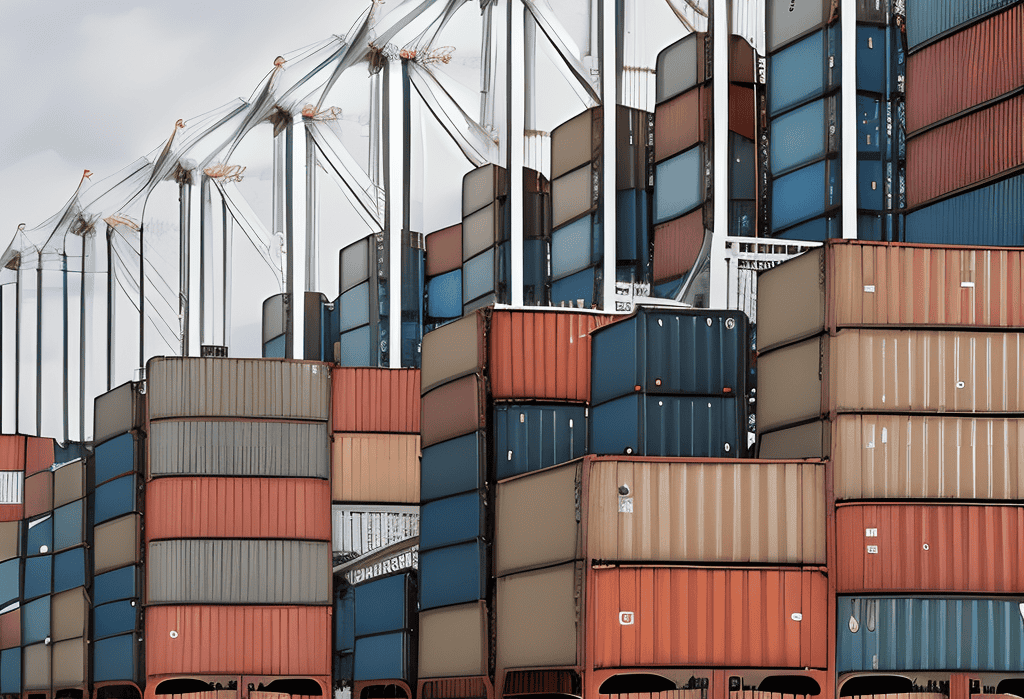

In the realm of international business, repatriating profits from overseas operations is a critical aspect of financial management and strategic decision-making. However, this process is fraught with challenges stemming from regulatory constraints, currency fluctuations, tax considerations, and geopolitical uncertainties. Here, we delve into the complexities of repatriating profits in international business and strategies for overcoming the associated challenges to ensure seamless capital flow and financial optimization across borders.

Understanding the Challenges of Repatriating Profits

- Regulatory Hurdles:

Repatriating profits entails compliance with a myriad of regulatory requirements and foreign exchange controls imposed by host countries, including restrictions on capital repatriation, withholding taxes, and repatriation approval procedures. Navigating complex regulatory landscapes and securing necessary approvals can be time-consuming, costly, and subject to regulatory scrutiny, posing significant challenges for multinational corporations.

- Currency Risks:

Currency fluctuations and exchange rate volatility can impact the value of repatriated profits, leading to financial losses or diminished returns for businesses repatriating funds from overseas subsidiaries or operations. Fluctuating exchange rates can erode profitability, increase transaction costs, and introduce uncertainties in financial planning and cash flow management, complicating the repatriation process for multinational corporations.

- Tax Implications:

Tax considerations play a crucial role in repatriating profits from international operations, as businesses must navigate complex tax laws, treaties, and regulations governing cross-border transactions and profit repatriation. High withholding tax rates, double taxation issues, and tax residency requirements can affect the after-tax returns on repatriated profits, influencing the timing and structure of profit repatriation strategies.

Strategies for Overcoming Repatriation Challenges

- Strategic Financial Planning:

Develop comprehensive financial planning and risk management strategies to mitigate currency risks, optimize tax efficiency, and maximize returns on repatriated profits. Utilize hedging instruments, such as forward contracts and currency options, to manage currency exposures and protect against adverse exchange rate movements, ensuring stability and predictability in cash repatriation.

- Tax Optimization:

Engage in tax planning and structuring initiatives to optimize the tax efficiency of profit repatriation strategies and minimize tax liabilities on repatriated funds. Explore tax-efficient repatriation methods, such as dividend repatriation, intercompany loans, or reinvestment strategies, to leverage tax incentives, treaty benefits, and exemptions available in host and home countries.

- Regulatory Compliance:

Stay abreast of regulatory developments, changes in foreign exchange controls, and compliance requirements governing profit repatriation in target markets. Establish robust internal controls, compliance frameworks, and due diligence processes to ensure adherence to regulatory requirements, mitigate compliance risks, and facilitate timely and compliant repatriation of funds from overseas operations.

#InternationalBusiness #ProfitRepatriation #FinancialManagement #CurrencyRisks #TaxConsiderations #RegulatoryCompliance #CrossBorderTransactions #BusinessStrategy #RiskManagement #GlobalEconomy

Read more views