Digital payment platforms have revolutionized international trade, offering unparalleled efficiency, security, and accessibility. As businesses continue to expand their global footprint, the role of these platforms will only become more integral in driving economic growth and fostering prosperity on a global scale.

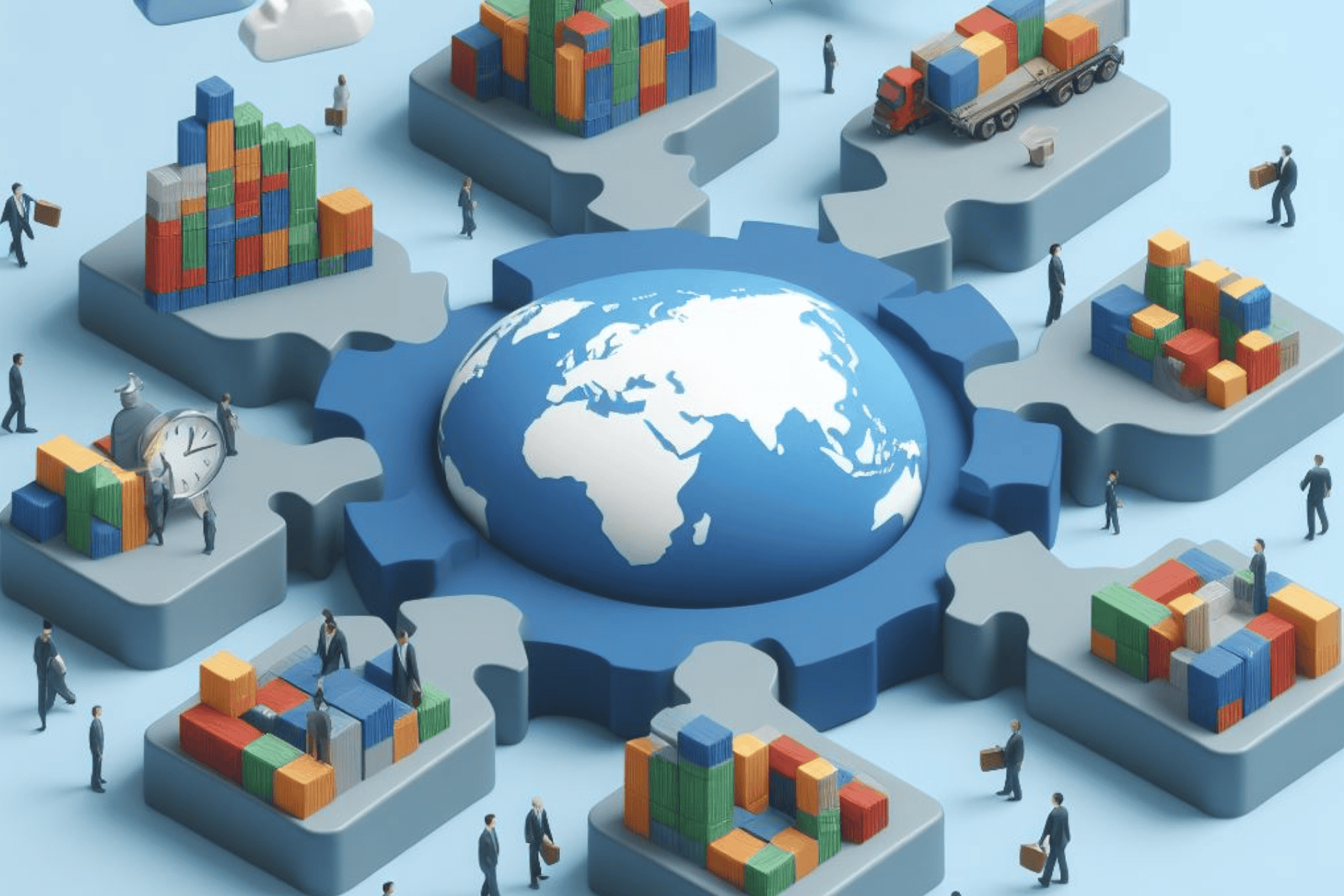

In the ever-evolving landscape of global commerce, digital payment platforms have emerged as pivotal facilitators, reshaping the way businesses engage in international trade. Gone are the days of cumbersome paperwork and delayed transactions; today, digital payment platforms offer seamless, efficient, and secure solutions that transcend geographical boundaries. As businesses increasingly operate on a global scale, these platforms have become indispensable tools for streamlining transactions, mitigating risks, and fostering economic growth.

One of the key advantages of digital payment platforms in international trade lies in their ability to transcend traditional barriers. With the click of a button, businesses can initiate transactions across continents, eliminating the need for physical presence or reliance on antiquated banking systems. This level of accessibility not only expedites the exchange of goods and services but also opens doors to new markets and opportunities previously inaccessible to many businesses.

Moreover, digital payment platforms offer unparalleled transparency and security, addressing concerns associated with fraud and compliance. Advanced encryption technologies and robust authentication measures ensure the integrity of transactions, instilling confidence among buyers and sellers alike. Additionally, the transparency provided by these platforms enables stakeholders to track transactions in real-time, enhancing accountability and reducing the risk of disputes.

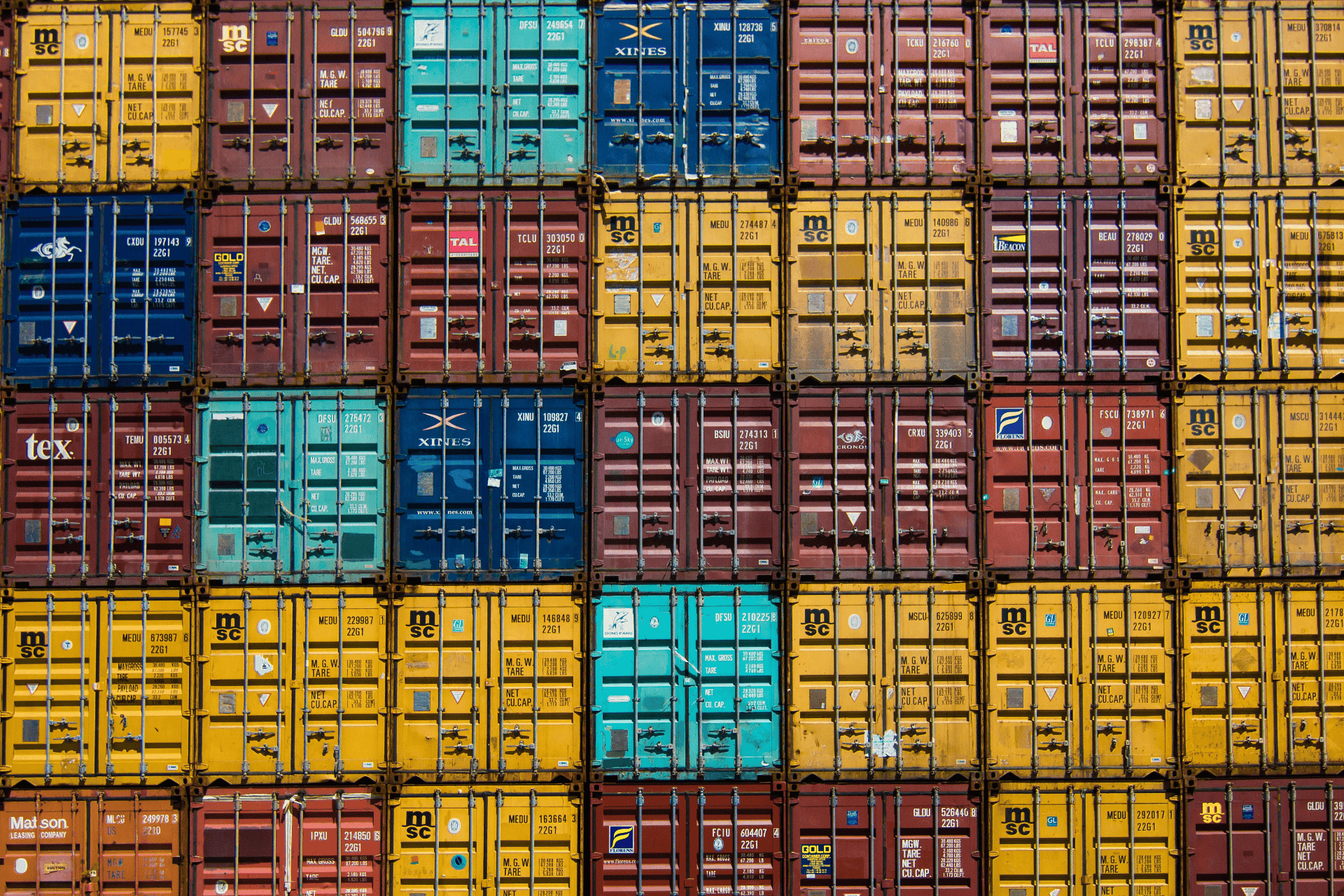

Furthermore, digital payment platforms play a crucial role in mitigating the inherent risks associated with cross-border transactions, such as currency fluctuations and regulatory compliance. By offering multi-currency support and real-time exchange rates, these platforms empower businesses to conduct transactions in their preferred currency, minimizing exposure to foreign exchange risks. Additionally, built-in compliance tools help businesses navigate the complex regulatory landscape, ensuring adherence to international standards and regulations.

The impact of digital payment platforms extends beyond mere transactional efficiency; it also fosters financial inclusion and empowerment, particularly in emerging economies. By providing access to digital financial services, these platforms empower businesses and individuals to participate in the global economy, thereby driving economic growth and reducing poverty. Moreover, the digitization of payments facilitates greater financial literacy and inclusion, laying the foundation for sustainable development and prosperity.

However, despite their myriad benefits, digital payment platforms also face challenges, including cybersecurity threats, regulatory complexities, and interoperability issues. Addressing these challenges requires collaboration among stakeholders, including governments, financial institutions, and technology providers, to ensure the continued evolution and resilience of these platforms.

#DigitalPayment #InternationalTrade #GlobalCommerce #FinancialInclusion #EconomicGrowth #DigitalTransformation #Cybersecurity #RegulatoryCompliance #CurrencyExchange #FinancialServices

Related Information