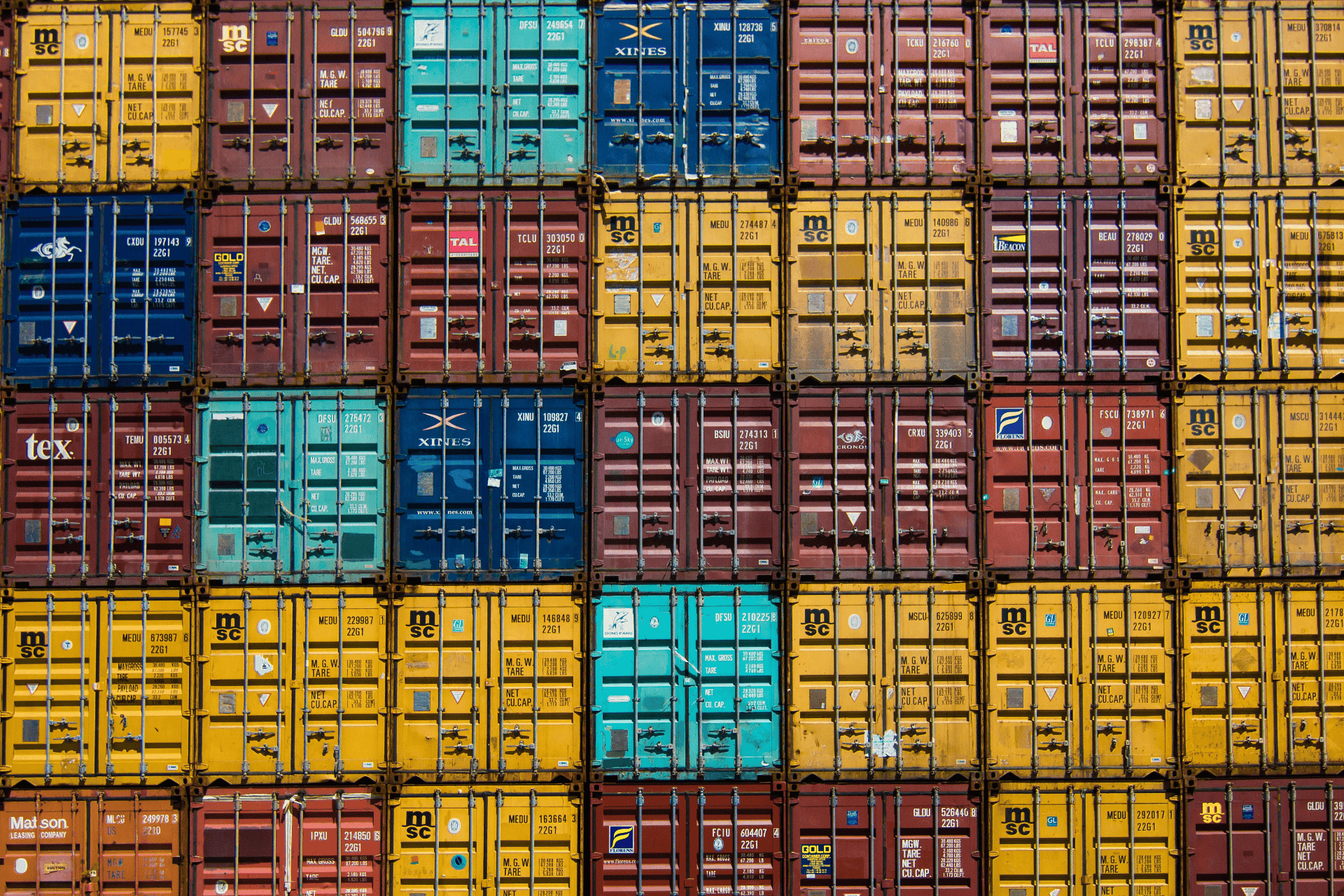

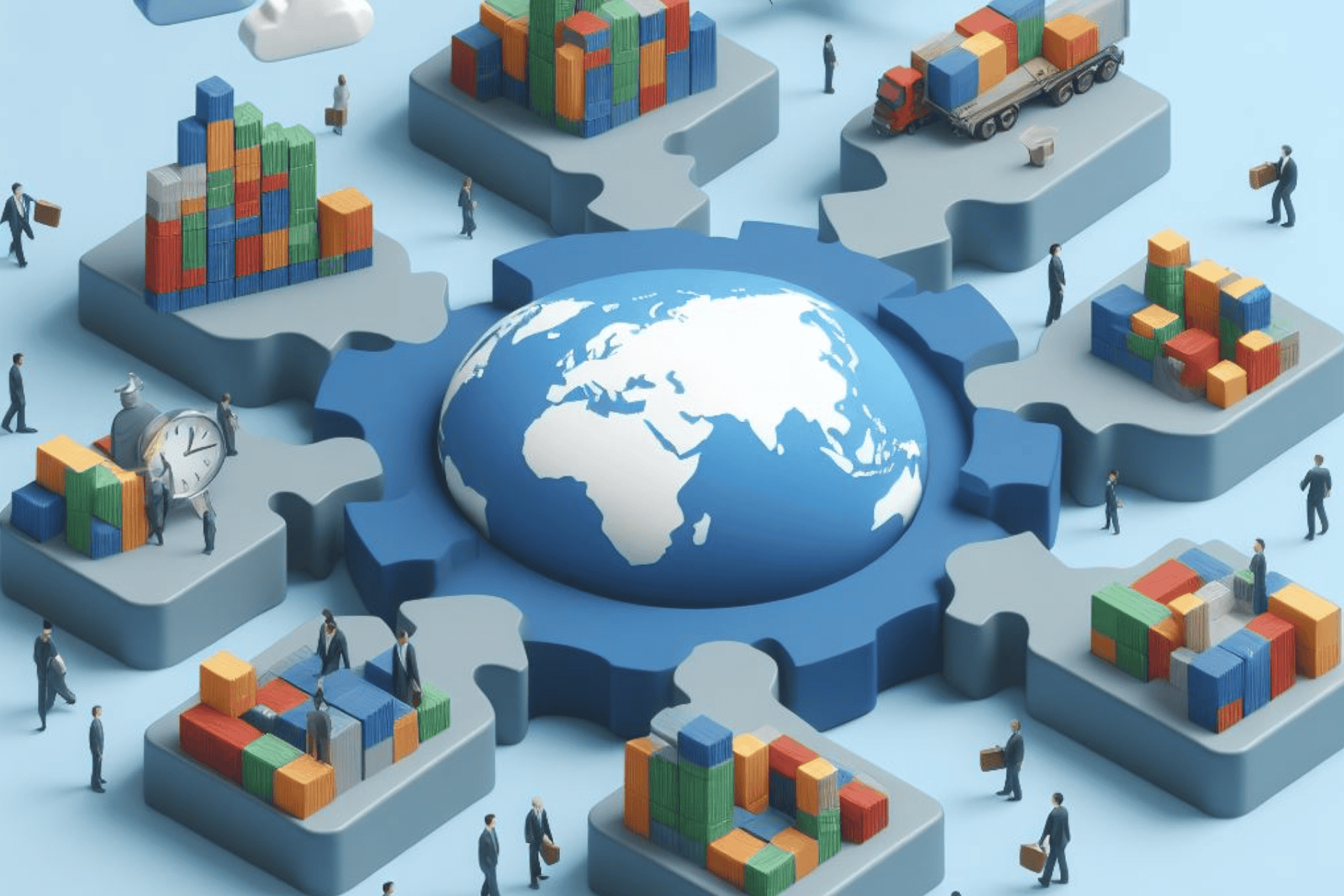

In the ever-evolving landscape of international trade, managing foreign exchange risk is a critical component of business success. By understanding the various types of currency risk and implementing proactive risk management strategies, companies can navigate the complexities of global markets with confidence. Whether through derivative instruments, natural hedging techniques, or comprehensive risk management policies, businesses can safeguard their financial stability and capitalize on opportunities for growth in an increasingly interconnected world.

In the dynamic realm of international trade, one of the most prevalent challenges faced by businesses is managing foreign exchange risk. Fluctuations in currency values can significantly impact the profitability and competitiveness of companies engaged in cross-border transactions. Therefore, devising effective strategies to mitigate these risks is paramount for sustainable growth and success in the global marketplace.

Understanding Foreign Exchange Risk:

Foreign exchange risk, also known as currency risk, arises from the potential volatility in exchange rates between currencies. When conducting international trade, businesses are exposed to various types of foreign exchange risk, including transaction risk, translation risk, and economic risk.

Transaction risk occurs when companies engage in transactions denominated in foreign currencies. Fluctuations in exchange rates between the transaction date and settlement date can lead to gains or losses for the businesses involved. Translation risk arises from the conversion of foreign currency-denominated assets, liabilities, revenues, and expenses into the reporting currency for financial reporting purposes. Economic risk, on the other hand, pertains to the impact of currency fluctuations on future cash flows and market competitiveness.

Effective Strategies for Managing Foreign Exchange Risk:

- Forward Contracts: Forward contracts are agreements to buy or sell a specified amount of currency at a predetermined exchange rate on a future date. By locking in exchange rates in advance, businesses can hedge against potential losses stemming from adverse currency movements. Forward contracts provide certainty in cash flows and protect profit margins, making them a valuable tool for managing transaction risk.

- Currency Options: Currency options grant businesses the right, but not the obligation, to buy or sell a specified currency at a predetermined price within a specified period. Unlike forward contracts, options offer flexibility, allowing companies to capitalize on favorable exchange rate movements while limiting downside risk. By purchasing call options to hedge against currency appreciation or put options to hedge against depreciation, businesses can tailor their risk management strategies to their specific needs.

- Currency Swaps: Currency swaps involve the exchange of principal and interest payments in one currency for equivalent amounts in another currency. These agreements enable businesses to access foreign currency funding at more favorable terms while mitigating exchange rate risk. Currency swaps are particularly beneficial for companies with long-term foreign currency liabilities or financing needs, providing stability and cost-effectiveness in managing economic risk.

- Natural Hedging: Natural hedging involves aligning revenues and expenses in different currencies to offset the impact of currency fluctuations. For instance, companies can strategically diversify their sourcing and sales activities across multiple markets to reduce dependency on a single currency. By matching currency inflows with outflows, businesses can naturally hedge against foreign exchange risk without resorting to derivative instruments.

- Risk Management Policies: Implementing robust risk management policies and procedures is essential for effectively managing foreign exchange risk. Businesses should regularly monitor exchange rate movements, assess their exposure to currency risk, and implement appropriate hedging strategies based on their risk tolerance and business objectives. Additionally, establishing clear guidelines for currency risk management ensures consistency and accountability across the organization.

#ForeignExchange #CurrencyRisk #InternationalTrade #RiskManagement #Hedging #ForwardContracts #CurrencyOptions #CurrencySwaps #NaturalHedging #BusinessStrategy

Related Information