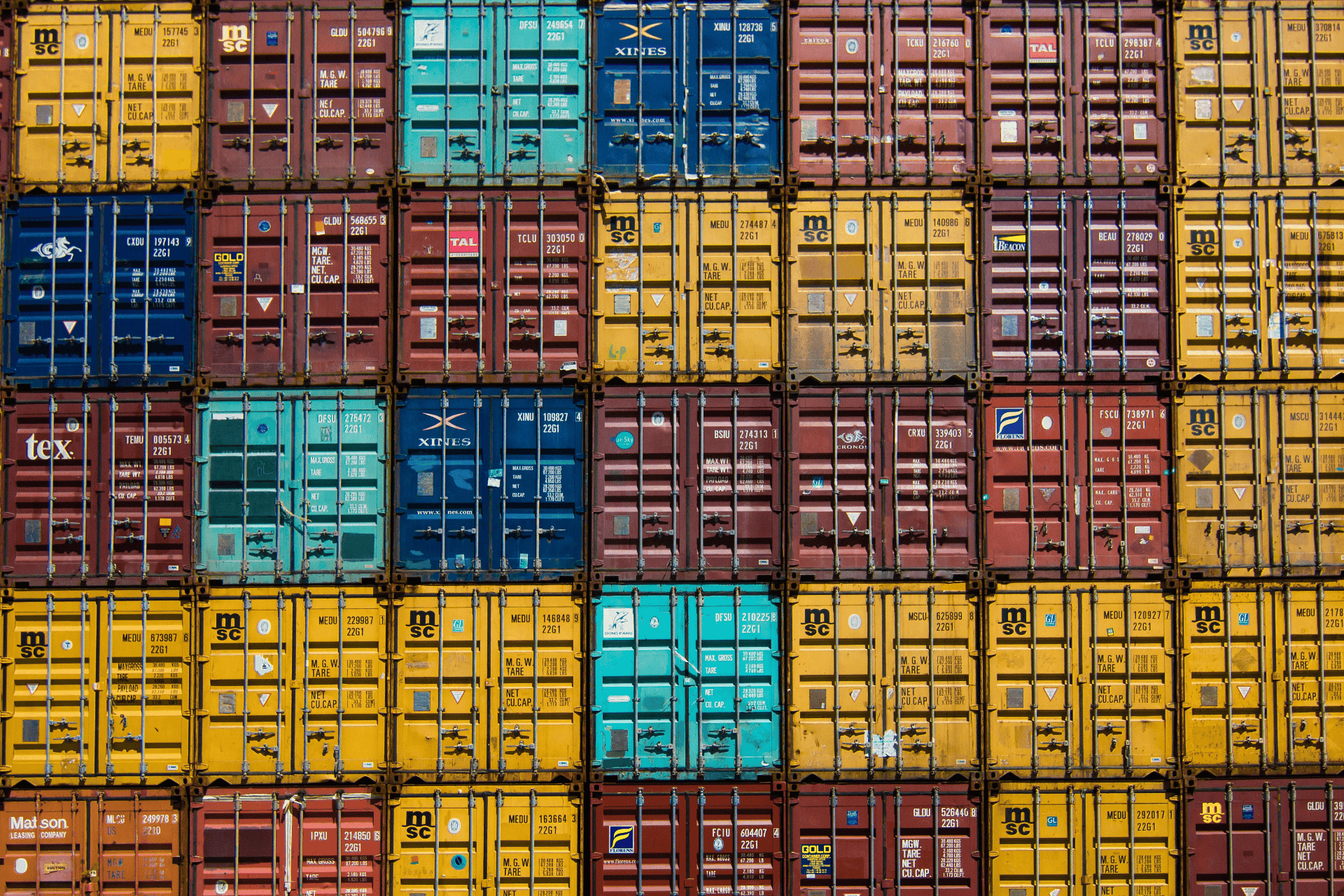

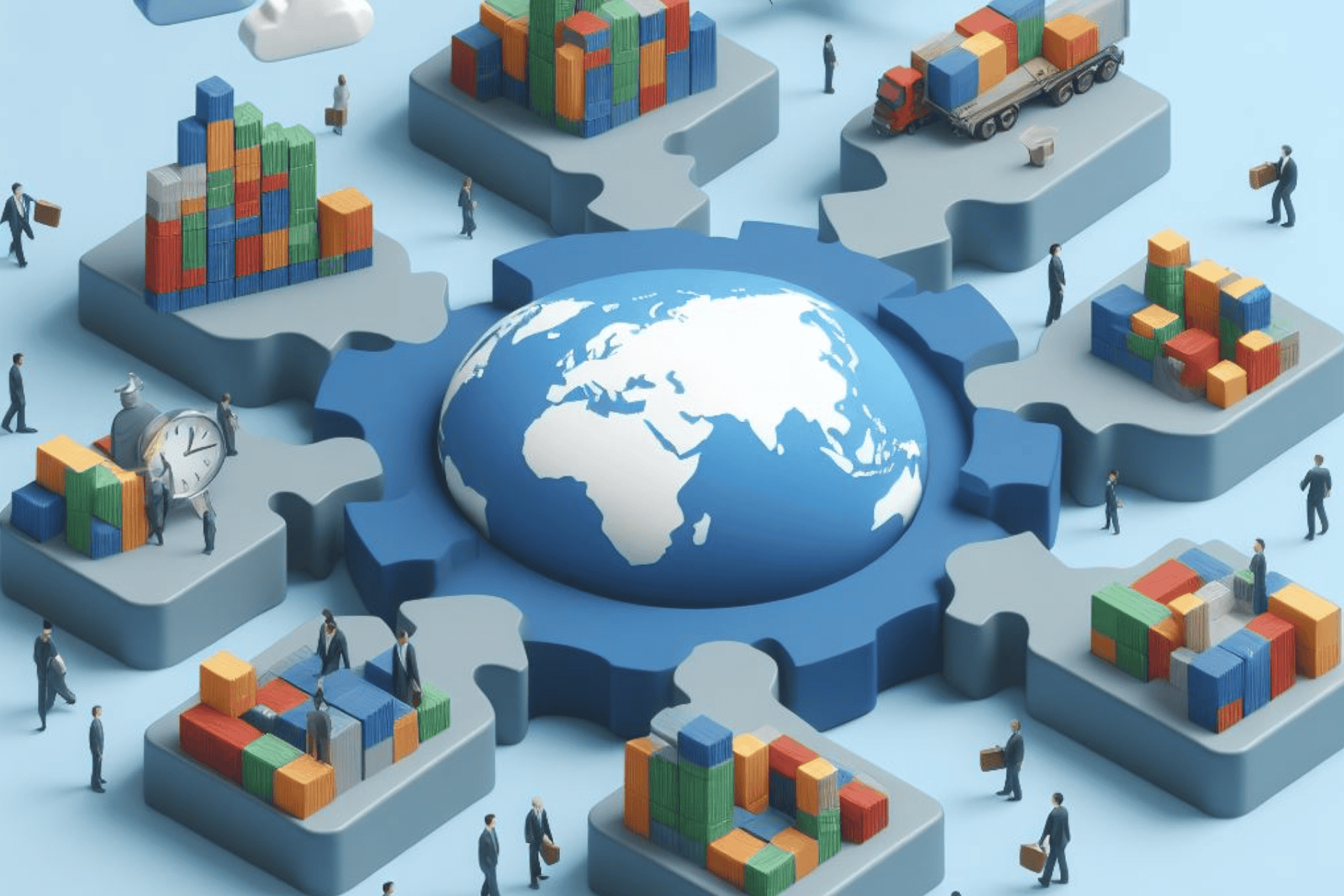

Navigating the complex landscape of international e-commerce laws and regulations is essential for exporters looking to tap into global markets successfully. By understanding and complying with the diverse legal frameworks governing consumer protection, data privacy, taxation, intellectual property rights, and electronic contracts, businesses can mitigate risks and foster trust with customers worldwide. Staying informed and proactive in addressing legal requirements will position exporters for sustainable growth and success in the dynamic world of e-commerce.

In the ever-expanding realm of e-commerce, the world truly is your marketplace. With the click of a button, businesses can reach customers on the other side of the globe, opening up unprecedented opportunities for growth and expansion. However, along with this vast potential comes a complex web of international laws and regulations that exporters must navigate to ensure compliance and mitigate risks. Understanding these legal frameworks is crucial for any business looking to tap into international markets.

One of the primary challenges for exporters in the realm of international e-commerce is dealing with the diverse regulatory landscape across different countries. Each nation has its own set of laws governing e-commerce activities, covering areas such as consumer protection, data privacy, taxation, intellectual property rights, and electronic contracts. Failure to comply with these regulations can result in hefty fines, legal disputes, and damage to reputation.

Consumer protection laws vary significantly from one country to another. For example, some jurisdictions mandate clear disclosure of product information, return policies, and dispute resolution mechanisms to protect consumers' rights. In contrast, others may have more relaxed requirements. Exporters must familiarize themselves with the consumer protection laws of their target markets to ensure they meet the necessary standards.

Data privacy and security have emerged as major concerns in the digital age, leading many countries to enact stringent regulations to safeguard individuals' personal information. The European Union's General Data Protection Regulation (GDPR) is one of the most comprehensive frameworks in this regard, imposing strict requirements on businesses handling EU citizens' data. Similarly, other regions have their own data protection laws that exporters must adhere to when conducting e-commerce activities.

Taxation is another critical aspect of international e-commerce. Different countries have varying tax regimes governing online transactions, including value-added tax (VAT), sales tax, and customs duties. Failure to collect and remit the appropriate taxes can lead to legal repercussions and financial penalties. Exporters must stay abreast of tax laws in their target markets and implement robust systems for tax compliance.

Intellectual property (IP) rights protection is paramount in e-commerce, where digital content and innovations are easily replicable and susceptible to infringement. Exporters must ensure they have the necessary trademarks, copyrights, and patents in place to protect their intellectual assets. Additionally, they should be vigilant in monitoring and enforcing their IP rights to prevent unauthorized use or reproduction of their products and content.

Electronic contracts are a fundamental component of e-commerce transactions, enabling businesses to establish legally binding agreements with customers across borders. However, the enforceability of these contracts can vary depending on the jurisdiction and the presence of specific requirements, such as electronic signatures and consent mechanisms. Exporters must ensure their electronic contracts comply with the applicable laws to avoid disputes and legal challenges.

#InternationalEcommerce #ExportRegulations #GlobalTradeLaws #EcommerceCompliance #CrossBorderCommerce #ConsumerProtection #DataPrivacy #Taxation #IntellectualProperty #ElectronicContracts

Related Information