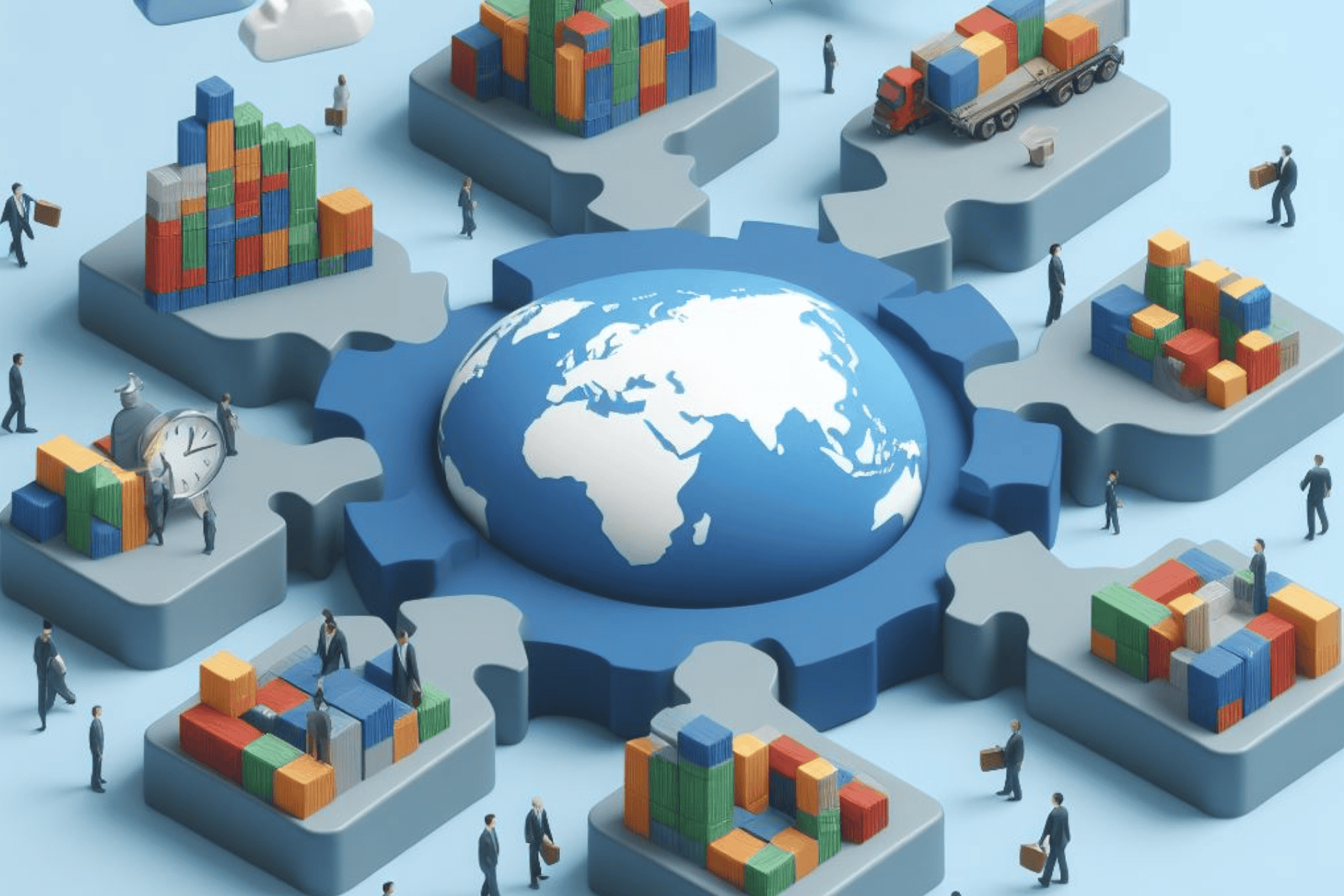

In the realm of international trade, Export Credit Agencies (ECAs) serve as pivotal entities facilitating commerce across borders. These agencies play a significant role in supporting exporters and investors by providing financial solutions and mitigating risks associated with international transactions. Understanding the functions and utilization of ECAs is essential for businesses venturing into global markets.

The Role of Export Credit Agencies

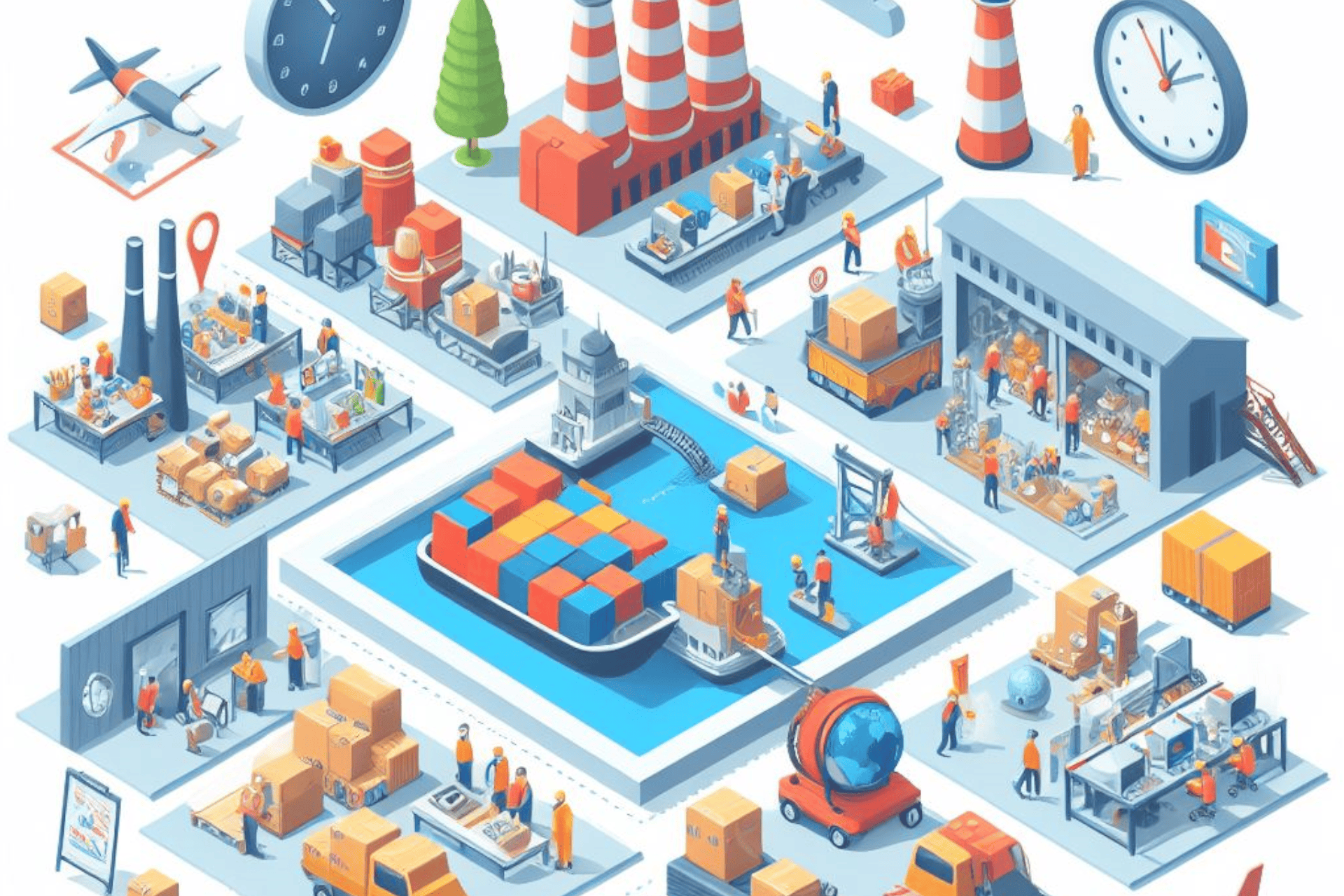

Export Credit Agencies are governmental or quasi-governmental institutions that extend financial support to domestic companies involved in exporting goods and services. Their primary objective is to promote international trade by offering various forms of financial assistance, including:

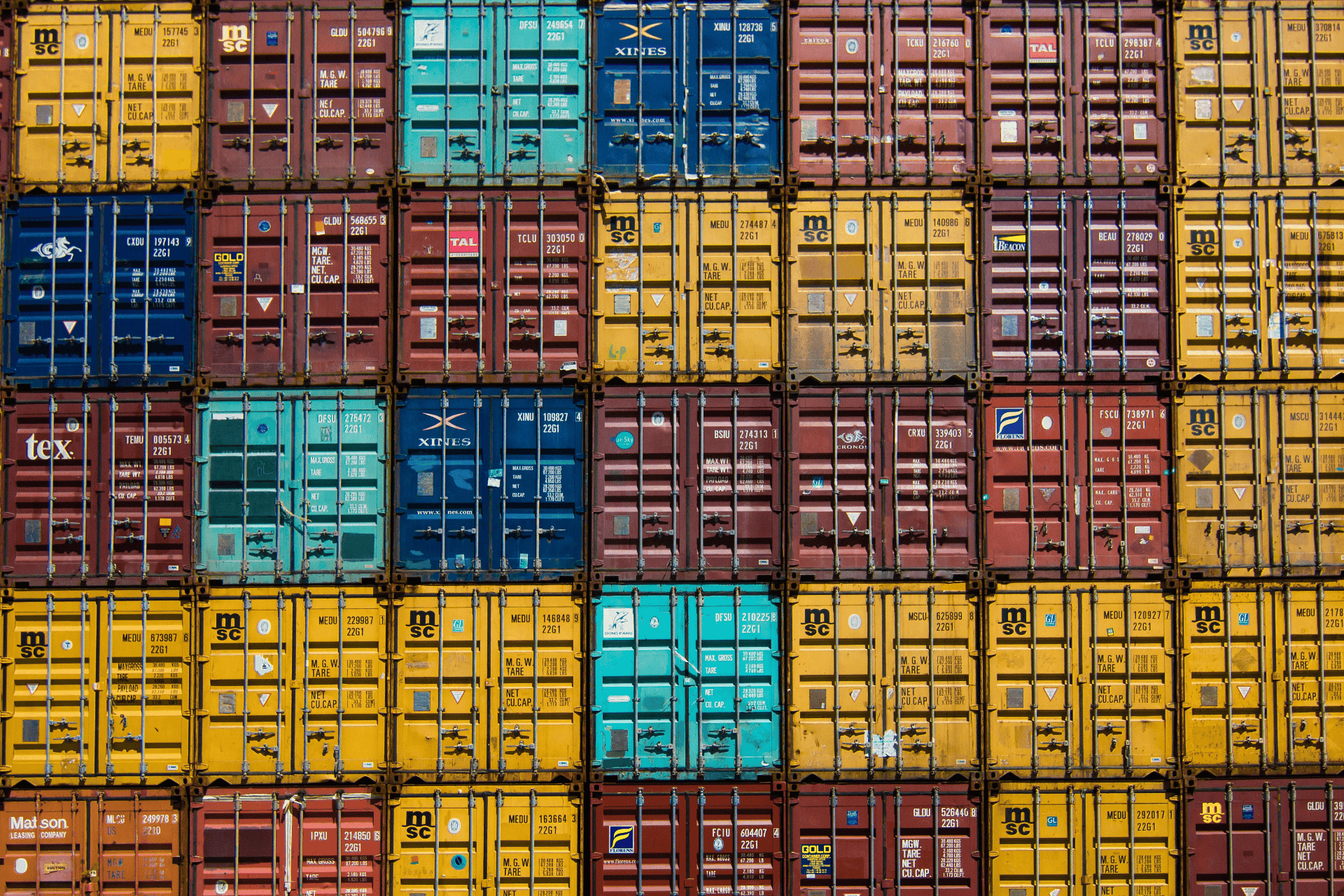

- Export Financing: ECAs provide loans, credits, and guarantees to support export transactions, ensuring that exporters receive payment for their goods and services.

- Risk Mitigation: They offer insurance and guarantees to protect exporters against commercial and political risks, such as non-payment by foreign buyers, currency fluctuations, and political instability.

- Project Finance: ECAs facilitate long-term financing for large infrastructure projects undertaken by domestic companies in foreign markets, promoting economic development and investment.

- Market Access: By offering competitive financing terms, ECAs help domestic companies penetrate foreign markets and compete effectively with international rivals.

How ECAs Operate

ECAs typically operate in collaboration with export-oriented businesses and financial institutions. The process of utilizing ECAs involves several key steps:

- Application: Exporters interested in ECA support submit applications detailing their export transactions and financing requirements.

- Evaluation: ECAs assess the creditworthiness of exporters and the viability of their proposed transactions, considering factors such as the nature of the export, the financial strength of the buyer, and the associated risks.

- Financial Assistance: Upon approval, ECAs provide various forms of financial assistance tailored to the needs of exporters, including direct loans, export credit insurance, and guarantees.

- Execution: Exporters execute their transactions with the support of ECAs, ensuring smooth and secure trade operations.

- Repayment: Exporters repay the financing extended by ECAs according to agreed-upon terms, typically tied to the successful completion of export transactions.

Benefits and Challenges

The utilization of Export Credit Agencies offers numerous benefits for exporters and investors:

- Enhanced Access to Financing: ECAs provide financing solutions that may not be available through traditional commercial lenders, enabling exporters to pursue lucrative opportunities in foreign markets.

- Risk Mitigation: By insuring against various risks, ECAs minimize the potential losses associated with international trade, instilling confidence among exporters and investors.

- Competitive Advantage: Favorable financing terms offered by ECAs give exporters a competitive edge in global markets, increasing their chances of winning contracts and expanding their market share.

However, leveraging ECAs also presents certain challenges:

- Complexity: Navigating the intricacies of ECA procedures and requirements can be daunting for exporters, necessitating expert guidance and resources.

- Competition: As ECAs support exporters from different countries, competition for ECA-backed deals can be fierce, requiring exporters to differentiate themselves and offer compelling value propositions.

- Regulatory Compliance: Exporters must adhere to regulatory guidelines and compliance standards set forth by both domestic and foreign authorities when utilizing ECAs, adding complexity to the transaction process.

#ExportCreditAgencies #InternationalTrade #GlobalBusiness #ExportFinance #RiskMitigation #TradeFinance #EconomicDevelopment #MarketAccess #ProjectFinance

Related Information