Export financing presents numerous opportunities for small and medium enterprises to overcome financial barriers and unlock their potential in the global marketplace. Whether through trade credit insurance, export factoring, government-sponsored programs, or alternative financing mechanisms, SMEs have access to a range of options to support their export initiatives. By understanding and leveraging these financing tools effectively, SMEs can navigate the complexities of international trade with confidence, driving sustainable growth, and prosperity for their businesses.

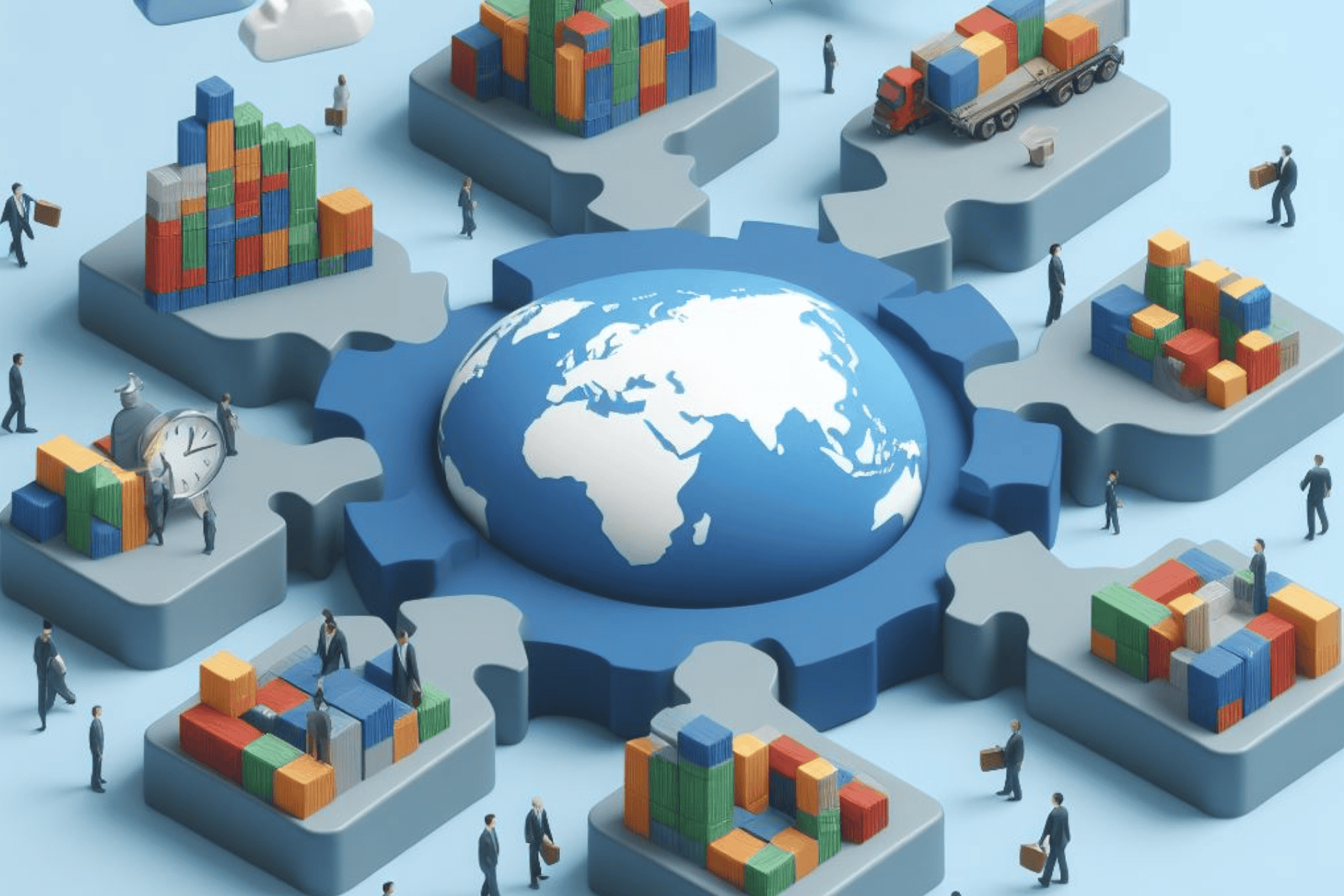

In today's global marketplace, small and medium enterprises (SMEs) often find themselves facing significant challenges when it comes to expanding their businesses beyond borders. One major obstacle they encounter is securing the necessary financing to support their export endeavors. However, with the right knowledge and guidance, SMEs can explore various options for export financing that can propel their growth and success on the international stage.

One of the primary avenues available to SMEs for export financing is trade credit insurance. This form of insurance protects businesses against the risk of non-payment by their overseas buyers. By mitigating the financial risks associated with exporting, SMEs can confidently pursue new markets and customers without fear of potential losses. Additionally, trade credit insurance can enhance access to working capital by providing reassurance to lenders and investors, thereby facilitating easier access to financing.

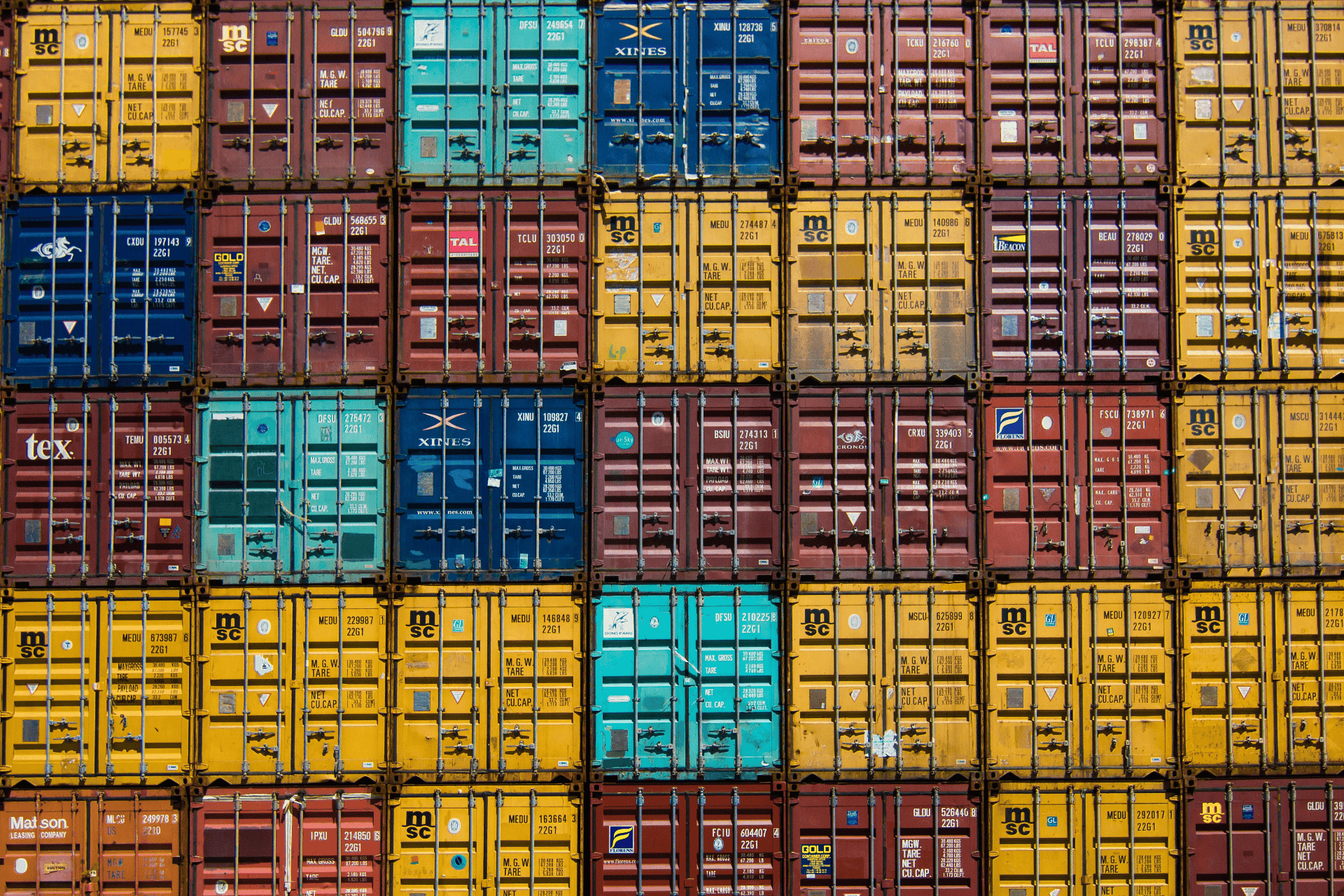

Another valuable tool for SMEs engaged in export activities is export factoring. Export factoring involves selling accounts receivable to a financial institution at a discounted rate in exchange for immediate cash. This allows SMEs to quickly access funds tied up in outstanding invoices, enabling them to address pressing financial needs such as production costs, inventory management, and expansion initiatives. Furthermore, export factoring can help SMEs mitigate the risks associated with late payments or default by customers, ensuring steady cash flow and sustained business operations.

Furthermore, government-sponsored export financing programs can be instrumental in supporting SMEs' international trade aspirations. Many governments offer various financial assistance schemes, grants, and loan programs specifically designed to facilitate export activities for small and medium-sized businesses. These programs often provide favorable terms, reduced interest rates, and flexible repayment options, making them highly attractive options for SMEs seeking export financing solutions. By leveraging government support, SMEs can access the financial resources needed to explore new markets, invest in export capabilities, and compete effectively on a global scale.

In addition to traditional financing mechanisms, SMEs can also consider alternative forms of export financing, such as supply chain finance and crowdfunding. Supply chain finance involves optimizing cash flow within the supply chain by leveraging relationships with suppliers and buyers to access favorable financing terms. Crowdfunding platforms offer SMEs the opportunity to raise capital from a diverse pool of investors interested in supporting innovative and promising export ventures. By tapping into these alternative funding sources, SMEs can diversify their financing strategies and access additional capital to fuel their international expansion efforts.

#ExportFinancing #SMEs #InternationalTrade #TradeCreditInsurance #ExportFactoring #GovernmentSupport #AlternativeFinance #SupplyChainFinance #Crowdfunding

Related Information