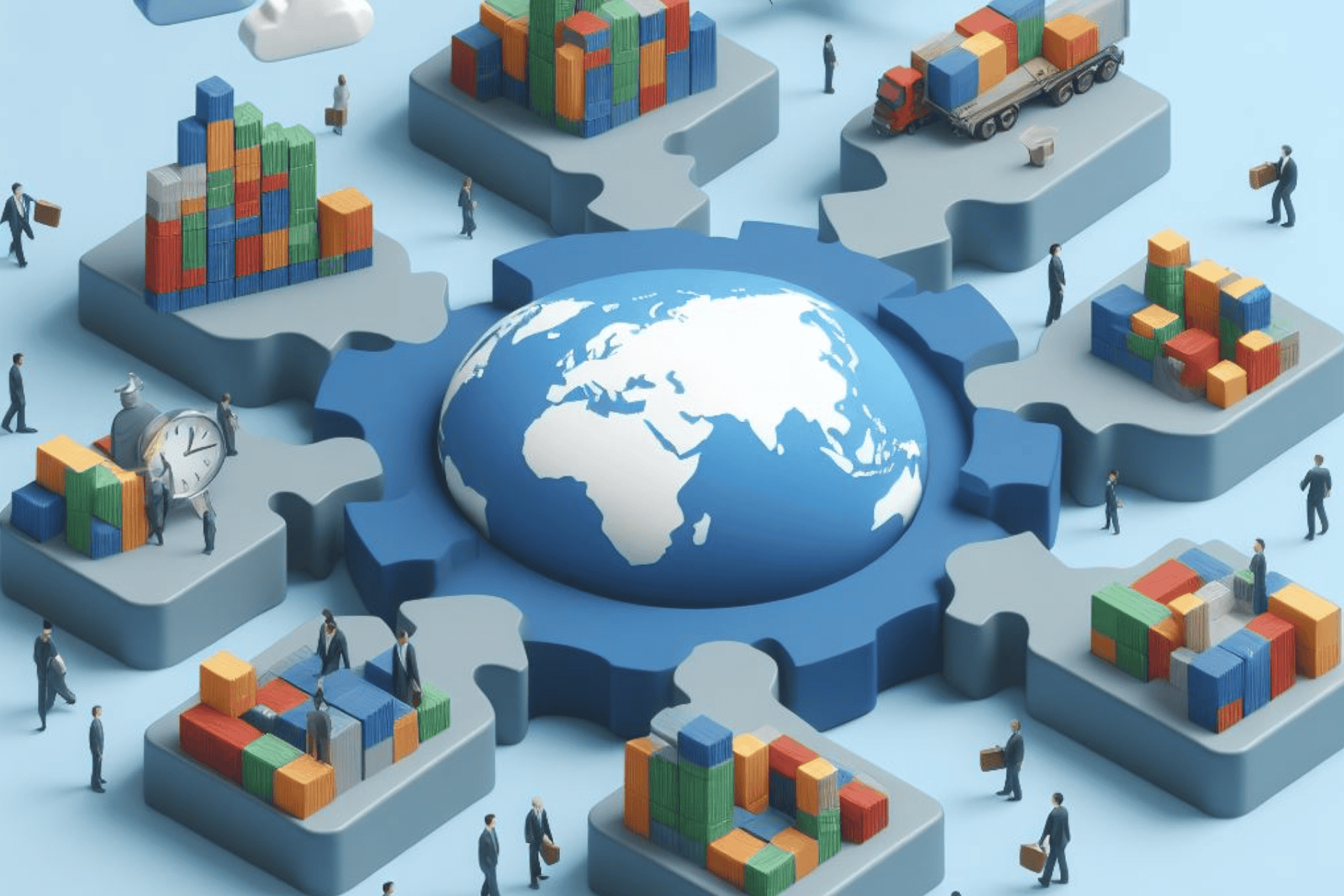

Selecting an optimal strategy for entering a foreign market involves considering various approaches including exporting, licensing or franchising, foreign direct investment, joint ventures, strategic alliances, and piggybacking. Each method offers unique benefits and challenges, and the choice largely depends on the firm's objectives, resources, and risk tolerance, as well as the target market's specific characteristics. Proper understanding of these strategies can provide a roadmap for companies seeking to expand their reach globally.

cThe task of penetrating a foreign market is no small feat for any business, big or small. The allure of untapped potential, promising profit margins, and a new audience to serve is often too enticing to resist. However, the approach to achieving this goal is far from one-size-fits-all. The right strategy for market entry can vary widely depending on a company's industry, size, resources, and the specific market in question. This blog post will unpack the various strategies available to companies looking to make their mark in a foreign market.

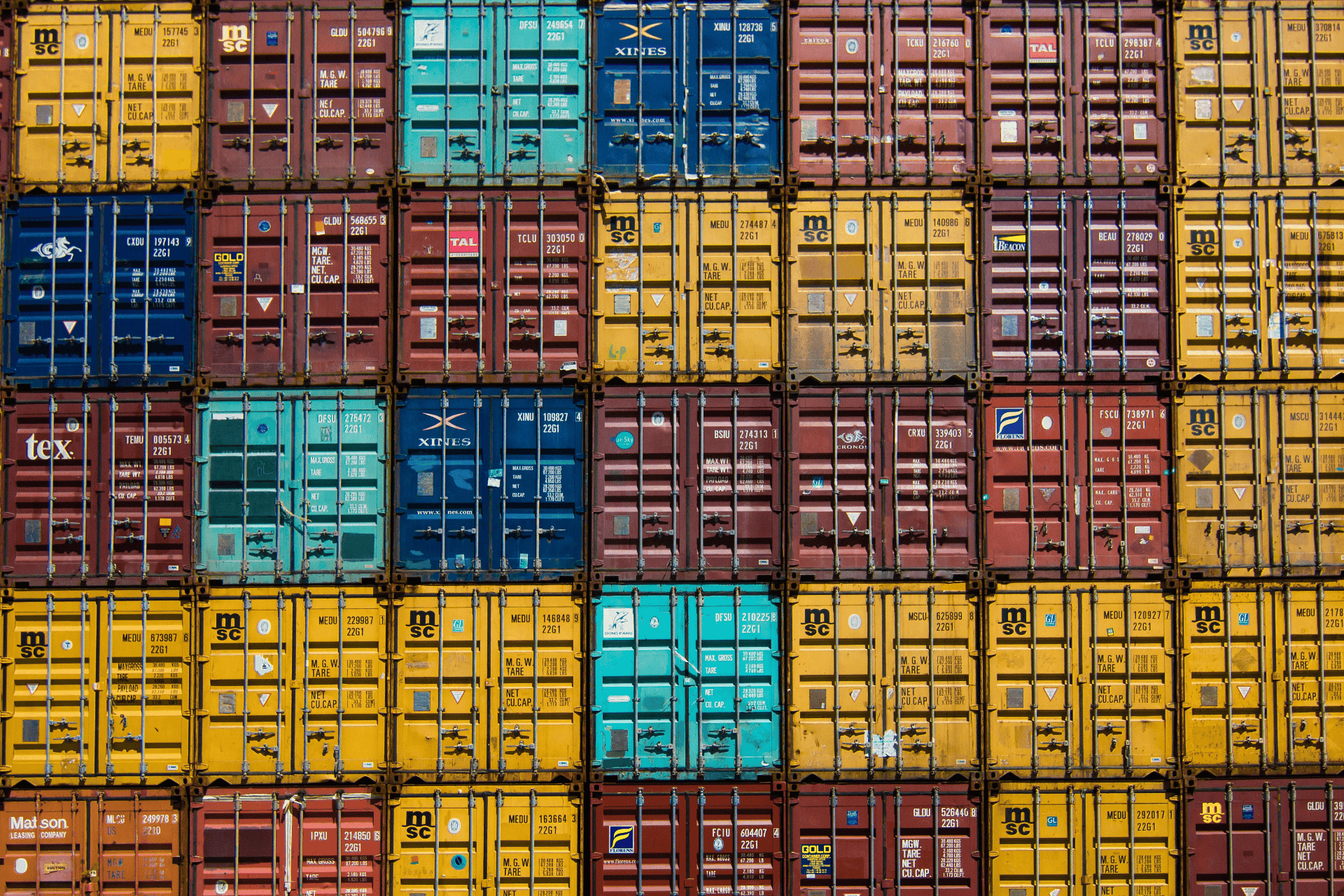

The first common strategy employed by firms seeking new territories is export entry. This approach involves selling a product directly to the foreign market, typically through a distributor. This method is considered relatively low risk, as it doesn't require establishing a physical presence in the market. However, businesses must grapple with complex export regulations, tariffs, and logistics issues, not to mention navigating cultural nuances that may affect the product’s reception.

The second strategy often employed is licensing or franchising. This involves an agreement where a company allows a foreign company to use its brand, technology, or product specifications. In return, the domestic company receives royalty payments or fees. This approach requires less investment and offers quicker market access, but at the cost of lower potential returns and less control over the brand and product in the foreign market.

Foreign Direct Investment (FDI) is another strategy that involves a company setting up a physical presence in the foreign market, either by building facilities from scratch (greenfield investment) or by buying existing facilities (brownfield investment). This is a more capital-intensive approach, but it allows for more control over operations and closer contact with customers.

For businesses that seek to leverage local knowledge and resources, joint ventures and strategic alliances are preferred. These entail partnering with a local company to share resources and responsibilities in operating in the new market. The collaboration provides local market insight, sharing of risks, and costs, but potential conflicts and profit sharing could be challenging.

The 'piggyback' approach, on the other hand, involves using another company’s existing infrastructure and distribution networks to sell a product in a foreign market. This method is especially beneficial for smaller companies that lack the resources to independently penetrate a foreign market, allowing them to ride on the coat-tails of a more established brand.

Each of these strategies has its unique pros and cons, and the choice of approach largely depends on a company’s objectives, resources, risk tolerance, and the nature of the market it wishes to penetrate. It is also vital for businesses to consider the foreign market's political, cultural, and economic climate. Market entry is not just about making a product or service available in a new country—it's about adapting to and integrating with a completely different market environment.

As businesses take on the ambitious task of entering foreign markets, it becomes clear that there is no singular approach to this complex endeavour. Whether it's exporting, licensing, FDI, joint ventures, strategic alliances, or piggybacking, each strategy holds its unique merits and drawbacks. However, understanding these strategies and how they align with a company’s unique circumstances will serve as the compass guiding firms in their journey of global expansion.

Related Information