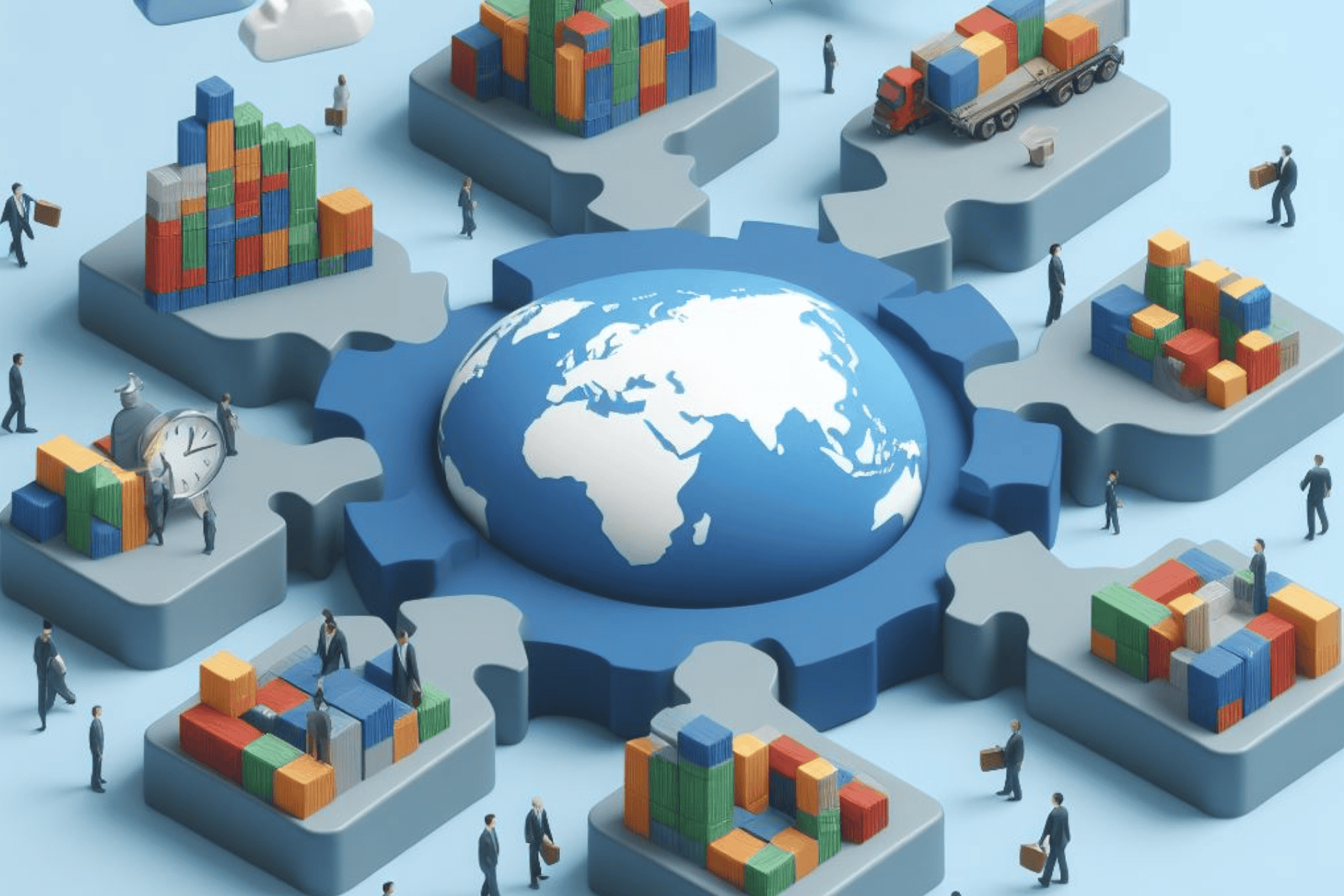

Export tax rebates serve as valuable tools for businesses seeking to leverage international trade opportunities and enhance competitiveness in global markets. By refunding taxes paid on exported goods, these rebates offer a means to reduce production costs, stimulate export growth, and improve profitability for businesses engaged in cross-border trade. However, navigating the intricacies of rebate claims requires careful consideration of compliance requirements, documentation, and regulatory nuances. By understanding and effectively utilizing export tax rebates, businesses can gain a competitive edge and capitalize on the vast potential of the global marketplace.

In the intricate world of international trade, navigating through various policies and regulations is crucial for businesses aiming to expand their market reach. Among the many strategies available, understanding and utilizing export tax rebates can significantly benefit companies engaged in exporting goods. These rebates offer a means to bolster competitiveness, enhance profitability, and stimulate growth in the global marketplace.

What are Export Tax Rebates?

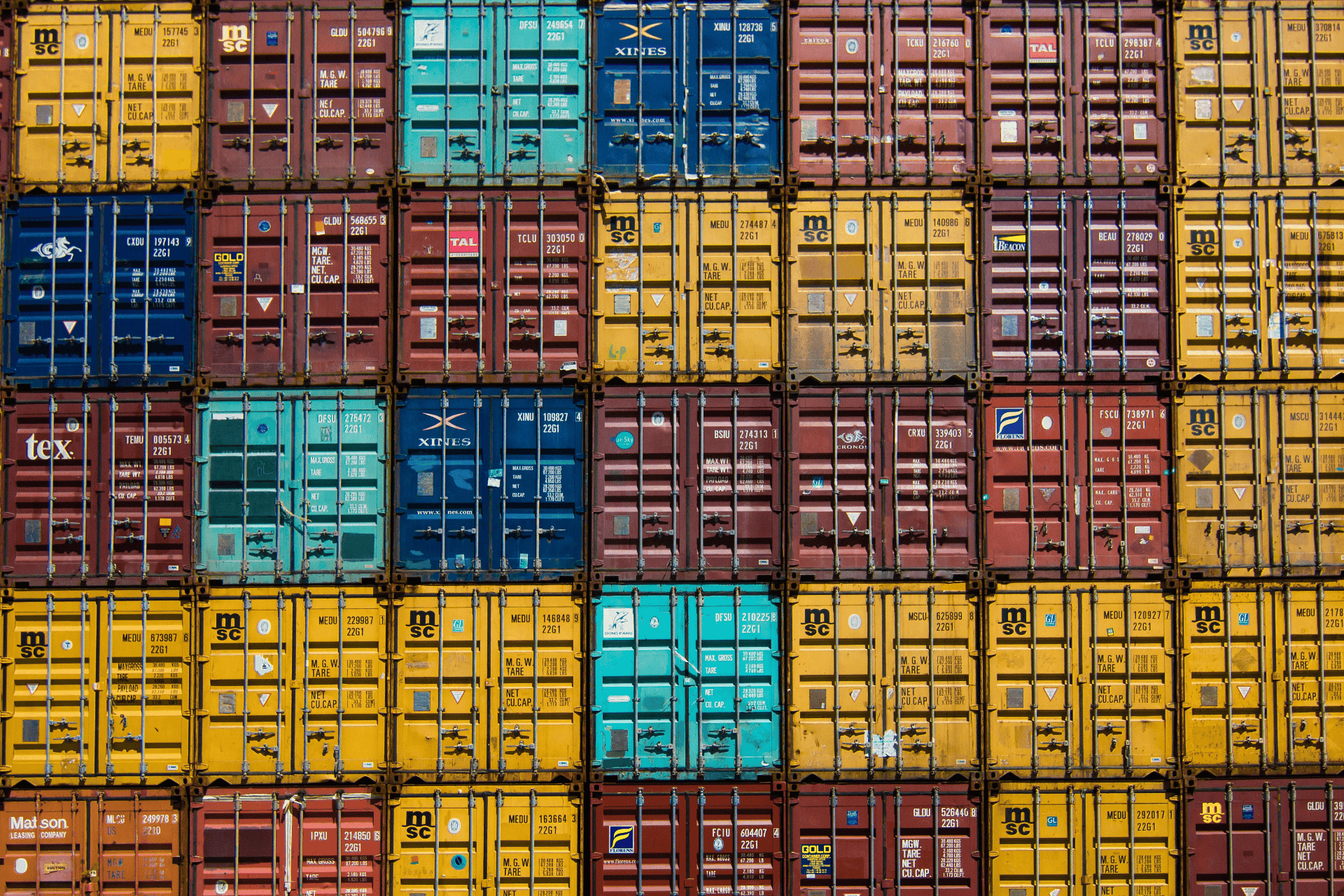

Export tax rebates, also known as export VAT refunds or export tax refunds, are mechanisms employed by governments to incentivize and support export-oriented industries. Essentially, these rebates entail the refund of taxes paid on goods destined for foreign markets. The rationale behind such rebates is to alleviate the tax burden on exported goods, making them more competitive in international markets and fostering economic growth through increased exports.

How Export Tax Rebates Work

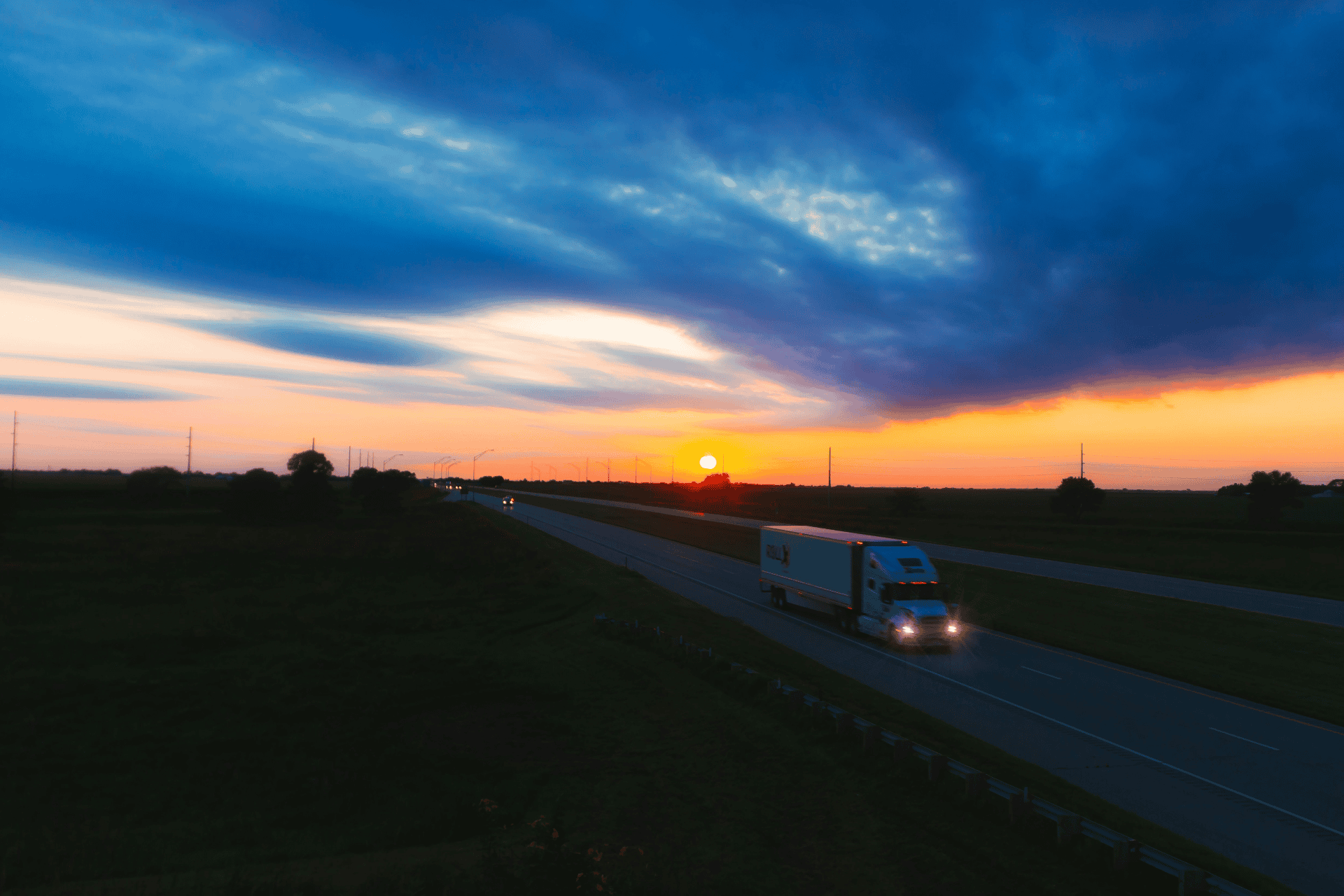

When a product is manufactured for export, it typically incurs various taxes throughout the production process. These taxes might include value-added tax (VAT), consumption tax, or other levies imposed by the exporting country. However, to promote exports, governments often provide exporters with the option to claim refunds on the taxes paid during production or on inputs used in manufacturing goods intended for exportation.

The process of claiming export tax rebates usually involves submitting relevant documentation, such as invoices and customs declarations, to the appropriate government authorities. Upon verification of eligibility, exporters receive refunds equivalent to the taxes paid, thus reducing the overall cost of production and enhancing competitiveness in international markets.

Advantages of Utilizing Export Tax Rebates

- Cost Reduction: By refunding taxes paid on exported goods, export tax rebates effectively lower the production costs for businesses engaged in international trade. This reduction in expenses can significantly enhance profit margins and bolster competitiveness in global markets.

- Enhanced Competitiveness: Export tax rebates level the playing field for exporters by mitigating the impact of taxes on the final price of goods. This enables exporters to offer competitive pricing, thereby increasing their attractiveness to foreign buyers and expanding market share.

- Stimulated Export Growth: By incentivizing exports, governments aim to stimulate economic growth by boosting international trade activities. Export tax rebates encourage businesses to explore new markets and capitalize on global demand, driving overall economic prosperity.

- Improved Cash Flow: Timely refunds of export taxes contribute to improved cash flow management for exporters. The infusion of funds through tax rebates can be utilized for various purposes, such as investment in expansion, research and development, or working capital needs.

Key Considerations for Businesses

While export tax rebates present lucrative opportunities for businesses engaged in international trade, several considerations must be taken into account:

- Compliance Requirements: Exporters must adhere to specific eligibility criteria and compliance obligations set forth by relevant government authorities to qualify for tax rebates. Failure to comply with regulations may result in delays or denials of rebate claims.

- Documentation and Recordkeeping: Maintaining accurate records and documentation throughout the export process is essential for successful rebate claims. Detailed records of transactions, invoices, and customs declarations are crucial for substantiating rebate claims and demonstrating compliance with regulatory requirements.

- Navigating Complexities: The process of claiming export tax rebates can be complex, varying significantly across jurisdictions and industries. Businesses must stay informed about relevant regulations, procedures, and changes in tax policies to effectively navigate the complexities associated with rebate claims.

#ExportTaxRebates #InternationalTrade #ExportIncentives #GlobalMarket #BusinessStrategy #TaxRefunds #CompetitiveAdvantage #EconomicGrowth #ExportCompliance #GlobalTrade

Related Information