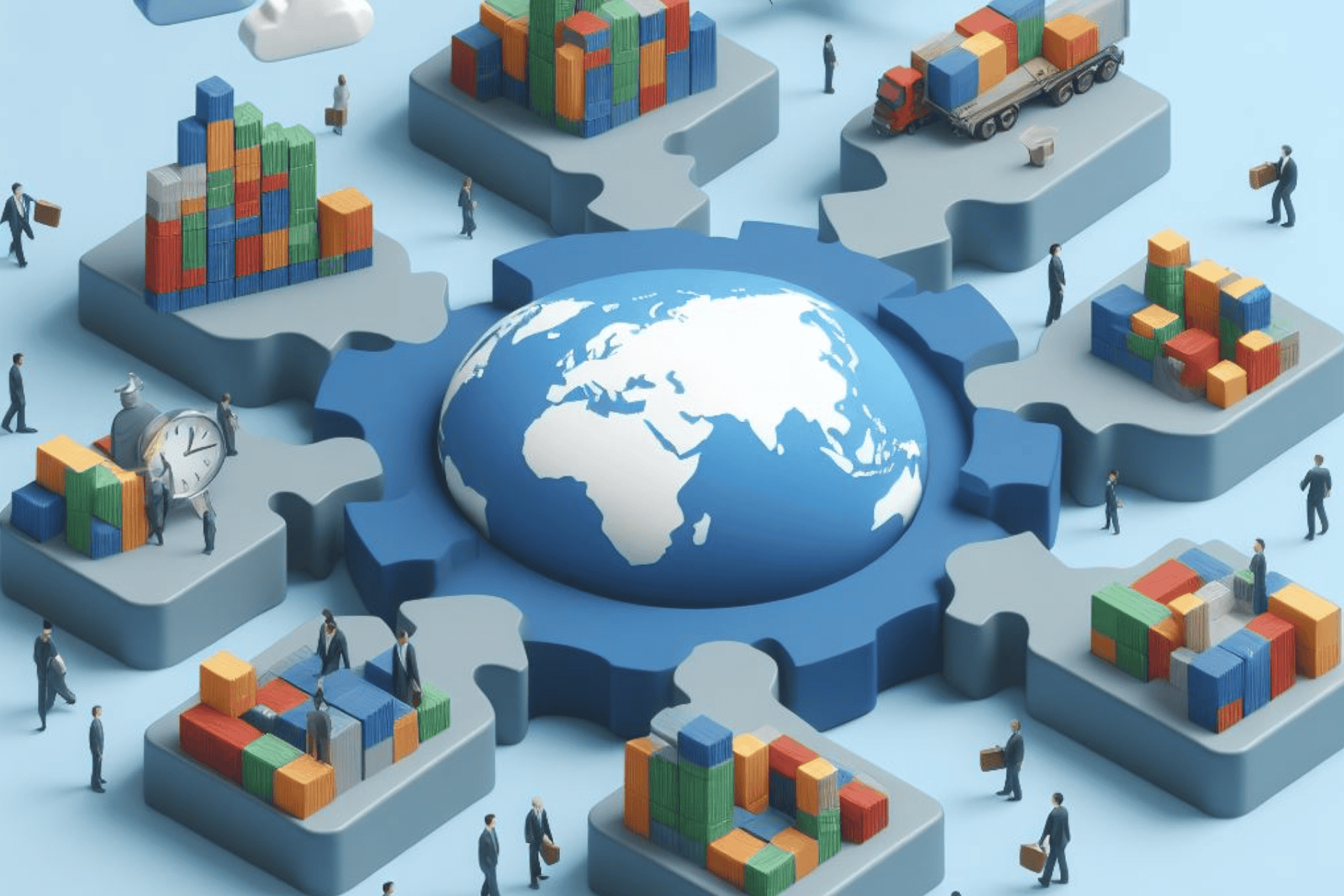

Navigating international trade regulations involves understanding tariff and non-tariff barriers, customs procedures, trade agreements, export controls, foreign trade regulations, and ethical trade practices. Non-compliance can lead to severe penalties and reputational damage. Utilizing expert advice, staying updated, and fostering a compliance culture can help businesses successfully navigate this complex landscape

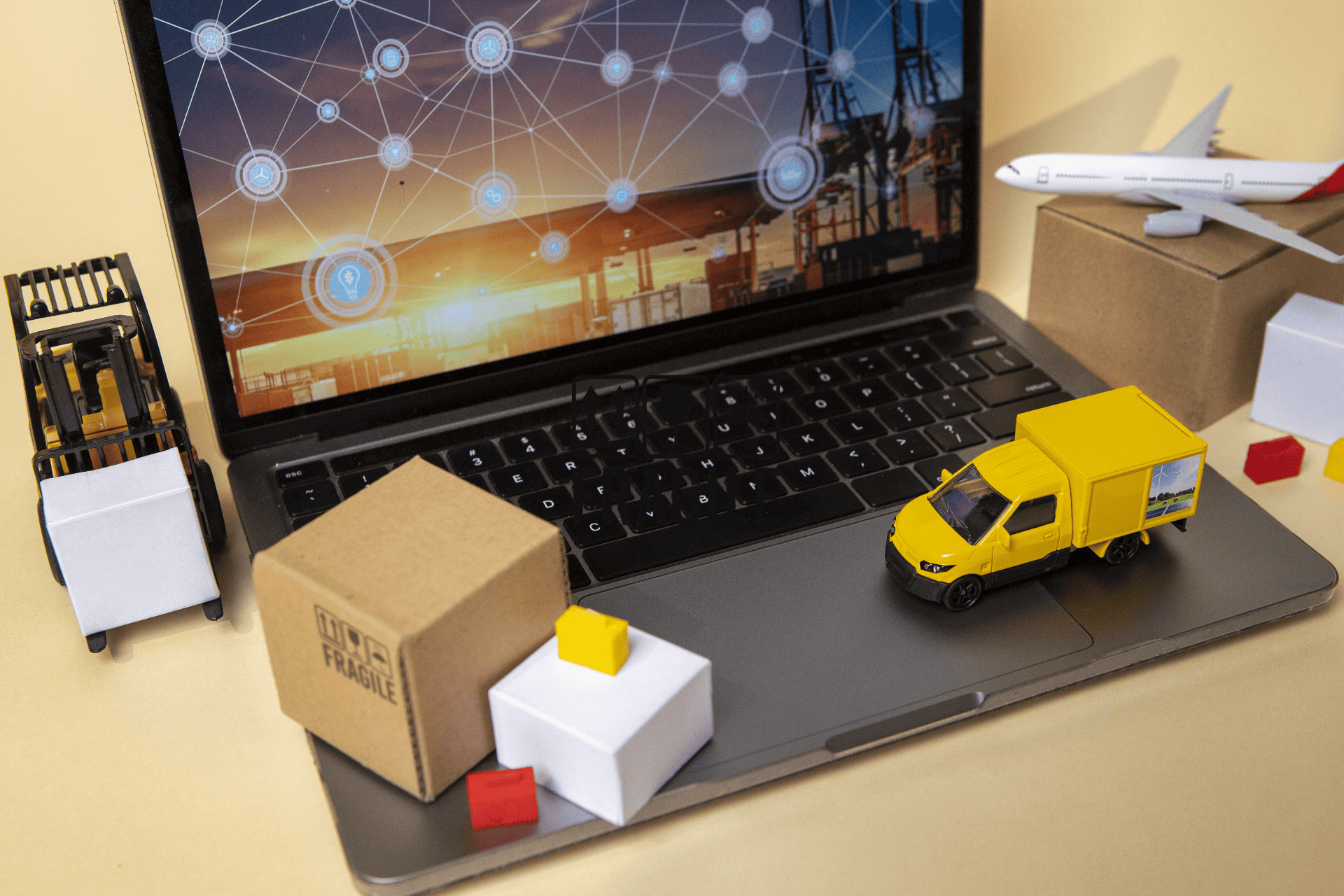

In the world of international trade, regulations are a complex web that businesses must navigate. Compliance with import and export regulations is crucial, with consequences of non-compliance ranging from financial penalties to damage to a company's reputation.

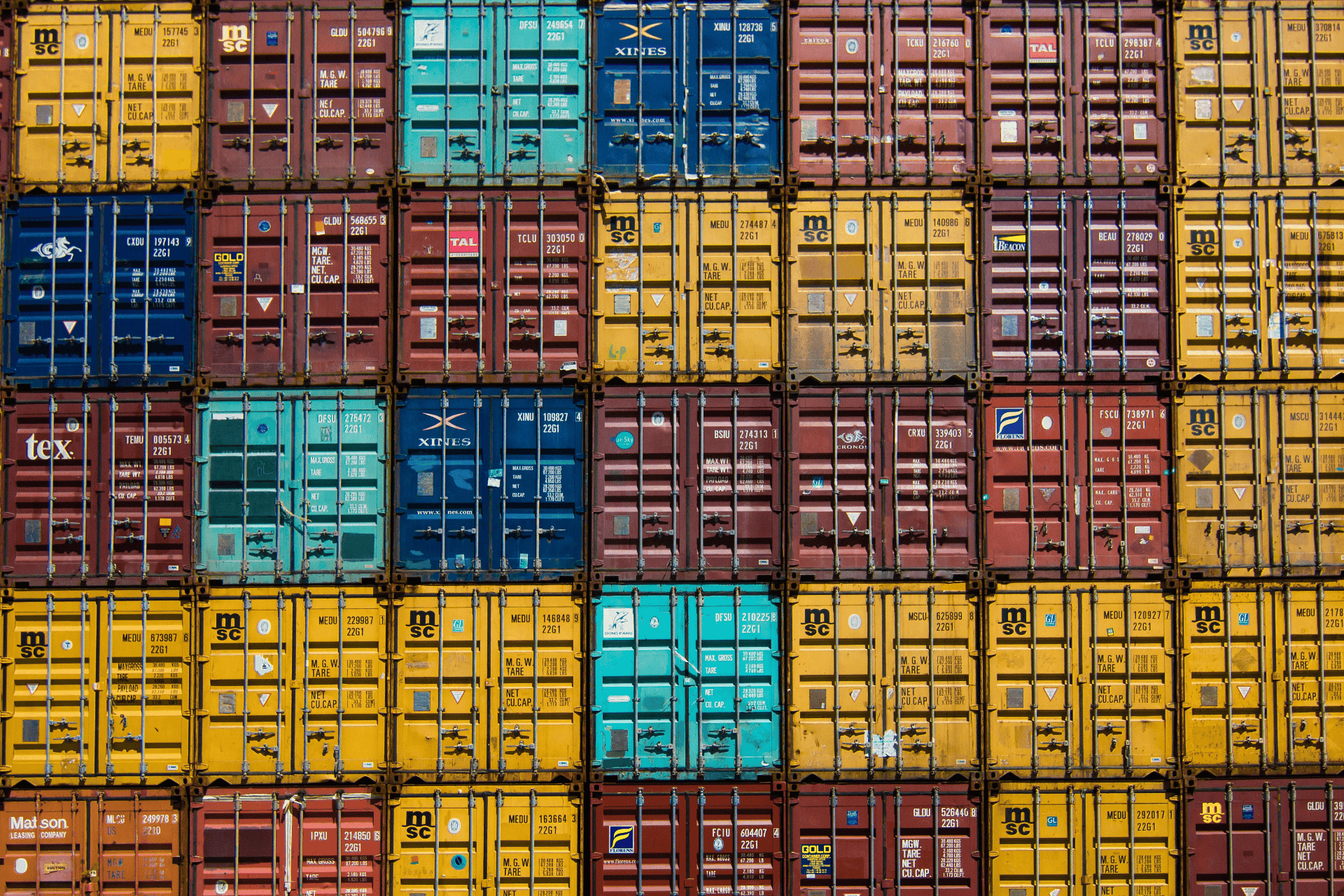

A primary area of concern is understanding and adhering to tariff and non-tariff barriers. Tariffs, which are taxes imposed on imported goods, vary significantly across countries and product categories. Non-tariff barriers include quotas, import licensing requirements, and standards and regulations related to health, safety, and environment.

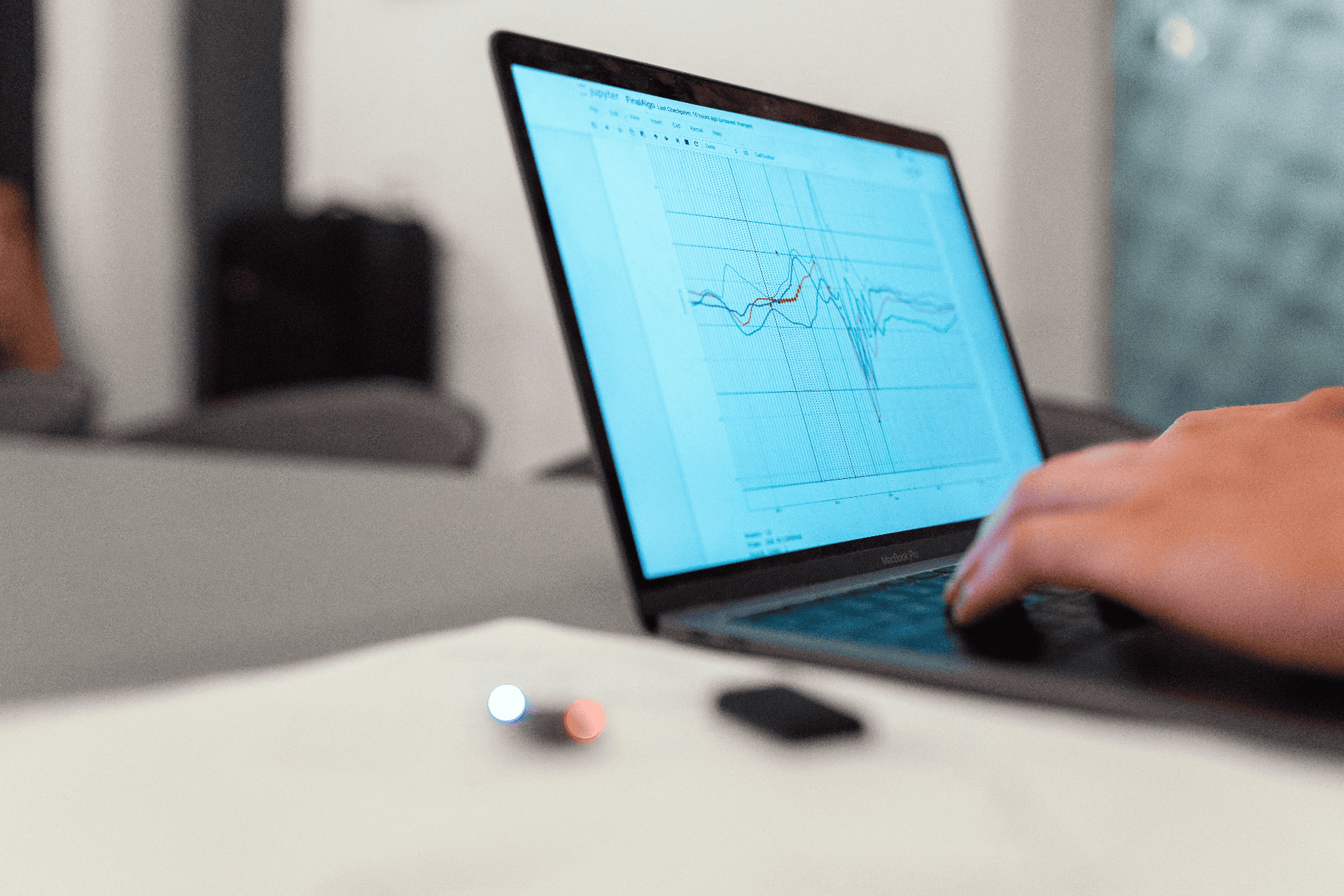

Next, businesses must grapple with customs regulations. Customs procedures can be complex, involving specific documentation, duties payment, and potential inspections. A thorough understanding of these procedures or collaboration with experienced customs brokers can help businesses navigate this process smoothly.

Moreover, trade agreements have a significant impact on international trade. These agreements, made between two or more countries, aim to reduce or eliminate trade barriers. Companies should understand the implications of these agreements for their business, as they can provide significant opportunities for market access and cost savings.

In addition, businesses must comply with export controls and sanctions. These are laws that restrict the export of certain goods, technology, or services to specific countries, organizations, or individuals. Violating export controls can result in severe penalties, including fines, imprisonment, and loss of export privileges.

Also, it's critical to adhere to foreign trade regulations. If a company plans to establish a presence in a foreign country, it must comply with local laws and regulations. These may relate to business registration, taxation, labor, privacy, and more.

Lastly, compliance with ethical trade practices is becoming increasingly important. This includes adhering to regulations around fair labor practices, environmental sustainability, and anti-corruption. Non-compliance can lead to reputational damage and consumer backlash.

Navigating international trade regulations can be challenging, but it is essential for any business involved in global commerce. Utilizing expert advice, staying updated with changes, and fostering a compliance culture within the organization can help businesses successfully traverse this complex landscape.

Related Information