Trade tariffs have a significant impact on global economic equilibrium by disrupting trade flows, affecting prices, and distorting market dynamics. The use of tariffs as a policy tool requires careful consideration of the potential trade-offs and unintended consequences they can create. Balancing the interests of domestic industries with the benefits of open and fair trade is crucial for maintaining a stable and prosperous global economic system.

-

Trade Flow Disruptions

Trade tariffs can disrupt established trade flows by increasing the cost of imported goods and reducing their competitiveness in the domestic market. As a result, import volumes may decline, altering the balance of trade between countries.

For example, the imposition of tariffs by the United States and China in 2018 as part of the trade war led to a significant decline in bilateral trade between the two countries. The total value of U.S. goods exported to China decreased from $129.9 billion in 2017 to $82.3 billion in 2019, according to the U.S. Census Bureau.

Price Effects

Trade tariffs can also affect prices, both for imported goods and domestically produced goods. When tariffs are imposed on imported goods, their prices increase, making them more expensive for consumers. This can lead to reduced consumer purchasing power and potential inflationary pressures.

Moreover, the impact of tariffs on imported goods can spill over to domestic industries. With higher import prices, domestic producers may face less competition from foreign goods, allowing them to raise prices. However, this may result in reduced consumer choice and increased costs for industries reliant on imported inputs.

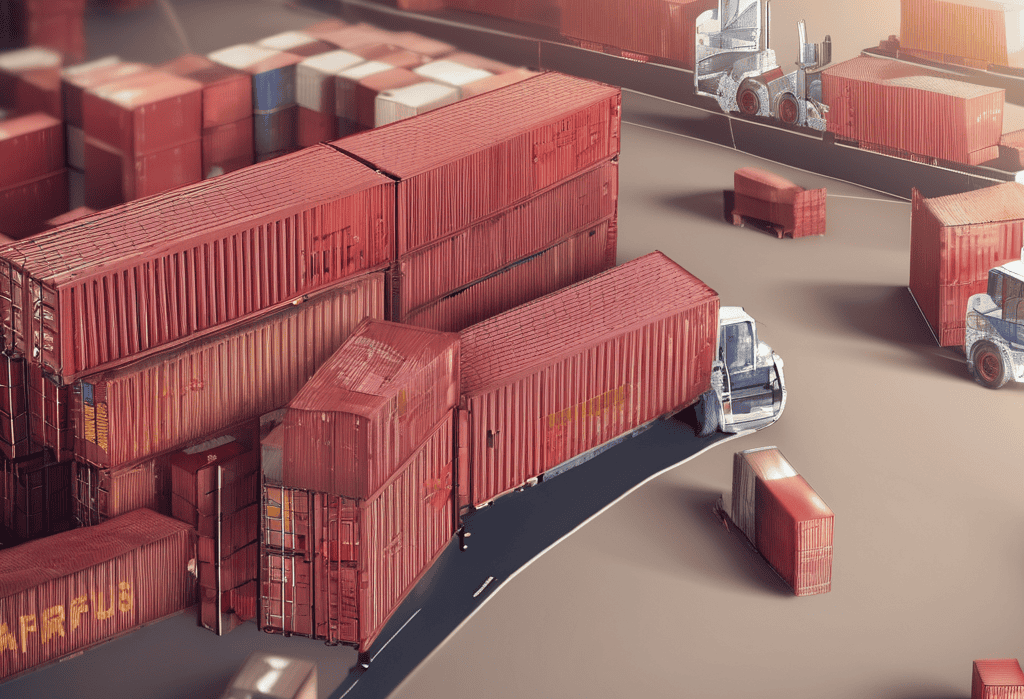

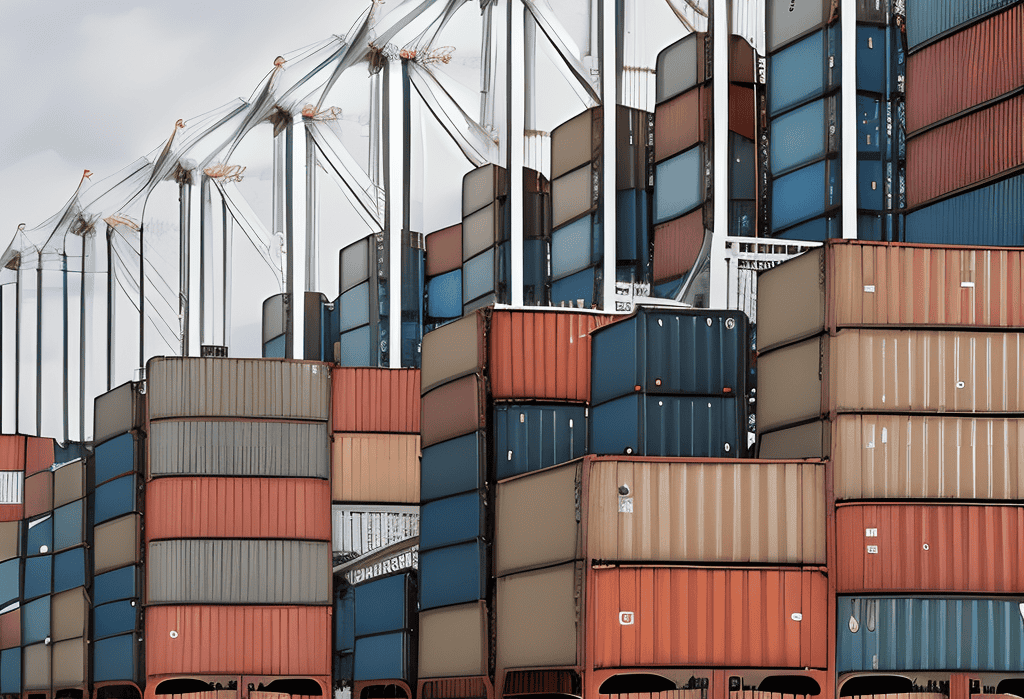

Market Dynamics and Supply Chains

Trade tariffs can disrupt global supply chains, as they affect the cost and availability of inputs and raw materials. Industries relying on imported components may face challenges due to increased costs or difficulties in sourcing alternative suppliers. This can lead to a restructuring of supply chains and the relocation of production facilities, impacting global economic equilibrium.

The disruptions caused by trade tariffs can also create uncertainties in business investment and planning decisions. Companies may hesitate to make long-term investments or expand their operations due to uncertain trade policies and potential retaliatory measures from trading partners.

Retaliatory Measures

Trade tariffs can trigger a cycle of retaliatory measures among trading partners. When one country imposes tariffs on another, the affected country may respond with counter-tariffs. This escalation can result in a trade war, characterized by a series of retaliatory measures that further disrupt trade flows and increase economic uncertainty.

During the U.S.-China trade war, both countries imposed tariffs on a wide range of goods, leading to a tit-for-tat escalation. The Peterson Institute for International Economics estimated that the average U.S. tariff on Chinese imports increased from 3.1% in 2017 to 19.3% by 2020, while the average Chinese tariff on U.S. imports rose from 8% to 20.9% during the same period.

Implications for Global Economic Equilibrium

The influence of trade tariffs on global economic equilibrium is multifaceted. While tariffs may provide short-term protection to domestic industries, they can lead to long-term inefficiencies and distortions in the global economy. Reduced trade flows, price distortions, supply chain disruptions, and retaliatory measures can undermine overall economic growth, productivity, and consumer welfare.

Moreover, the uncertainty created by trade tariffs hinders business confidence and long-term investment, potentially hindering innovation and technological advancements.

Read more views