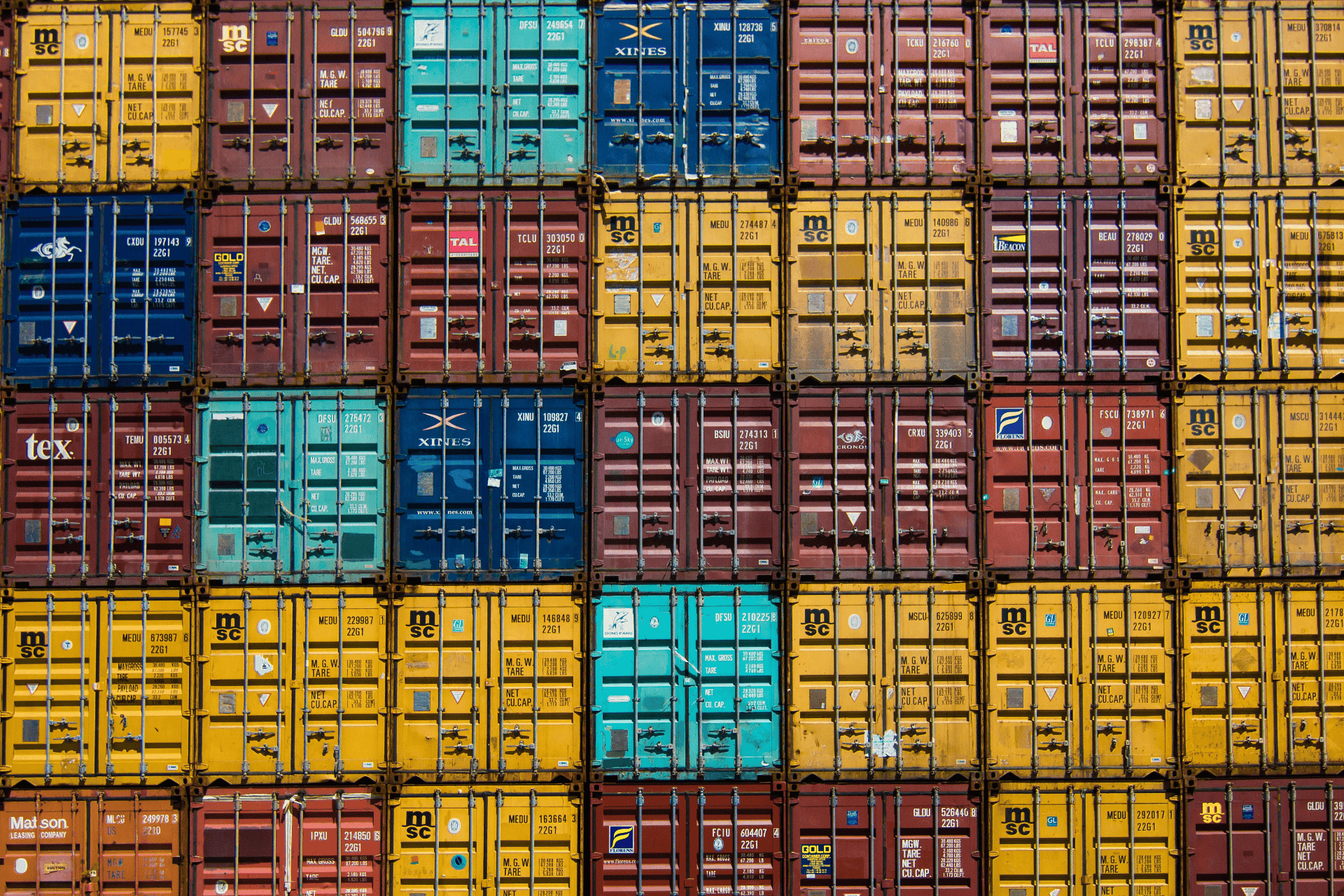

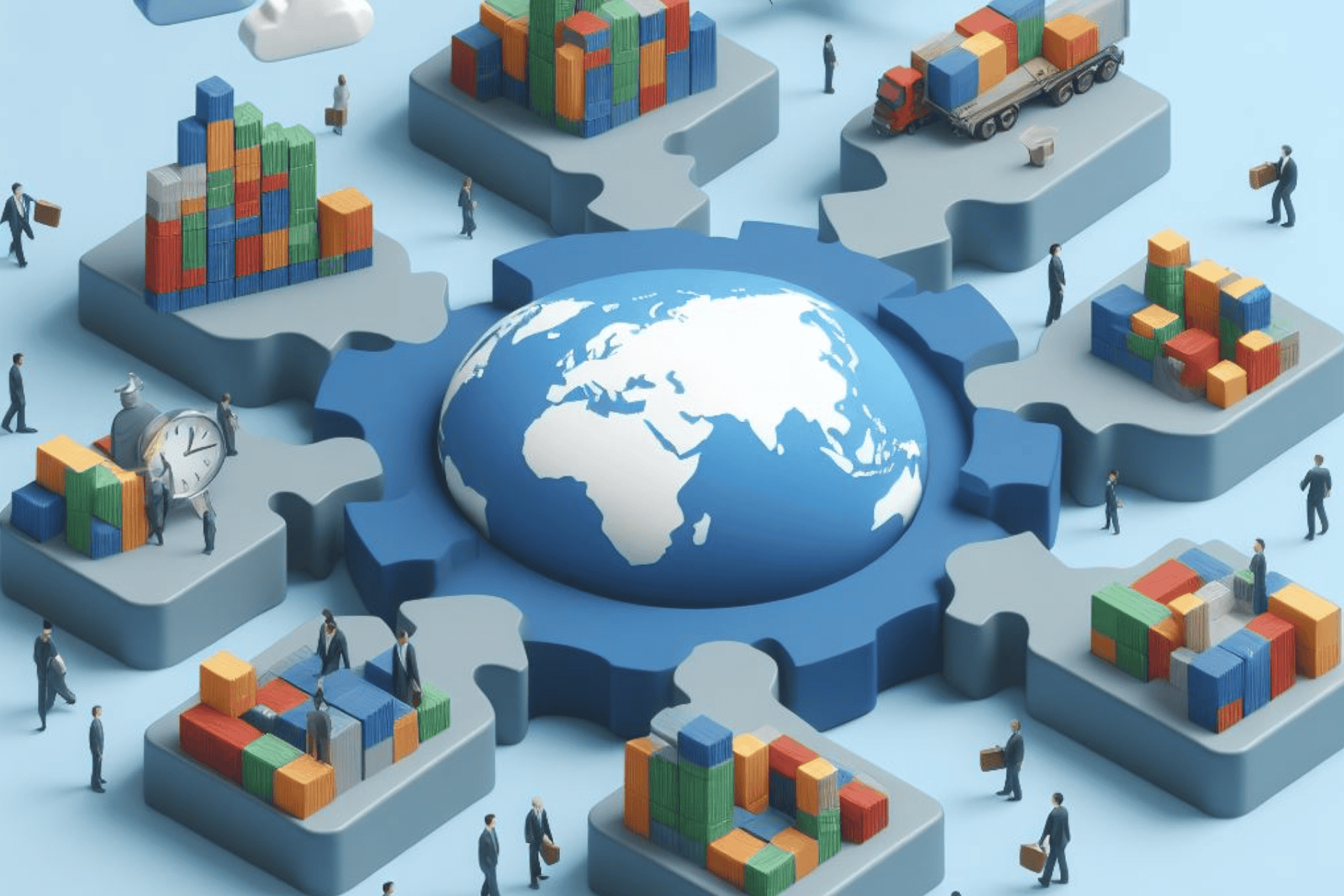

Export financing options tailored for SMEs play a crucial role in enabling small and medium-sized enterprises to overcome financial barriers and pursue global growth opportunities. Export credit insurance, export working capital loans, export factoring, export development grants, and financing through banks and financial institutions are among the key financing solutions available to support SME exporters. By leveraging these resources, SMEs can strengthen their financial capabilities, mitigate risks, and confidently expand into international markets. Export financing options empower SMEs to realize their export ambitions, contributing to their own growth as well as the overall economic prosperity of the countries they operate in.

Export Credit Insurance

Export credit insurance provides protection to SMEs against the risk of non-payment by overseas buyers. It helps mitigate the potential financial losses associated with export transactions by covering a portion of the insured amount in case of default or non-payment. This enables SMEs to confidently extend credit terms to foreign buyers and explore new markets without the fear of payment uncertainties.

Export Working Capital Loans

Export working capital loans are designed to provide SMEs with the necessary funding to fulfill export orders and cover the associated production and working capital costs. These loans help bridge the gap between the time of production and the receipt of payment from overseas buyers, ensuring smooth cash flow and uninterrupted operations. They are typically short-term loans that can be secured by export-related assets or through government-backed financing programs.

Export Factoring

Export factoring is a financing option that enables SMEs to receive immediate cash against their outstanding export invoices. Instead of waiting for the full payment term, SMEs can sell their accounts receivable to a factoring company, which provides them with the majority of the invoice value upfront. Export factoring helps SMEs improve cash flow, reduce credit risk, and focus on their core business operations while leaving the collection process to the factoring company.

Export Development Grants and Programs

Many governments and international organizations offer export development grants and programs specifically targeted at supporting SMEs in their export endeavors. These grants can provide financial assistance for market research, export training programs, participation in trade shows and exhibitions, and other activities aimed at expanding export capabilities. SMEs should explore such resources to leverage financial support and gain access to valuable networks and resources.

Export Financing through Banks and Financial Institutions

Banks and financial institutions often offer specialized export financing solutions for SMEs, such as export loans, export lines of credit, and export guarantees. These options can provide SMEs with the necessary funds for pre-shipment and post-shipment activities, export contract financing, and trade finance services. SMEs should consult with their banks or financial institutions to explore the specific export financing options available to them.

Related Information