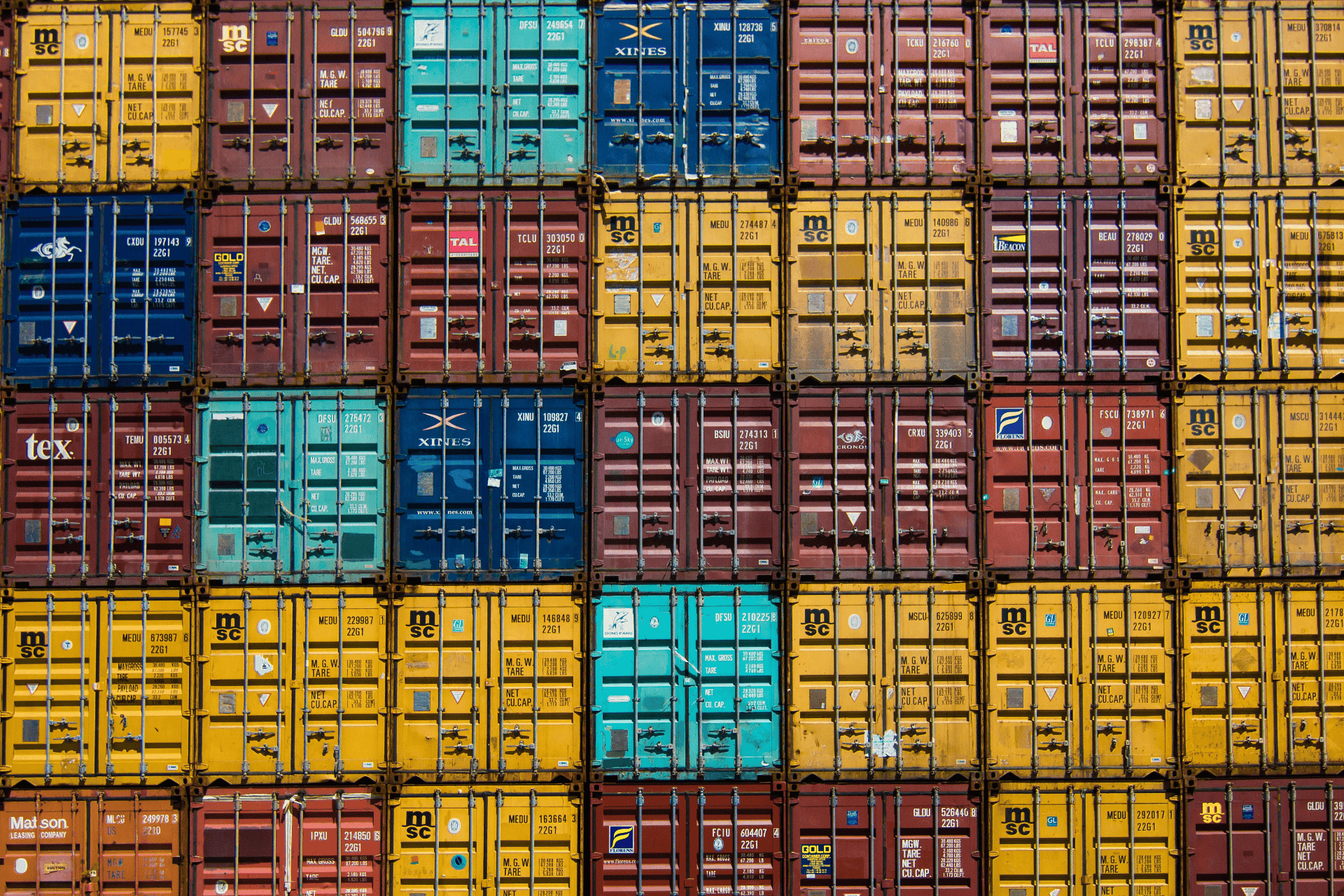

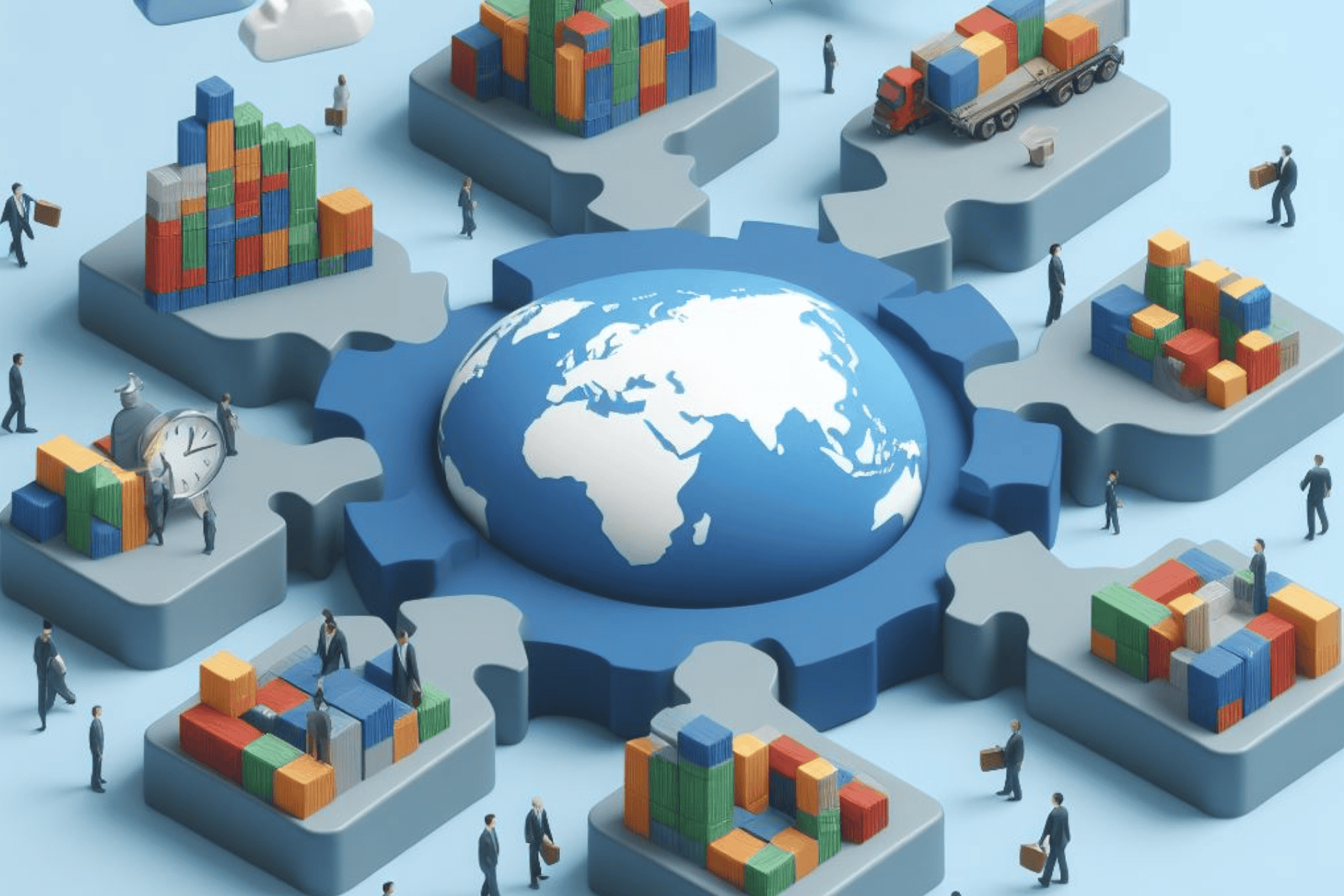

Export financing and risk management are essential components of a successful export strategy. Businesses can leverage trade loans, export credit insurance, and export factoring to secure the necessary funds for international trade. Additionally, conducting thorough market research, diversifying export markets, ensuring strong contractual protections, managing currency risks, and complying with trade regulations are crucial risk management techniques. By adopting a holistic approach to financing and risk management, businesses can mitigate potential risks, secure their financial stability, and capitalize on the opportunities presented by global markets.

Export Financing Options

Trade Loans: Trade loans are specifically designed to finance export activities. They provide businesses with the necessary working capital to cover production costs, transportation expenses, and other trade-related expenses. Trade loans can be obtained from banks, export credit agencies, or international financial institutions.

Export Credit Insurance: Export credit insurance protects businesses against the risk of non-payment by foreign buyers. It provides coverage for commercial and political risks, such as buyer insolvency, protracted default, or government actions that hinder payment. Export credit insurance not only safeguards cash flow but also enables businesses to explore new markets and expand their customer base with confidence.

Export Factoring: Export factoring is a financing solution where a company sells its export receivables to a factoring company at a discounted rate. This provides immediate cash flow to the exporting business while transferring the collection responsibility to the factoring company. Export factoring can help businesses bridge the gap between delivery and payment, ensuring a steady flow of working capital.

Risk Management Techniques

Market Research and Due Diligence: Thorough market research is essential to identify potential risks and opportunities in target markets. Understanding local regulations, cultural dynamics, and economic factors can help businesses make informed decisions and develop appropriate risk mitigation strategies.

Diversification: Diversifying export markets can help reduce dependence on a single market and spread risks across multiple regions. By expanding into different countries, businesses can mitigate the impact of economic downturns, political instability, or changes in trade policies in a specific market.

Contractual Protections: Well-drafted export contracts that clearly define terms and conditions, including payment terms, warranties, and dispute resolution mechanisms, can help protect businesses from potential risks. It is advisable to seek legal expertise in drafting international contracts to ensure compliance with local laws and international trade regulations.

Currency Risk Management: Fluctuations in exchange rates can significantly impact export revenues. Businesses can manage currency risks through various techniques such as hedging, forward contracts, or currency options. These tools help minimize the uncertainty associated with exchange rate movements and provide stability in cash flows.

Compliance with Trade Regulations: Strict adherence to export control regulations and trade compliance measures is vital to avoid legal issues and penalties. Implementing robust export compliance programs, conducting internal audits, and staying updated with changing regulations can help businesses navigate the complexities of international trade.

Related Information