Export financing options such as export working capital loans and letters of credit provide businesses with the necessary capital and secure payment methods to support their export activities. Credit insurance offers protection against non-payment by buyers, mitigating financial risks and facilitating market expansion. By utilizing export financing and credit insurance, businesses can minimize financial risks in international trade and ensure smooth and secure transactions.

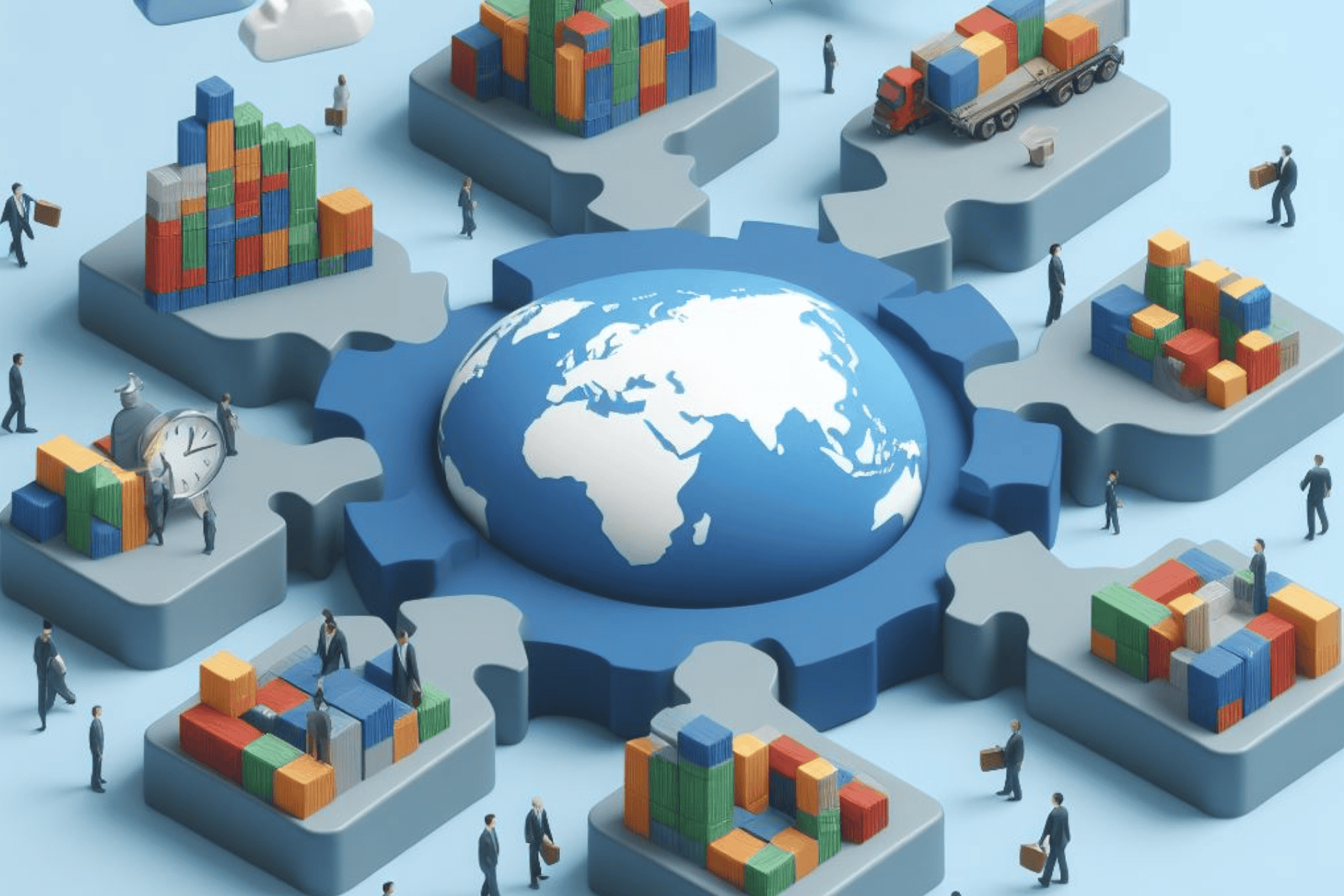

Engaging in international trade offers exciting opportunities for businesses to expand their reach and tap into new markets. However, it also brings financial risks that must be carefully managed. Export financing and credit insurance are two crucial tools that businesses can utilize to minimize these risks and ensure smooth and secure transactions in the global marketplace.

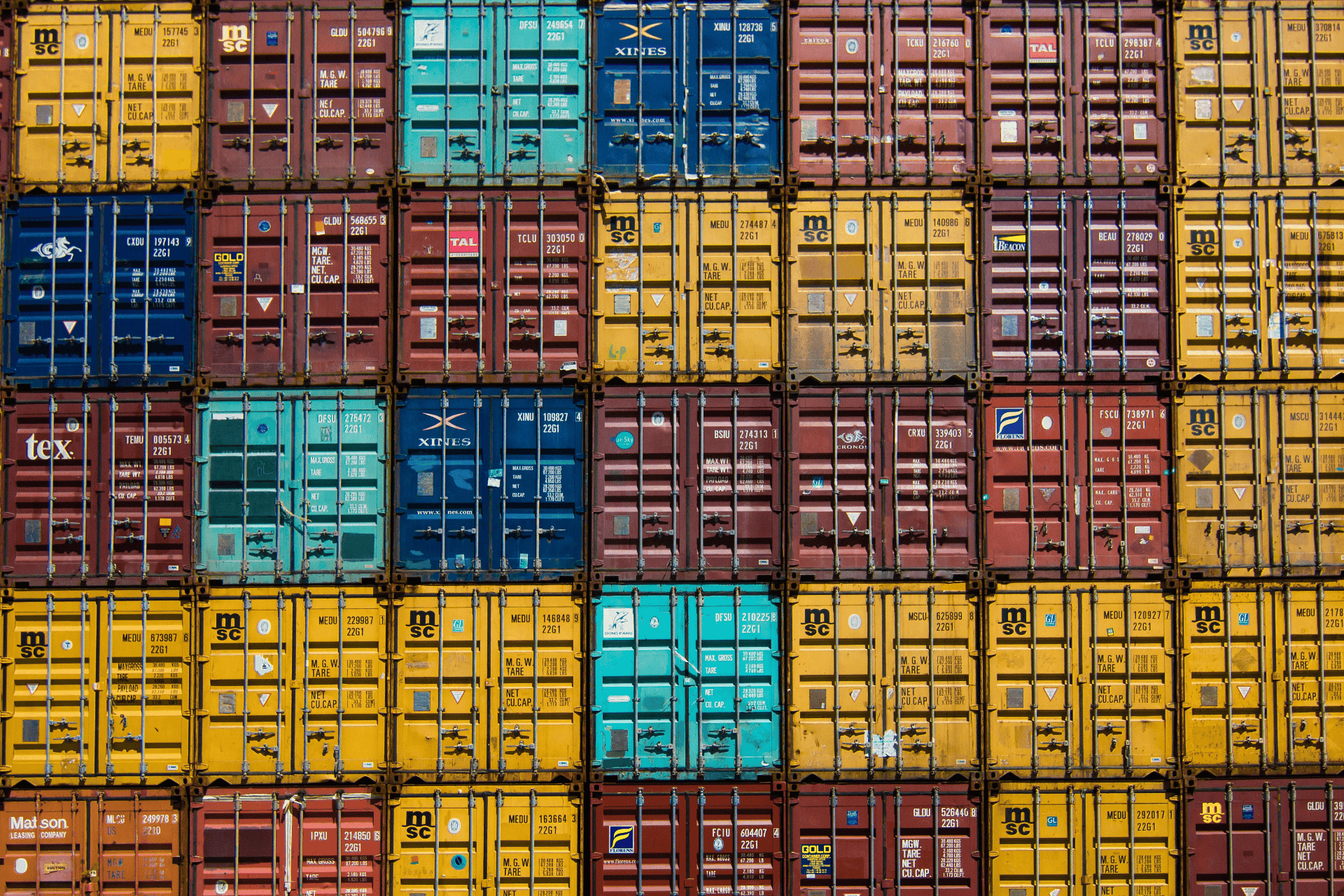

Export Financing Options

Export financing provides businesses with the necessary capital to support their export activities. Here are some common export financing options:

Export Working Capital Loans: These loans provide businesses with the working capital needed to fulfill export orders. Lenders may consider factors such as purchase orders, accounts receivable, and inventory as collateral. Export working capital loans help bridge the gap between production and payment, ensuring that businesses have the necessary funds to fulfill export contracts.

Export Credit Insurance: Export credit insurance protects businesses against the risk of non-payment by foreign buyers. This insurance covers losses arising from commercial or political risks, including buyer insolvency, protracted default, or political events that prevent payment. Export credit insurance provides businesses with peace of mind and allows them to expand into new markets with confidence.

Letters of Credit: Letters of credit are financial instruments issued by banks that guarantee payment to exporters upon meeting specified conditions. With letters of credit, exporters can ensure timely payment and mitigate the risk of non-payment or default by the buyer. Letters of credit offer a secure payment method, instilling trust between buyers and sellers.

Credit Insurance

Credit insurance is a risk management tool that protects businesses against losses resulting from non-payment by buyers. Here are some key benefits of credit insurance:

Risk Mitigation: Credit insurance minimizes the risk of non-payment by providing coverage against buyer insolvency, bankruptcy, or default. Businesses can confidently extend credit terms to buyers, knowing that they are protected against potential financial losses.

Access to Financing: Credit insurance enhances businesses' ability to secure financing from banks or lenders. Lenders are more willing to provide capital to businesses that have credit insurance coverage, as it provides an additional layer of security.

Market Expansion: With credit insurance, businesses can explore new markets and work with new buyers without the fear of non-payment. This facilitates market expansion and enables businesses to seize growth opportunities.

Credit Management Support: Credit insurance providers often offer valuable credit management tools and resources. These tools help businesses assess the creditworthiness of potential buyers, set appropriate credit limits, and monitor the financial health of existing customers.

Related Information