Countertrade offers both opportunities and challenges for businesses seeking to navigate the complexities of international trade, finance, and market access in diverse and dynamic global markets. By understanding the dynamics of countertrade, assessing its implications, and adopting proactive strategies for risk management and operational excellence, businesses can leverage countertrade as a strategic tool for expanding their international reach, mitigating risks, and driving sustainable growth in the interconnected world of global commerce.

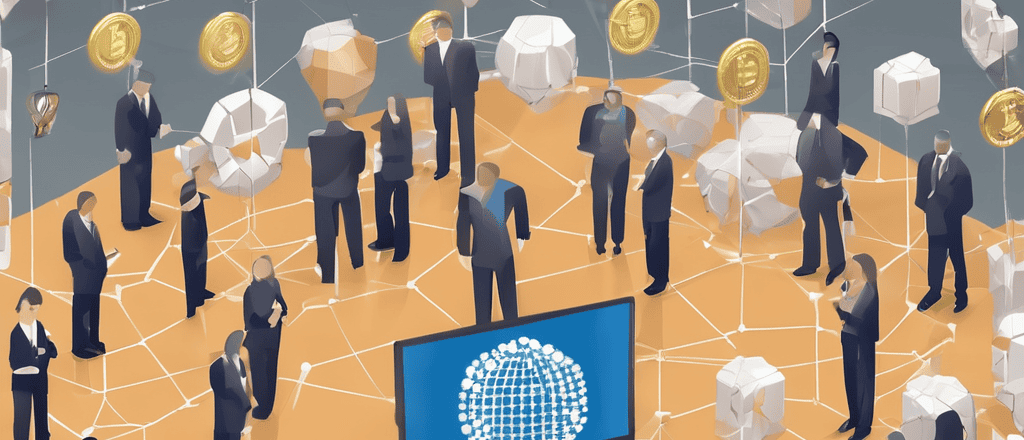

Countertrade, a complex form of international trade where goods or services are exchanged for other goods or services rather than currency, presents both opportunities and challenges for businesses engaged in global commerce. While countertrade offers an alternative means of financing, market access, and risk mitigation in challenging environments, it also introduces complexities, uncertainties, and operational hurdles for businesses navigating diverse and dynamic international markets. Here, we delve into the intricacies of countertrade and examine its implications for businesses operating in the global marketplace.

Understanding the Dynamics of Countertrade

- Types of Countertrade:

Countertrade encompasses various forms of reciprocal trade arrangements, including barter, offset agreements, counterpurchase, and buyback arrangements, tailored to the specific needs and preferences of trading partners. Each type of countertrade involves unique terms, conditions, and contractual obligations, reflecting the preferences, capabilities, and constraints of buyers and sellers in international transactions.

- Financing and Risk Management:

Countertrade serves as an alternative financing mechanism for businesses seeking to overcome currency restrictions, credit limitations, and financing challenges in foreign markets. By exchanging goods or services for other goods or services, businesses can secure essential resources, reduce financial exposure, and mitigate currency, credit, and sovereign risks associated with traditional financing arrangements.

- Market Access and Localization:

Countertrade facilitates market access and localization strategies for businesses seeking to establish a presence in foreign markets and comply with local content requirements, import restrictions, or government regulations. By participating in countertrade arrangements, businesses can satisfy procurement mandates, support local industries, and gain preferential treatment in government contracts, enhancing their competitive position and market share in target markets.

Opportunities and Challenges of Countertrade in International Business

- Opportunities for Market Expansion:

Countertrade offers opportunities for businesses to enter new markets, establish strategic partnerships, and gain competitive advantage by leveraging their unique capabilities and resources in international trade. By participating in countertrade arrangements, businesses can access untapped markets, diversify revenue streams, and forge long-term relationships with trading partners in diverse and dynamic global markets.

- Challenges of Operational Complexity:

Countertrade introduces operational complexities, logistical challenges, and administrative burdens for businesses managing diverse supply chains, inventory management systems, and contractual obligations in international trade. Coordinating multiple transactions, managing inventory levels, and ensuring compliance with regulatory requirements require robust systems, processes, and capabilities to navigate the complexities of countertrade effectively.

- Risks of Non-Performance and Disputes:

Countertrade exposes businesses to risks of non-performance, contractual disputes, and financial losses arising from quality issues, delivery delays, or unforeseen circumstances in international transactions. Businesses must conduct thorough due diligence, negotiate clear contractual terms, and establish dispute resolution mechanisms to mitigate risks, protect their interests, and preserve commercial relationships in countertrade agreements.

#Countertrade #InternationalTrade #MarketAccess #RiskManagement #GlobalCommerce #MarketExpansion #TradeFinance #BusinessStrategy #OperationalComplexity #SupplyChainManagement

Read more views