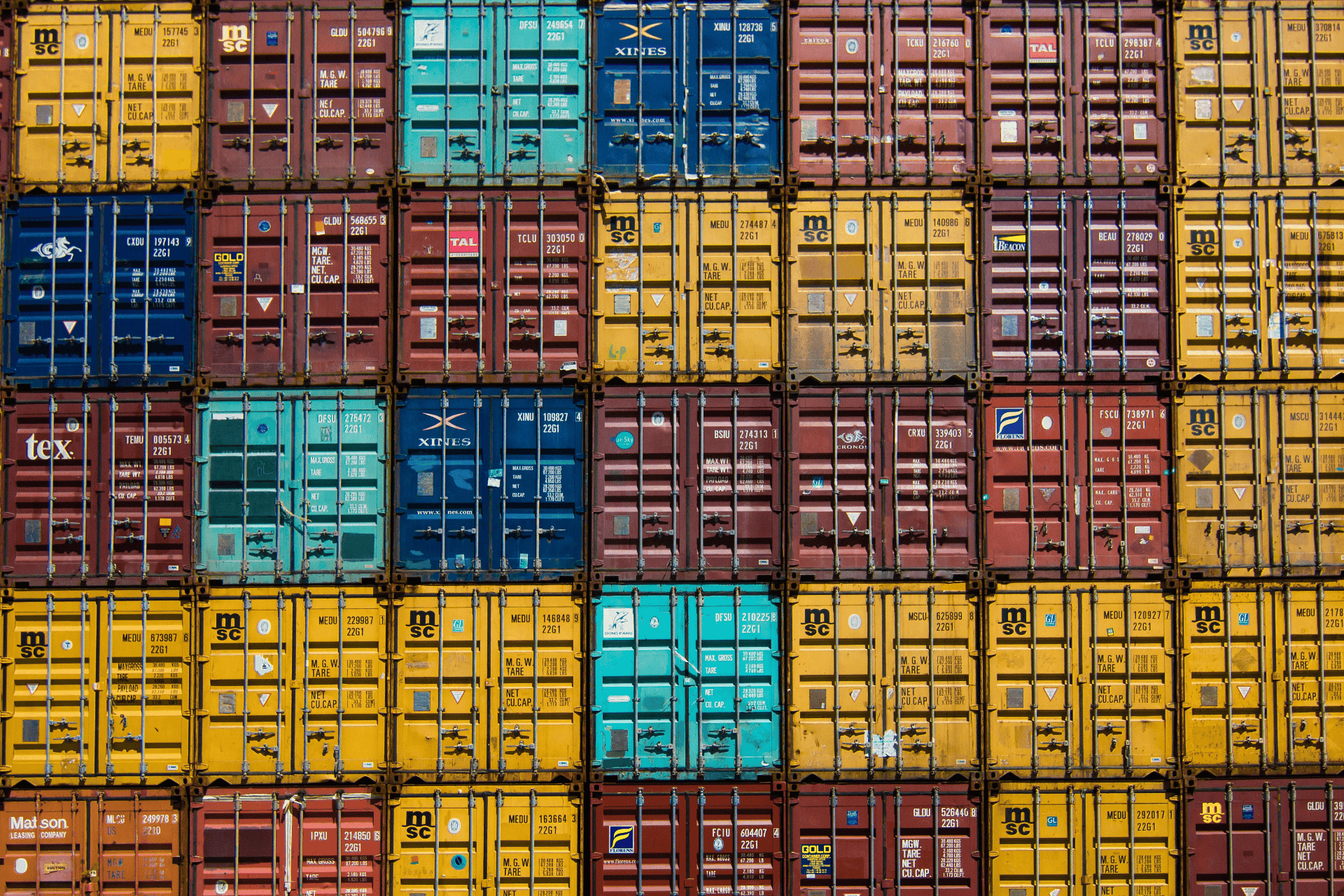

Effective export debt collection requires a proactive and strategic approach that encompasses clear communication, diligent credit management, and proactive measures to mitigate risks. By implementing these key strategies, exporters can optimize their debt collection processes, minimize financial losses, and sustain healthy business relationships with overseas clients.

In the realm of international trade, exporting is a lucrative avenue for businesses looking to expand their reach and tap into new markets. However, along with the opportunities come challenges, and one of the most significant hurdles for exporters is managing debt collection from overseas clients. Navigating the complexities of export debt collection requires a strategic approach to ensure timely payments and mitigate financial risks. Here are some key strategies for effective export debt collection:

- Clear Communication and Documentation: Establishing clear communication channels and documenting all transactions from the outset is crucial. Ensure that terms of payment, including due dates, currency, and payment methods, are explicitly outlined in contracts or agreements. This transparency lays the foundation for smoother debt collection processes.

- Know Your Customer (KYC): Conduct thorough due diligence on potential overseas clients before engaging in business. Understanding their financial stability, creditworthiness, and payment history can help mitigate the risk of non-payment. Utilize credit reports, trade references, and online resources to gather relevant information about the client's background.

- Flexible Payment Options: Offer flexible payment options to accommodate the diverse needs of international clients. Accepting various forms of payment, such as wire transfers, letters of credit, or online payment platforms, can facilitate faster transactions and encourage prompt payment.

- Implement Credit Policies: Establish clear credit policies and guidelines for extending credit to overseas customers. Define credit limits, payment terms, and penalties for late payments upfront to set expectations and minimize disputes.

- Proactive Invoicing: Send invoices promptly and consistently follow up on overdue payments. Utilize automated invoicing systems to streamline the process and ensure accuracy. Clearly state payment deadlines and penalties for late payments to encourage compliance.

- Maintain Relationships: Cultivate strong relationships with overseas clients built on trust and mutual respect. Regular communication and personalized interactions can foster goodwill and encourage timely payments. Address any concerns or issues promptly to prevent disputes from escalating.

- Engage Professional Assistance: In cases of persistent non-payment or complex debt recovery situations, consider engaging the services of professional debt collection agencies or legal counsel with expertise in international debt collection laws. These professionals can navigate legal complexities and negotiate on your behalf to recover outstanding debts.

- Monitor and Evaluate: Continuously monitor the status of outstanding invoices and track payment trends to identify potential delinquencies early on. Evaluate the effectiveness of your debt collection strategies periodically and make adjustments as needed to improve efficiency and effectiveness.

- Cultural Sensitivity: Be mindful of cultural differences and nuances when communicating with overseas clients regarding debt collection. Adapt your approach and communication style to resonate with the cultural norms and preferences of your international clientele.

- Seek Insurance Coverage: Consider obtaining export credit insurance to protect against the risk of non-payment due to insolvency or protracted default by overseas buyers. This insurance provides coverage for losses incurred from unpaid invoices, offering peace of mind and financial protection.

#Export #DebtCollection #InternationalTrade #CreditManagement #RiskMitigation #BusinessStrategy #FinancialManagement #GlobalBusiness #InvoiceManagement #ExportCreditInsurance #CommunicationSkills

Related Information