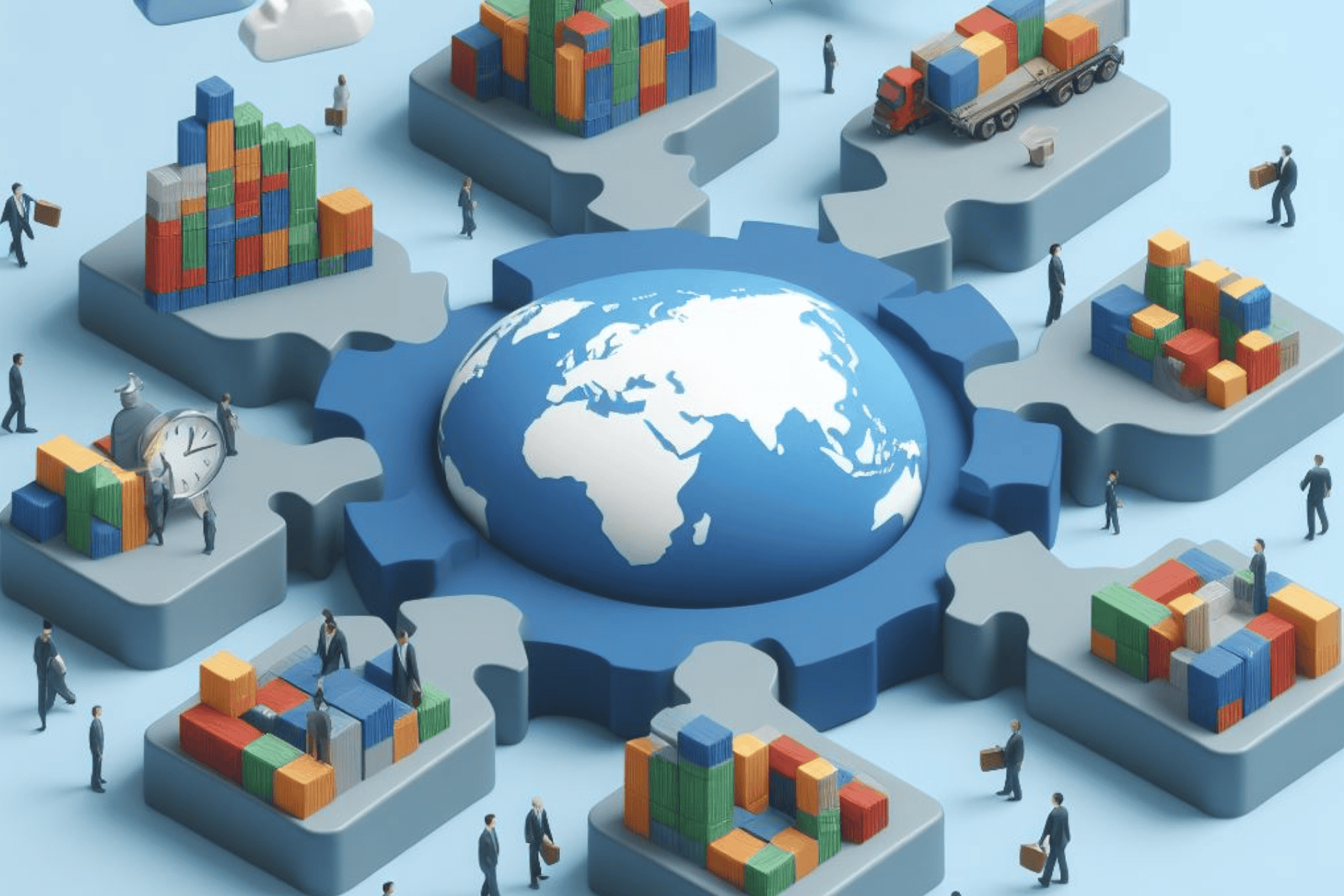

Trade finance innovations are revolutionizing the way exporters conduct business on the global stage. Through the adoption of blockchain technology, digitization, alternative financing models, and innovative service delivery models, exporters can enhance their liquidity, flexibility, and competitiveness. As the finance industry continues to evolve, exporters must stay abreast of these developments to leverage the latest tools and strategies for success in the international marketplace.

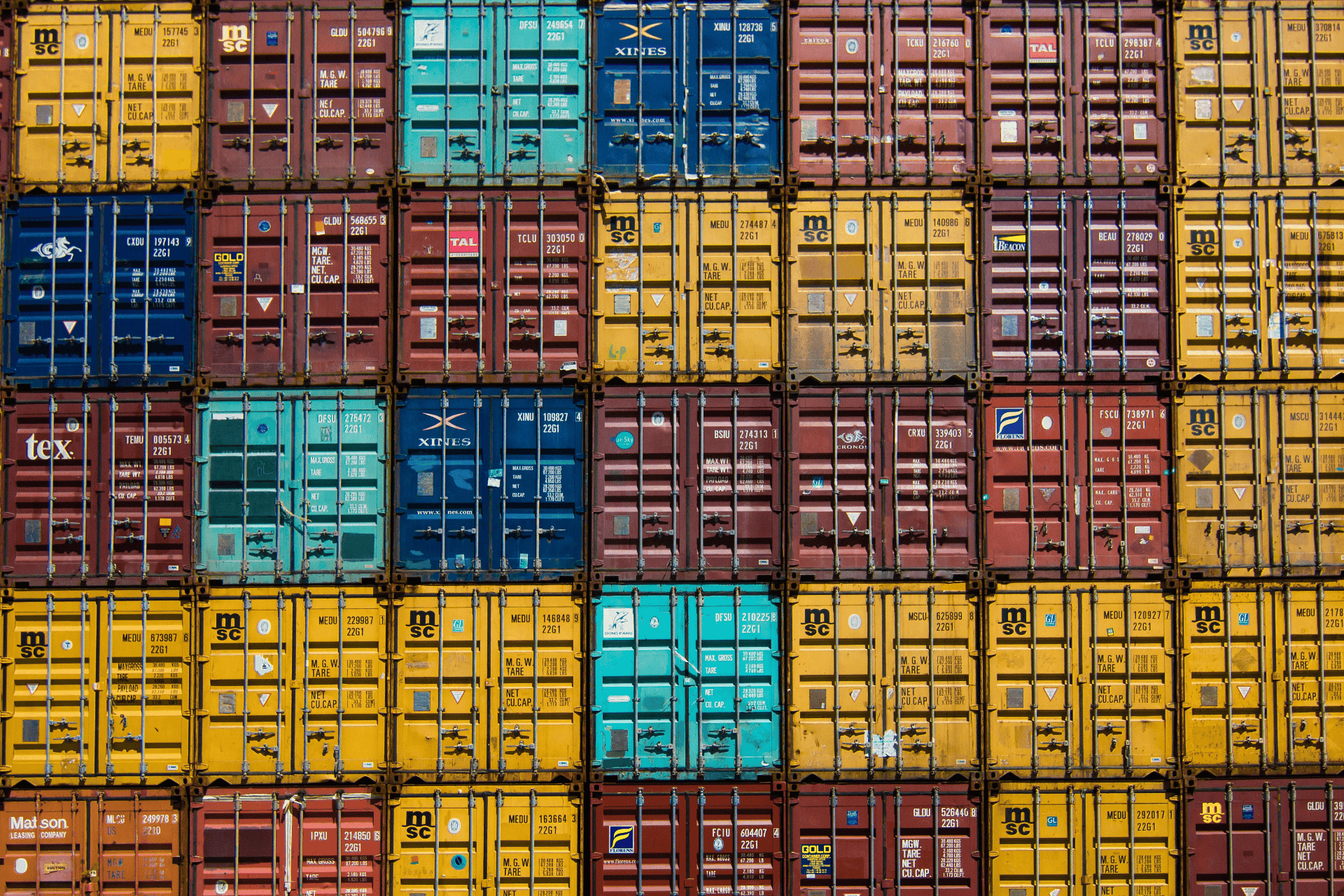

In today's global economy, trade finance plays a pivotal role in facilitating international trade transactions. Exporters rely heavily on trade finance to mitigate risks, ensure payment security, and enhance liquidity. However, traditional trade finance methods often come with challenges such as lengthy processing times, high costs, and limited flexibility. In response to these obstacles, the finance industry has witnessed a surge in innovative solutions aimed at revolutionizing trade finance and empowering exporters like never before.

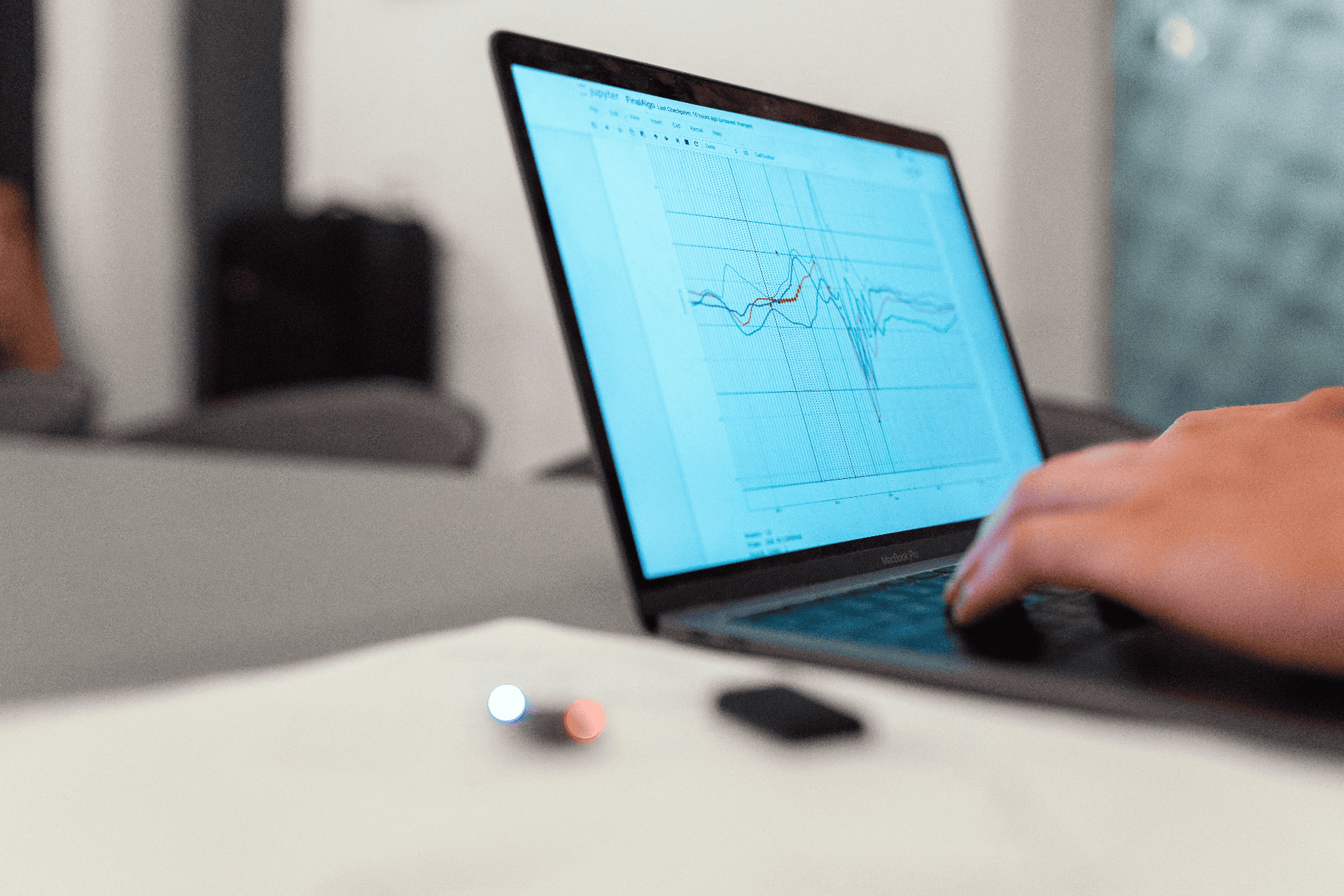

One of the most significant innovations transforming trade finance is the adoption of blockchain technology. Blockchain offers a decentralized and immutable ledger system that enables secure and transparent transactions. By leveraging blockchain, trade finance processes such as letters of credit and supply chain financing can be streamlined, reducing paperwork, minimizing fraud risks, and accelerating transaction settlement. This technology has the potential to revolutionize how exporters access liquidity and manage their financial operations.

Furthermore, the emergence of fintech companies has brought about a wave of digitization in trade finance. These innovative startups harness technology to offer agile and cost-effective solutions tailored to the needs of exporters. From online platforms that facilitate trade finance transactions to automated document verification systems, fintech firms are reshaping the landscape of export finance. By embracing these digital tools, exporters can gain greater efficiency, transparency, and accessibility in managing their trade finance requirements.

Additionally, alternative financing models are gaining traction as exporters seek more flexible and diversified funding options. Peer-to-peer lending platforms, crowdfunding, and trade credit insurance are among the alternative finance mechanisms that cater to the unique needs of exporters. These non-traditional approaches provide exporters with additional avenues to secure funding, mitigate risks, and optimize cash flow, thereby enhancing their competitiveness in the global market.

Moreover, initiatives such as trade finance as a service (TFaaS) are democratizing access to trade finance by offering scalable and customizable solutions to exporters of all sizes. TFaaS platforms leverage cloud technology and data analytics to provide on-demand access to a wide range of trade finance services, including financing, risk management, and compliance support. By outsourcing trade finance functions to specialized providers, exporters can focus on their core business activities while benefiting from the expertise and resources of finance professionals.

#TradeFinance #Export #Blockchain #Fintech #Innovation #Digitization #TFaaS #AlternativeFinance #GlobalTrade #Liquidity #Flexibility

Related Information