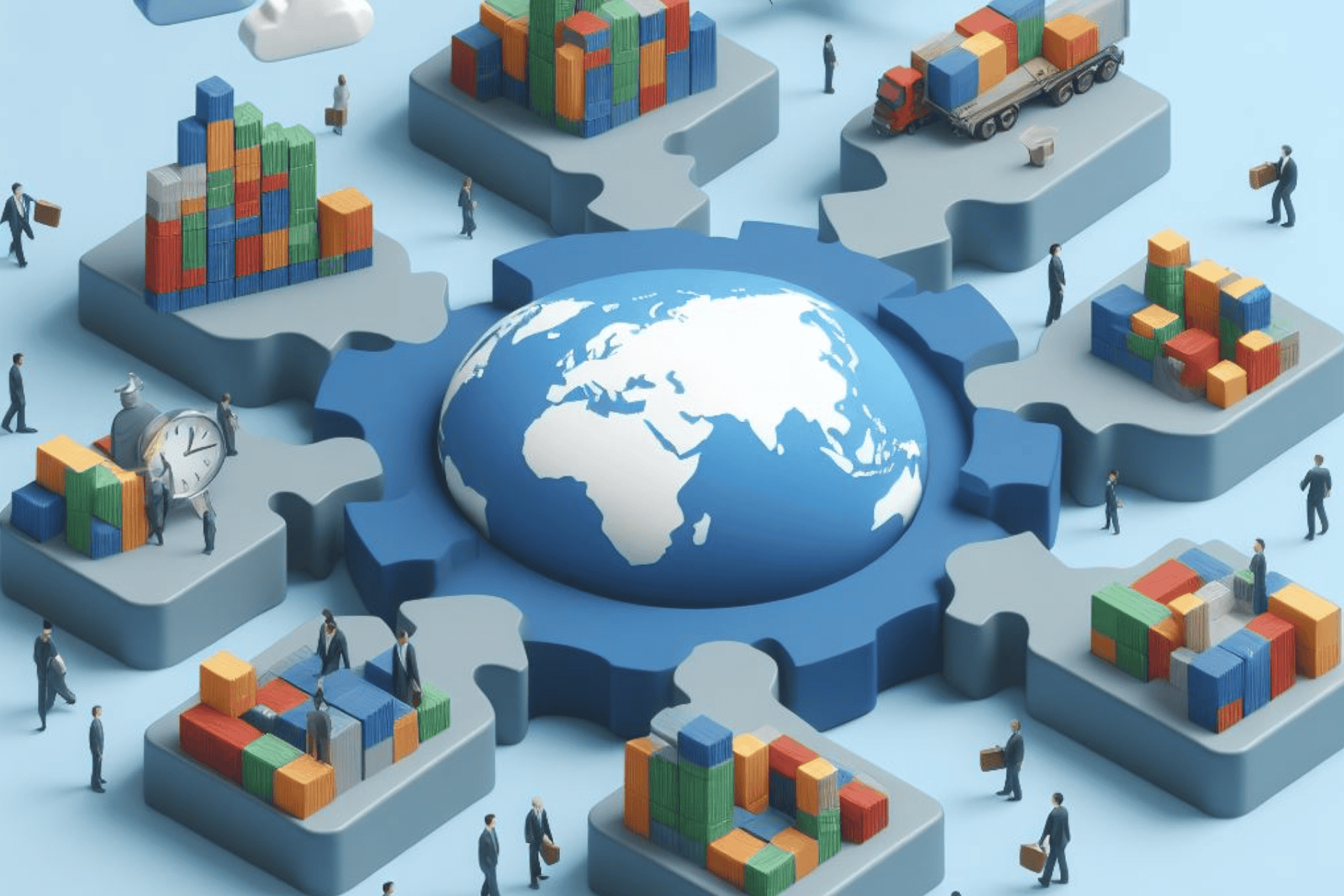

Understanding anti-dumping and countervailing duties is essential for stakeholders involved in international trade. These measures serve as crucial instruments for combating unfair trade practices, protecting domestic industries, and upholding the principles of free and fair trade. By navigating the complexities of anti-dumping and countervailing duties effectively, countries can foster a more equitable and sustainable global trading system for the benefit of all.

In the global landscape of trade, anti-dumping and countervailing duties play a crucial role in ensuring fair competition and protecting domestic industries from unfair trade practices. Understanding these measures is essential for businesses and policymakers alike to navigate the complexities of international trade. Let's delve deeper into what anti-dumping and countervailing duties entail, how they work, and their significance in the realm of global commerce.

What are Anti-Dumping Duties?

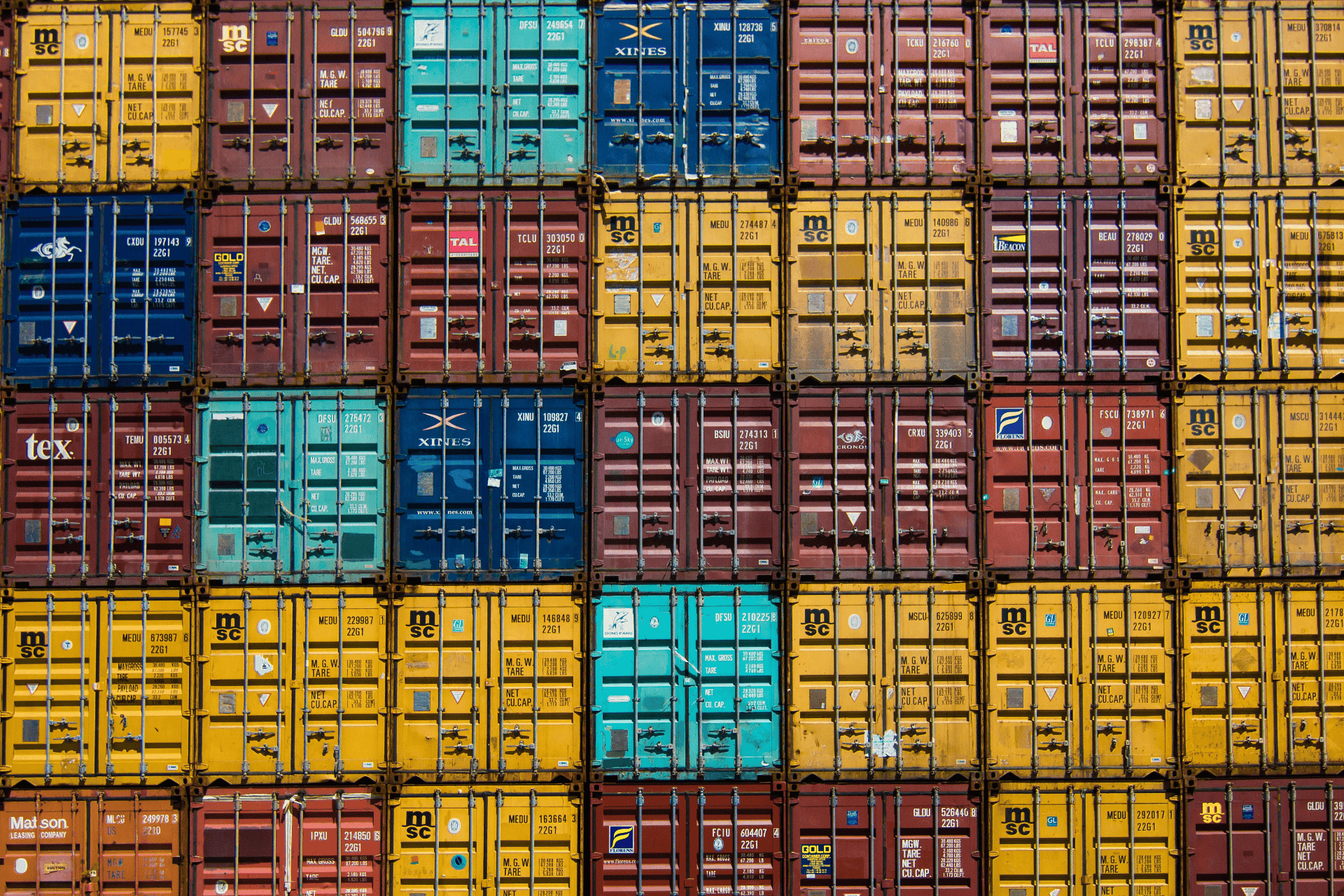

Anti-dumping duties are tariffs imposed on imported goods that are priced below fair market value, a practice known as "dumping." This occurs when foreign producers export goods to another country at a price lower than the price charged in their domestic market or below the cost of production. Such actions can harm domestic industries by undercutting prices and creating unfair competition.

To address this issue, countries have mechanisms in place to investigate and impose anti-dumping duties on these unfairly priced imports. These duties aim to level the playing field by making the imported goods more expensive and thus less competitive with domestically produced goods. Anti-dumping measures are typically implemented through thorough investigations conducted by trade authorities, taking into account factors such as the dumping margin, injury to domestic industry, and the impact on consumers.

Countervailing Duties: An Overview

Countervailing duties, on the other hand, are tariffs imposed on imported goods that benefit from subsidies provided by their government. Subsidies can take various forms, including grants, loans, tax breaks, or other financial assistance, aimed at promoting and supporting domestic industries. While subsidies are not inherently illegal, they can distort competition in international trade when they give foreign producers an unfair advantage over domestic competitors.

To counteract the adverse effects of subsidized imports, countries may impose countervailing duties. Similar to anti-dumping duties, these tariffs aim to offset the advantage gained by subsidized imports and protect domestic industries from unfair competition. The imposition of countervailing duties involves investigations by trade authorities to determine the existence and extent of subsidies, as well as their impact on domestic industries.

Significance in Global Trade

The significance of anti-dumping and countervailing duties in global trade cannot be overstated. These measures serve as vital tools for maintaining a fair and competitive trading environment, safeguarding domestic industries, and ensuring a level playing field for businesses. By addressing unfair trade practices such as dumping and subsidization, anti-dumping and countervailing duties help to promote free and fair trade while protecting the interests of domestic producers and workers.

Moreover, anti-dumping and countervailing duties contribute to the enforcement of international trade rules and agreements, such as those established by the World Trade Organization (WTO). These rules provide guidelines for the imposition of such duties, ensuring transparency, predictability, and fairness in trade relations among member countries.

#Trade #AntiDumping #CountervailingDuties #GlobalCommerce #FairTrade #InternationalTrade #DomesticIndustry #Tariffs #Subsidies #WTO #FairMarket #Dumping

Related Information